Shale Daily | NGI All News Access | NGI The Weekly Gas Market Report

Marcellus, Eagle Ford Led Last Year’s Production Gains

Higher spot prices for natural gas last year stimulated production from shale plays — particularly the Marcellus and Eagle Ford — lifting total U.S. gas supplies to record levels. However, futures prices fell, and that is expected to encourage long-term demand growth, according to the latest State of the Markets report from FERC staff.

“The recovery in U.S. natural gas prices was demand driven. Overall demand for natural gas increased 2.3% in 2013 to 70 Bcf/d, the highest on record,” staff of the Federal Energy Regulatory Commission (FERC) said in a report presented to the Commission Thursday. “Colder than normal weather in the first quarter helped drive residential and commercial demand up 16% in 2013.”

Industrial sector natural gas demand grew 1.8%, supported by new gas-intensive projects in mining, manufacturing and petrochemicals. Demand from the power generation sector declined 10% as the increase in gas prices reduced natural gas’ competitiveness with coal. Coal use for power generation rose almost 5% over 2012.

While demand growth drove natural gas prices up across the country, supply growth helped to moderate some of the price increases. Total U.S. natural gas supply, including production, imports via pipeline, and liquefied natural gas (LNG) imports, averaged 68 Bcf/d in 2013, up 1.0% from 2012.

Supported by relatively high prices for natural gas liquids and crude oil, associated natural gas production rose 1.9% to 65 Bcf/d.

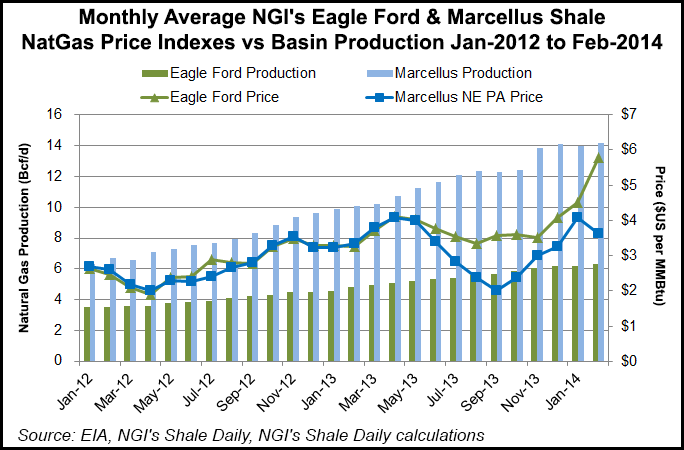

The Marcellus and Eagle Ford shales were the largest contributors to higher production. Production from the Marcellus Shale rose 44% to average 12 Bcf/d in 2013, while Eagle Ford production rose 36% to average 4.5 Bcf/d.

Growth in U.S. domestic natural gas production displaced imported natural gas. Net imports from Canada shrank 1.8% to 5.2 Bcf/d. LNG imports fell to 0.3 Bcf/d, a 36% decrease from 2012.

By the end of 2013, growth in U.S. natural gas production had lowered the long-term natural gas futures curve on the New York Mercantile Exchange. The long-term outlook for low cost natural gas is contributing to investments in gas-fired generation and encouraging industrial customers, including petrochemicals and manufacturing, to re-enter the United States.

More than 90 new gas-consuming industrial projects or expansions began operation last year, and almost 220 new projects or expansions have 2014 in-service dates.

“Ample and relatively low cost natural gas is also driving two other potential sources of demand, natural gas exports to Mexico and LNG exports,” the report said. “Proposed pipelines to Mexico total over 4 Bcf/d, which would bring total export capacity to Mexico to 9.6 Bcf/d in the next few years. LNG exports could also add 6 to 12 Bcf/d of natural gas demand by the end of the decade.”

New exports could add as much as 16 Bcf/d to U.S. gas demand by 2020, according to FERC staff. “The decline of the long-term futures curve shows the market expects long-term supply growth to more than meet the growth in long-term demand,” the report said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |