NGI Data | Markets | Natural Gas Prices | NGI All News Access

Spring has Sprung? NatGas Physical Quotes, Futures Ease

Spot natural gas prices for Friday delivery on average fell about a quarter in Thursday’s trading as winter-weary market participants welcomed the first day of spring with quotes mostly lower across the board.

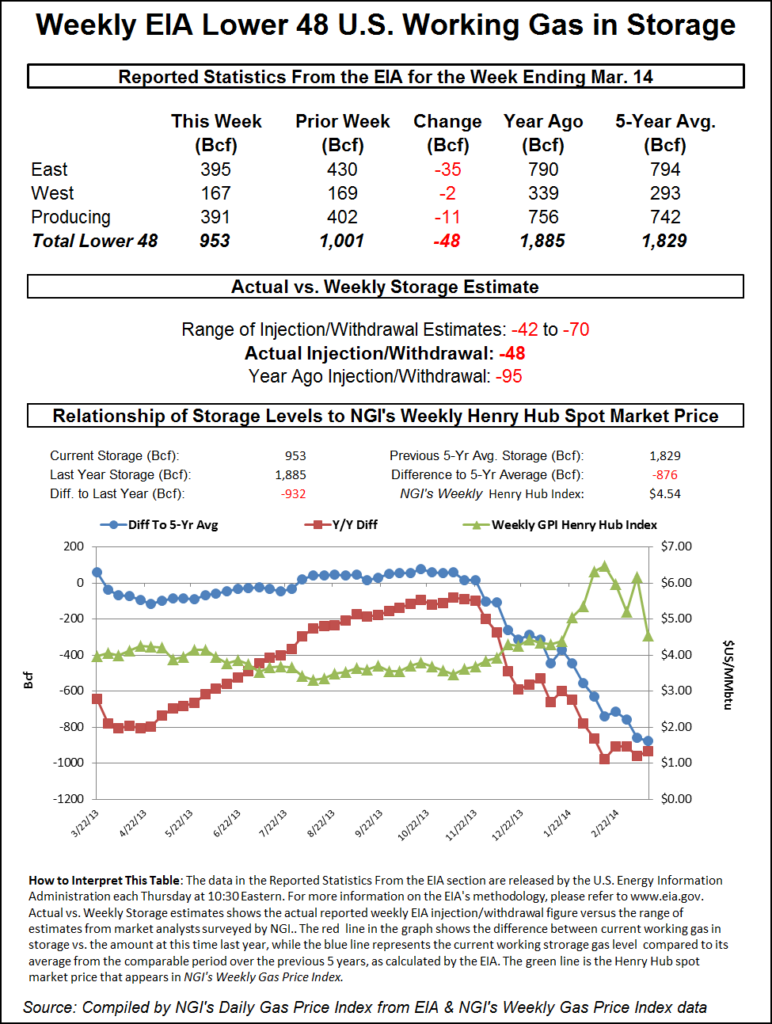

Some Midwest points took a double-digit drubbing, and Marcellus locations were down a half dollar. Metropolitan eastern points were off just over a dime. The Energy Information Administration reported a storage withdrawal of 48 Bcf for the week ended March 14, less than trader expectations, and futures were relegated to the “I’ve fallen and can’t get up” category. At the close April had dropped 11.5 cents to $4.369 and May was off 10.9 cents to $4.349. April crude oil shed 94 cents to $99.43/bbl.

Midwest buyers for Friday were tantalized by forecasts of above-normal temperatures, but an examination of the data showed that Ol’ Man Winter wasn’t quite ready to throw in the towel as temperatures Saturday were expected to nose-dive 15 degrees. Forecaster WSI Corp. predicted that the Thursday high in Minneapolis of 42 would rise to 44 Friday before dropping to 29 on Saturday. The normal mid-March high in Minneapolis is 46. Chicago’s 47 high Thursday was anticipated to climb to 59 Friday before diving to 44 on Saturday. The seasonal high in the Windy City is 50. Indianapolis’ maximum on Thursday of 52 was seen jumping to 64 Friday before sliding back down to 52 on Saturday. The normal high in Indianapolis is 56.

Tom Skilling of the Chicago Weather Center calculates that since Dec. 1, Chicago has endured the most severe cold in more than 140 years. “Spring arrives at 11:57 am [Thursday]. While the Dec. 1 through March 19 period has ranked coldest in 143 years of record keeping — beating previous coldest 1977-78 by just under 0.1 degree, temps today are to reach seasonable levels approaching 50,” he posted on his Facebook page. “It’s Friday that produces something of a thermal bonanza with the first 60 here in 4 months — since a 69-degree high back on Nov 17. But colder air sweeps in in stages over the weekend and the Chicago area may be setting up for a sticking snow in the Mon night/Tuesday time frame.”

That small reprieve was enough to send next-day gas in the Midwest to double-digit losses in some cases. Quotes at the Joliet Hub tumbled 30 cents to $4.91, and gas at the Chicago Citygates was down by 13 cents at $4.59. On Alliance, next-day gas came in at $4.91, down 33 cents, and on Northern Natural Ventura Friday parcels were quoted at $4.59, down 5 cents. At Demarcation, gas changed hands for Friday delivery at $4.59, down 3 cents.

Farther east, Friday packages fell by double digits. Deliveries on Consumers were seen at $5.03, down 26 cents, and on Michcon next-day gas was quoted at $5.04, down 20 cents. At storage-starved Dawn, Friday gas dropped 33 cents to $5.20.

Consistent with a milder temperature regime, analysts have noted reduced pipeline flows out of the Rocky Mountains. Industry consultant Genscape reported that “as demand decreased with milder weather in Midcontinent, Midcontinent imports decreased in the past week, especially those from the Rockies region. Most of the decreases come from flows on REX, Trailblazer, and Cheyenne Plains. The declines are about -0.1 Bcf/d week on week on each of those three pipelines.”

In the Marcellus bottlenecks continue to be a problem. “Net receipts on Leidy line have begun to decrease as Northeast demand decreased with milder weather,” said Genscape. “Receipts on Leidy line continue to be dependent on weather due to constraints of takeaway capacity in the Marcellus area.”

Gas for Friday delivery on Transco Leidy line plunged 50 cents to $2.38, and gas delivered to Tennessee Zone 4 Marcellus dropped 32 cents to $2.54.

Active springtime weather was not enough to keep quotes at New York and Philadelphia points from sliding. The National Weather Service in suburban Philadelphia reported that “the center of high pressure will slide to our south later tonight and Friday. A low pressure system is then forecast to track just to our north Saturday, with a cold front moving through around midday. A secondary cold front then moves through Saturday night. A strong high pressure system will build across the plains Sunday, then move to the Great Lakes Monday and New England on Tuesday.”

“A low-pressure system developing in the eastern Gulf of Mexico early Tuesday is forecast to move northeastward, and track south and east of our region later Tuesday into Wednesday. High pressure then builds in for Wednesday night and Thursday.”

Gas for Friday delivery on Tetco M-3 Delivery dropped 11 cents to $4.23, and packages of gas to New York City on Transco Zone 6 fell 11 cents as well to $4.34.

Traders may not want to put away those winter coats just yet, as longer term heating requirements are anticipated to be above long term averages. In its Thursday morning 20-day forecast WeatherBELL Analytics calls for heating requirements for the next two weeks to be slightly below last year but well above historical averages. Nationally it tallied 284.8 heating degree days (HDD), fewer than last year’s 291.3 but more than an average accumulation of 227.3 HDD.

The problem is that the data is not as conclusive as forecasters would like. “Confidence is in the tank,” said WeatherBELL’s Joe Bastardi. “In the mid-range (end of week 1, start of week 2) storms and rumors of storms are the big problem. The entire winter in the corridor from the Ohio Valley into the Mid-Atlantic, snows have hit within a few days of it getting mild. The storm [Friday] into Saturday is an I-90 on north storm (for the most part) and allows the southwest wind to pump temperatures into the Mid -Atlantic states on Saturday. Then the cold pushes, and astoundingly there is modeling with snow on Sunday in the areas that have seen this several times since December. The NAM [North American Mesoscale model] is most bullish, and while this may be something that is naturally dismissed given its track record, an event like this would ‘fit’ the pattern of the winter.”

In spite of what may be elevated heating requirements near term, analysts are breathing a big sigh of relief now that Spring is here and attention can turn to summer projections, storage refill, power requirements, etc. “We don’t want to jinx anybody’s plans, but we think winter is just about cooked. Good riddance too,” said John Sodergreen, editor of Energy Metro Desk (EMD). “Next week will see a bit of a chill down, compared to this week, but gone are the days of massive heating demand. This past week, for example, demand fell hard — to the lowest level since the middle of November. Remember November? We don’t. We’d much rather look ahead and enmesh ourselves in summer projections, fall projections, and speculating on how many heads might roll over the recent price spikes.”

In its weekly survey EMD came up with an estimated withdrawal of 58 Bcf for the storage report, about in line with others. Last year 74 Bcf was pulled, and the five-year average stands at a 30 Bcf withdrawal. United ICAP was calling for a 57 Bcf decline, and a Reuters survey of 21 industry traders and analysts showed an average 59 Bcf with a range of 42-70 Bcf.

Traders were surprised by the lack of market reaction to an otherwise bearish storage withdrawal figure. “We were looking for a 58 to 60 Bcf withdrawal, but I’m thinking the market response is pretty bullish. We were trading around $4.377 before the number came out, and we basically hung around there and traded within a 2-cent range,” said a New York floor trader.

Others didn’t see any bullish connotations at all. “The 48 Bcf draw was certainly at the lower end of the range of market expectations — a bearish surprise,” said Tim Evans of Citi Futures Perspective. “This suggests a weakening of the background supply-demand balance that could translate into somewhat smaller withdrawals going forward as well.”

Inventories now stand at 953 Bcf and are 932 Bcf less than last year and 876 Bcf below the five-year average. In the East Region 35 Bcf was withdrawn and in the West Region 2 Bcf was pulled. Inventories in the Producing Region fell by 11 Bcf.

The Producing region salt cavern storage figure increased by 8 Bcf from the previous week to 62 Bcf, while the non-salt cavern figure fell by 19 Bcf to 329 Bcf.

Addison Armstrong of Tradition Energy in his morning report said natural gas bulls are going to have to deal with “declining seasonal demand. But severely depleted storage levels that are at an 11-year low and a heavier than normal spring nuclear power plant maintenance and refueling season will likely provide support for gas prices in the coming weeks.”

“Temperatures are expected to fluctuate in the coming weeks, with below to well below normal temperatures expected across much of the East in the next 10 days, but are then expected to shift warmer during the first part of April.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |