Shale Daily | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Pennsylvania’s Shale Gas Taxes Among Lowest, Report Finds

Pennsylvania’s impact fee on unconventional natural gas wells is lower than the severance tax rate levied by 10 states for natural gas extraction, according to a report released Thursday by the state’s Independent Fiscal Office (IFO).

In a 72-page report, “Natural Gas Extraction: An Interstate Tax Comparison,” the IFO used four scenarios, with varying degrees of production and natural gas prices, to compare the amount of revenue generated over the next 30 years by Pennsylvania’s impact fee with the effective tax rates of 10 states.

“[Our] analysis finds that Pennsylvania has the lowest total effective tax rate, [including] state severance and certain local taxes, among the comparison states under each of the four scenarios,” IFO said. “If one considers only state severance taxes, then Pennsylvania’s effective tax rate is second lowest in the low production [5 Bcf] scenario, and it is tied for lowest in the high production [10 Bcf] scenario.”

The agency used the U.S. Energy Information Administration’s (EIA) Henry Hub spot price forecast for all price scenarios. IFO’s analysis also only applied to wells scheduled to begin production in 2014, and excluded legacy wells.

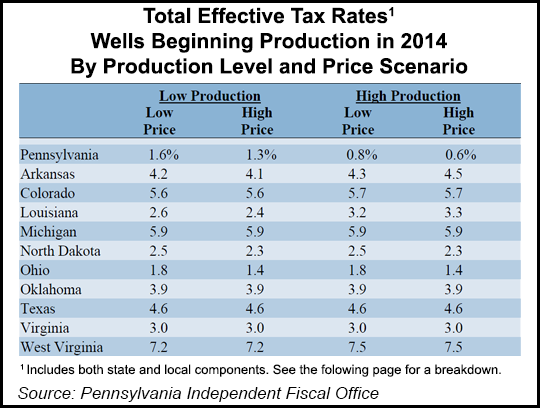

According to the IFO, Pennsylvania’s impact fee equates to a total effective tax rate of 1.6% under a scenario that assumes low production and low gas prices. Ohio’s severance tax rate was slightly higher at 1.8%, followed by North Dakota (2.5%), Louisiana (2.6%), Virginia (3.0%), Oklahoma (3.9%), Arkansas (4.2%), Texas (4.6%), Colorado (5.6%), Michigan (5.9%) and West Virginia (7.2%).

Under a scenario that assumes low production but high gas prices, IFO said Pennsylvania’s impact was equal to a total effective tax rate of 1.3%. The tax rates for most of the aforementioned states remained unchanged, but the rates in Ohio (1.4%), North Dakota (2.3%), Louisiana (2.4%) and Arkansas (4.1%) each fell slightly.

Pennsylvania’s impact fee was lower under two scenarios that assumed high production. With low prices, the impact fee equates to a total effective tax rate of 0.8%, while under high prices it fell further, to 0.6%. By comparison, Ohio ranged from 1.8-1.4% under low and high prices, respectively, followed by North Dakota (2.5-2.3%), Virginia (3.0% for both), Louisiana (3.2-3.3%), Oklahoma (3.9% for both), Arkansas (4.3-4.5%), Texas (4.6% for both), Colorado (5.7% for both), Michigan (5.9% for both) and West Virginia (7.5% for both).

IFO said the total effective tax rates included both state and local components.

But in a statement Thursday, the Marcellus Shale Coalition (MSC) called the IFO’s report “a flawed analysis that provides no new, meaningful information,” and took issue with its methodology and focus.

“While Pennsylvania does not have a severance tax on oil and natural gas development, nor any other extractive industry, the Commonwealth has a host of taxes and fees that other oil and gas producing states do not have,” the MSC said. “Though IFO readily acknowledges this, it stands to reason that its incomplete analysis lacks an ‘apples to apples’ comparison of the total tax liability for oil and natural gas producers across states. Rather, it reflects a narrow snapshot of exclusively energy production taxes.

“Those who oppose shale development will inevitably seek to leverage this flawed analysis as a rallying cry, based purely on politics rather than objective facts and economic realities, for higher energy taxes on businesses and families. Such policies would have a chillingly negative impact on job creation, economic growth and responsible energy production in the Commonwealth.”

For the 2013-14 fiscal year, Arkansas and Texas will levy severance taxes on the market value of gas produced, at 5% and 7.5%, respectively. Colorado’s severance tax of 2.0-5.0% is based on the gross annual income from the sale of gas, while Louisiana (11.8 cents/Mcf), North Dakota (8.33 cents/Mcf) and Ohio (2.5 cents/Mcf) each levy taxes based on production.

Meanwhile, Michigan levies a 5% severance tax based on the gross cash market value of gas produced; Oklahoma charges a 7% severance tax based on the gross market value of gas produced; Virginia’s severance tax ranges from 1.0-3.0% and is based on gross receipts from gas produced, and West Virginia’s 5.0% severance tax is based on the gross value of gas produced.

Debate has raged for several years over Pennsylvania’s decision to enact an impact fee rather than a severance tax, with the MSC and Republican Gov. Tom Corbett opposed to a severance tax while other policy groups and Democratic gubernatorial candidates voicing support for one (see Shale Daily, Jan. 28; Oct. 11, 2013; Sept. 6, 2013; May 15, 2013; Sept. 17, 2012; Feb. 8, 2012).

Earlier this month, attorneys representing both sides in a legal challenge to Act 13, Pennsylvania’s omnibus Marcellus Shale law, said they were not opposed to having the impact fee continue, regardless of the ultimate outcome of the case (see Shale Daily, March 18). Last December, the state Supreme Court struck down parts of the law as unconstitutional (see Shale Daily, Dec. 20, 2013).

The impact fee, which is allocated to local communities and state agencies, has generated an estimated $406 million since it was established in 2012 (see Shale Daily, Feb. 15, 2012).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |