NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Daily GPI | Markets | Natural Gas Prices | NGI All News Access | NGI Data

Northeast Hit Hard, But Basis Swells; April Futures Out Like A Lion

Physical gas prices fell again in Thursday trading for Friday delivery, but most of the hard selling occurred in the Northeast where some points suffered multi-dollar drubbings.

Locations in and around the Great Lakes were off by anywhere from 50 cents to a dollar, but producing zone trading points were typically within a few cents of unchanged. The Energy Information Administration (EIA) reported a storage withdrawal of 57 Bcf for the week ended March 21, a moderately bullish number relative to expectations, and that along with procrastinating bidweek buyers was enough to send the expiring April contract out the door with an 18.2-cent gain to $4.584. May rose by 14.3 cents to $4.538, and May crude oil managed an advance of $1.02 to $101.28/bbl.

Temperature forecasts called for the East Coast to see above-normal temperatures on Friday but to work lower by Saturday. Forecaster Wunderground.com predicted Thursday’s high of 45 degress in Boston would jump to 56 Friday but slide to 51 Saturday. The seasonal high in Boston is 49. New York City’s Thursday high of 43 was anticipated to surge to 59 Friday before easing to 51 on Saturday.

The National Weather Service in southeast Massachusetts forecast an active 24 hours. “Low pressure tracks to the north tonight and Friday. Its associated cold front approaches from the west Friday and slowly moves across the region Friday night. The frontal boundary drifts back north on Saturday. Meanwhile…low pressure slowly moves through the middle Atlantic region…emerges offshore Saturday night…and drifts east out to sea through early Monday. Weak high pressure then follows through Tuesday.”

Gas for Friday delivery at the Algonquin Citygates tumbled $2.08 to $5.00, and gas at Iroquois Waddington was quoted $1.16 lower at $5.03. Deliveries to Tennessee Zone 6 200 L dropped $2.38 to $5.01.

As recently as March 25, Algonquin Citygates settled at $14.76 for delivery March 26 so surely a basis of $1.51 to $1.80, as reported by the newly released NGI Bidweek Alert, when added to the April futures settlement of $4.58 for an April bidweek of $6.38 would be a steal.

“Not if the weather is warming up,” said a Houston-based pipeline veteran. “I think the $1.51 to $1.80 is a decent market assessment. The basis represents the average assessment of what the daily price will be throughout the month, which is pretty impossible to figure out and is usually based on historical data. The [Algonquin] basis is certainly high relative to where it’s been in past years, but not so when compared to the last three months.”

Other basis differentials at Northeast points came in on the plump side as well. NGI reported that Iroquois Waddington basis was from 95 cents to $1.05, and basis on Tennessee Zone 6 200 L came in at $1.55 to $1.80.

Next-day quotes at Midwest points were also lower, but not to the degree of the Northeast. On Alliance, Friday packages were seen at $4.94, down 62 cents, and at the Chicago Citygates next-day deliveries changed hands at $4.63, down 6 cents. At Joliet, gas fell 61 cents to $4.91, and on Consumers Friday parcels came in at $5.03, down 79 cents. On Michcon next-day gas was quoted at $5.06, down 79 cents.

Next-day quotes in the producing regions changed relatively little. In the Midcontinent Friday deliveries to the NGPL Midcontinent Pool added a penny to $4.36, and gas on ANR SW slipped 6 cents to $4.38. On OGT Friday packages changed hands at $4.21, up 3 cents, and on Panhandle Eastern next-day gas slid a penny to $4.35.

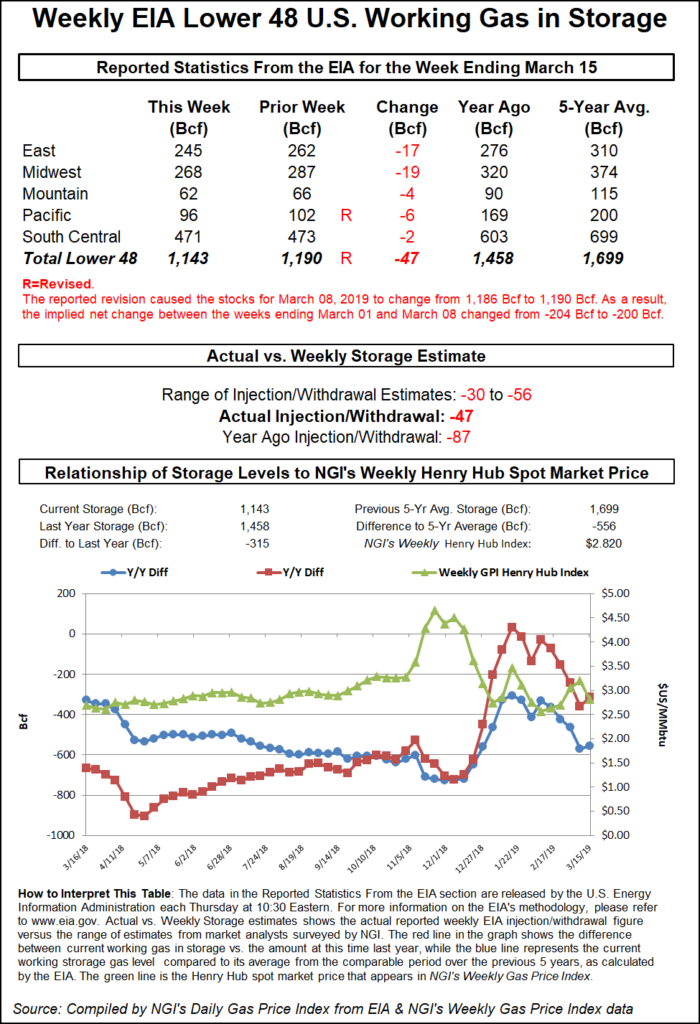

End-of-season storage withdrawals are starting to get interesting, and the Thursday morning release of EIA storage data did provide some incremental clarity. It looks as though season-ending storage of deep into the 800 Bcf area or perhaps below is in sight. For the week ended March 21 analysts were seeing pulls in the neighborhood of 55 Bcf, but it looks like next week’s report could be just as great. The folks at Energy Metro Desk (EMD) in their weekly survey came up with a 53 Bcf withdrawal, and were pretty confident of their assessment.

It doesn’t seem as though there is any worry of a forecast miss. “There’s not much in the tea leaves this week that points to a surprise of any kind,” said John Sodergreen, editor of EMD. “The market seems fairly confident that -52 to -54ish should be spot on. Our consensus came in with the rest of the market at -53 though [Sodergreen] came in a tad lower at -45 Bcf.” He was the Lowballer this week (a rare occurrence), and argued that operators are continuing to get more aggressive in pulling less and dumping more in — fundamentals be damned, and all that. “So, if the report does come in less than -50 Bcf, [Sodergreen] won’t be surprised anyway.”

One analyst believes that since recent actual withdrawals have come in lower than industry estimates, increased production is beginning to appear. “Last week we highlighted the fact that the weekly polls have over-estimated the last five out of six releases by an average 7.5 Bcf each week, which advances the argument that domestic production is beginning to recover [or weather forecasters have erred on the side of caution and been too aggressive in their forecasts for cold],” said Teri Viswanath, commodity strategist at BNP Paribas in New York. “Lending further weight to this assertion is the fact that the salt storage facilities recorded a net injection last week. Given known withdrawal limitations for the eastern reservoirs (storage ratchets), cash prices in the Producing region didn’t provide an incentive for withdrawing from these facilities. Why? A possible explanation is that rising production filled the ‘supply’ gap,” she said in a morning report to clients.

In Thursday morning comments to clients Addison Armstrong of Tradition Energy said, “Traders continue to focus on forecasts for below-normal temperatures and elevated heating demands in the coming weeks, expectations for a heavier than normal spring nuclear power plant maintenance and refueling season, and the 11-year low in storage levels. But robust production levels of gas and the anticipated drop-off in seasonal demand during shoulder season should provide some resistance to rising gas prices. Forecasts are little changed from yesterday, with normal to below-normal temperatures expected across much of the East in the coming weeks.”

Inventories now stand at 896 Bcf and are 899 Bcf less than last year and 926 Bcf below the five-year average, EIA said in its Thursday morning report. In the East Region 39 Bcf was withdrawn and in the West Region 3 Bcf was pulled. Inventories in the Producing Region fell by 15 Bcf.

The Producing region salt cavern storage figure increased by 3 Bcf from the previous week to 65 Bcf, while the non-salt cavern figure fell by 18 Bcf to 311 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |