NGI Weekly Gas Price Index | NGI All News Access | NGI Data

Traders See Futures Buying Opportunity Despite Weekly Losses

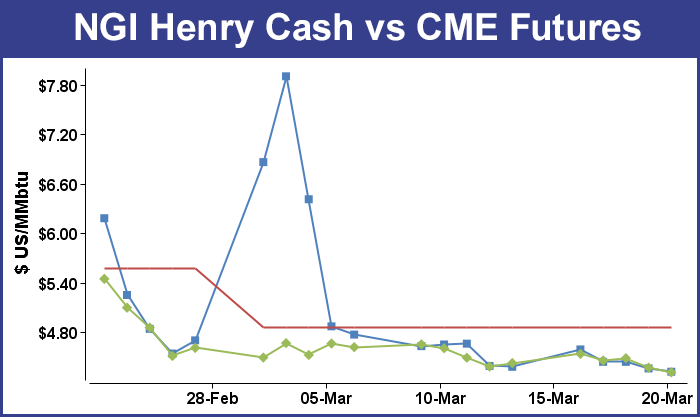

Weekly gas prices ending March 21 had the look and feel of air escaping from a flat tire as the first signs of spring became evident following what for many regions was a brutally cold winter. Nearly all physical cash points were down by double digits with the exception of a few Rockies and California locations which managed gains of just a few pennies. Every region followed by NGI posted a loss and the NGI National Spot Gas Average fell 43 cents from the previous week to $4.60. The individual market point with the greatest gain was El Paso S Mainline with a rise of all of 9 cents to average $4.65, and the greatest decline was seen at lightly traded Dracut with a loss of $8.86 to $7.75.

The region with the greatest loss was the Northeast falling $1.43 to $4.44 followed by the Midwest with a decline of 75 cents to $5.36.

Prices at Midcontinent points fell on average 17 cents to $4.55 and South Texas was off by 14 cents to $4.30.

South Louisiana was down by 12 cents to $4.39 and East Texas slipped 11 cents to $4.35. Both California and the Rocky Mountains were lower by 2 cents on the week to $4.69 and $4.38, respectively.

For the five trading sessions ended March 21 April futures fell 11.2 cents to $4.313. Traders looking beyond near term weather and factoring in what is expected to be a trouble-fee injection season continue to try the bulls’ patience. Some futures traders see the market overly concerned with short-term temperature dynamics and ready for an advance. “Despite today’s technical deterioration that saw May futures decline to lowest levels since the end of January, longer term uptrends stretching back to early November have managed to hold,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments to clients on Friday.

“We are maintaining a bullish trading posture following [Thursday’s] EIA inspired price plunge and we are viewing today’s trading range as a favorable entry region for position type traders. We feel that the market is currently too focused on some short term temperature moderation and will need to hone in on a short supply that will likely be about half of year ago and 5 year average levels with the issuance of next week’s EIA storage release. We will be looking for a draw next week significantly larger than yesterday’s reported 48 Bcf decline with such a number potentially igniting a price advance back to above $4.50 should next week’s temperature trends prove colder than currently anticipated.”

In the early going following the release of storage data Thursday, some traders were also optimistic, although by the end of the day April had posted a double digit loss. The lack of an immediate market response to an otherwise bearish 48 Bcf withdrawal had some thinking of latent bullish undertones. “We were looking for a 58 to 60 Bcf withdrawal, but I’m thinking the market response is pretty bullish. We were trading around $4.377 before the number came out, and we basically hung around there and traded within a 2 cent range,” said a New York floor trader. April futures, however, finished at $4.369.

Others didn’t see any bullish connotations at all. “The 48 Bcf draw was certainly at the lower end of the range of market expectations – a bearish surprise,” said Tim Evans of Citi Futures Perspective. “This suggests a weakening of the background supply/demand balance that could translate into somewhat smaller withdrawals going forward as well.”

Inventories now stand at 953 Bcf and are 932 Bcf less than last year and 876 Bcf below the 5-year average. In the East Region 35 Bcf were withdrawn and in the West Region 2 Bcf were pulled. Inventories in the Producing Region fell by 11 Bcf.

In spite of starting in the hole 900 Bcf, analysts see storage refill as a done deal. “Despite the relatively persistent pattern of below-normal conditions in the key consuming regions thru mid-April, there are simply very few days of winter left on the calendar,” said Teri Viswanath, commodity strategist with BNP Paribas.

“With the injection season officially set to start less than two weeks from now, prices already reflect the market’s anticipation of rapid restocking. New infrastructure additions, which will enable Lower-48 production growth this summer, certainly support this view. In the absence of well freeze-offs, the 1.4 Bcf/d of pipeline expansions completed last November will finally lift production levels from the Utica and Marcellus plays (the supply from this region has remained relatively flat due to ongoing disruptions from well freeze-offs).

“What’s more, the significant addition of 1.2 Bcf/d of much-needed processing capacity in the region (most of which will be online by the end of April) will boost overall production as operators will be not as constrained by pipeline specifications,” she said.

In Friday’s trading buyers not wanting to be caught short over the weekend bid prices at most points higher. Outsized advances in the Midwest, New England and the East more than compensated for scattered modest losses in the Gulf Coast and elsewhere. At the close of futures trading, April had continued its trek lower, falling 5.6 cents to $4.313 and May was down 5.2 cents to $4.297.

Prices for weekend and Monday delivery at points in and around Chicago and the Great Lakes jumped more than $1 as a combination of an early spring cold punch and reduced pipeline flows from the south prompted higher prices. AccuWeather.com predicted that the high Friday in Chicago of 51 would drop to 37 by Saturday and rise to only 38 by Monday. The seasonal high in Chicago is 49. Detroit’s 45 high on Friday was seen easing to 42 on Saturday and dropping further to 33 by Monday. The normal late-March high in Detroit is 48. Cleveland’s 44 Friday high was predicted to slip to 40 on Saturday and 29 by Monday. The normal high this time of year is 20 degrees higher.

Great Lakes cities are having difficulties extracting themselves from the ravages a record-setting winter. “Despite the transition into the spring season, the impacts of this year’s harsh winter will linger in Cleveland,” said AccuWeather.com’s Kirsten Rodman. “This winter, the city received 76.3 inches of snow in total, which is approximately 15.5 inches more than normal, [and] despite temperatures ranging between the 40s and 50s, snow showers are possible on Saturday along with morning rain showers.

“To begin the first full week of spring, cold air will return to Cleveland on Monday as temperatures plummet back down below freezing. Despite some sunshine on Sunday and Monday, the air will feel cold, dropping into the high 20s. Temperatures will hover around freezing through Thursday, [and] the city’s next chance for some snow showers will come on Tuesday.”

Gas for weekend and Monday delivery at the Chicago Citygates traded more than $1 less than neighboring market points such as Joliet, and traders suggested that supply issues on incoming pipelines were the cause. “There must be issues with gas coming in from Trunkline, Panhandle or even points up north,” said a Houston industry veteran. “Also, ANR storage in upper Michigan is probably bone-dry and there is just not enough gas. It’s also cold again. I would imagine the gas is all going over to Michigan. A lot of the times the price at Joliet is driven by Michcon.”

Incoming pipelines were indeed an issue. ANR posted on its website a notice of force majeure for gas deliveries on its southern leg. “Due to some minor delays, ANR is now scheduled to place the 1-501 line back in service on March 28, 2014; however, the 0-501 and 2-501 lines will remain out of service while work continues on those lines,” the company said. “ANR will post an update to this force majeure notice stating that the 1-501 line is in service and the amount of northbound and southbound available capacities through the Delhi Compressor Station.”

Gas for weekend and Monday delivery at the Chicago Citygates added 29 cents to $4.88, but deliveries at Joliet jumped $1.23 to $6.14. On Alliance, packages were seen $1.28 higher at $6.19, and on Northern Natural Ventura, gas changed hands at $5.90, up $1.31. Gas for the weekend and Monday on Michcon came in at $6.18, up $1.14, and deliveries to Consumers gained $1.27 to $6.30.

Eastern and New England points saw weekend and Monday prices jump more than $2 as forecasters called for a near-term return of cold. The National Weather Service in southeast Massachusetts said “high pressure will move across southern New England this [Friday] evening and then offshore overnight…bringing dry but chilly conditions. Low pressure will then track across northern New England Saturday bringing a few rain and snow showers to the region during the morning. Mild and windy conditions follow Saturday afternoon behind a frontal passage. An Arctic front moves across the area sun and brings unseasonably colder conditions Sun night into much of next week with temperatures more representative of January. A winter storm remains possible late Tuesday into Wednesday.”

Gas at the Algonquin Citygates for the weekend and Monday jumped $2.62 to $7.79, and deliveries to Iroquois Waddington gained $1.43to $6.71. On Tennessee Zone 6 200 L gas was seen at $8.26, up a stout $2.82.

Farther south, gas on Transco Leidy rose 31 cents to $2.69, and deliveries to Dominion added three cents to $4.04. Gas on Tetco M-3 Delivery gained 21 cents to $4.44, and gas bound for New York City on Transco Zone 6 rose 34 cents to $4.68.

Weather forecasters saw the weekend as most likely the last hurrah for below-normal temperatures. In its Friday morning six- to 10-day outlook, Commodity Weather Group showed below-normal temperatures extending east of a broad arc from Montana to Missouri to South Texas. “The forecast situation is fairly straightforward from a big picture perspective with the final big March cold outbreak arriving this weekend for the Midwest before spreading south and east for next week,” said Matt Rogers, president of the firm.

“Warming comes briskly behind it for the central to eastern third of the U.S. mid to late next week. But the one wrench in the works is a potential East Coast storm that could amplify stronger and slow down the moderation process a bit. If it trends stronger and more coastal, we could see colder impacts into Thursday-Friday next week, but if not, we could see much faster warming for this area leading to a mild to warm final weekend of March. The models are showing a highly variable 11-15 day story, but it seems like warmer risks outweigh cooler risks overall due to a significant reduction in the Alaska ridging story.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |