Shale Daily | NGI All News Access | NGI The Weekly Gas Market Report

U.S., Canada Forecast to Spend $641B for Midstream Through 2035

North America’s shales and tight resources will need a huge amount of midstream infrastructure annually to 2035, with almost half of the investments for natural gas growth, the advocacy arm of the Interstate Natural Gas Association of America (INGAA) reported Tuesday.

Close to $641 billion in North American midstream infrastructure investment is forecast to be needed over the next 22 years just to keep pace with booming energy production.

The latest projections are in a report prepared for the INGAA Foundation and co-sponsor America’s Natural Gas Alliance. ICF had provided an indepth overview of the market in 2011, but growth in the onshore led to the updated analysis (see Shale Daily, June 29, 2011).

Analysts’ middle-of-the-road scenario assumed long-term North American natural gas prices will average $6.00/MMBtu and oil $100.00/bbl. The base case is projecting significant supply development and growth in gas production, primarily from shale resources.

The study was done “to inform industry, policymakers and stakeholders about the new dynamics of North America’s energy markets and the infrastructure that will be needed to ensure that consumers benefit from the abundance of natural gas, crude oil and NGL [natural gas liquids] across the United States and Canada,” ICF analysts said. “This is particularly relevant as policymakers seek to promote job growth and economic development, protect the environment, increase energy security, and reduce the trade deficit.”

The latest analysis assessed midstream needs based on projections of drilling activity “and consideration of the increasing recoverable resource base and prevailing market conditions.”

Analysts reassessed the investments needed that were not considered in the 2011 study, including for compression for gas gathering lines, crude oil gathering lines, crude oil storage terminals, NGL fractionation facilities, NGL export facilities, oil and gas lease equipment, and liquefied natural gas (LNG) export facilities.

“These facilities account for a substantial portion of the total midstream investments identified in this study,” said analysts.

New natural gas infrastructure through 2035 would capture the bulk of spending, almost 49%, at $313.1 billion total (2012$), or around $14.2 billion a year; the 2011 report estimated gas midstream spend would be about $213.3 billion, or $8.5 billion every year. New gas midstream needs through 2035 are estimated to include:

- 43 Bcf/d in gas transmission capability;

- 850 miles/year in gas transmission mainline;

- 800 miles-plus a year for laterals to/from power plants, processing facilities and storage fields;

- 14,000 miles/year in gathering lines;

- 37 Bcf/d in working gas storage capacity;

- 580,000 hp or more every year for pipeline/gathering compression; and

- 9 Bcf/d for liquefied natural gas export capacity.

“This report shows a vibrant natural gas market in the future, and it also demonstrates the need for additional midstream infrastructure to support natural gas fulfilling its potential as a foundation fuel for our energy economy,” said INGAA Foundation President Don Santa. “The good news is that the natural gas industry has a proven track record of financing and constructing this level of infrastructure.”

ICF assumed that announced near-term midstream pipeline infrastructure projects would be completed. Unplanned projects are included in the projection when its computer model signaled a need for capacity.

Producers are likely to develop shale plays with large quantities of oil and natural gas liquids (NGL), which would require around $56 billion ($2.6 billion/year) over the next 22 years. That compares with 2011’s estimate of about $15.1 billion ( $600 million/year).

The NGL base case is projecting “substantial” liquids growth, particularly from the Marcellus/Utica plays, and across other areas of North America.

The growing need for new NGL outlets has been noted by pipeliners and producers for months.

Surplus NGLs produced in the northeastern United States want to move to established petrochemical markets on the Gulf Coast, while surging Alberta oilsands is going to require more pentanes-plus NGLs to dilute bitumen to aid transport through oil pipelines.

Raw NGLs also are seen doubling by 2035 from the Williston Basin and Central Rockies to the Gulf Coast through West Texas. NGL exports also are seen growing from the Gulf Coast and Western Canada.

New infrastructure for NGLs over the period is forecast to include about 3.6 million b/d from transmission capacity, almost 700 miles/year of transmission line, 30,000 hp/year for pumping requirements for pipeline; and 151,000 boe/d in fractionation capacity that is expected to be added every year. Almost 64,000 boe/d in new NGL export capacity also is expected to be added each year.

The base case expects almost $272 billion ($12.4 billion/year) to be spent for crude oil and condensate midstream growth over the forecast period, mostly from Alberta oilsands and tight/shale oil plays, driven by relatively high prices. ICF had forecast about $32.6 billion total, or $1.4 billion/year, to be spent in its prior analysis.

“Alberta oilsands production is projected to nearly triple by 2035,” ICF noted. “Bakken Shale crude oil production will double by 2020 to almost 1.8 million b/d and increase to 2.1 million b/d by 2035. Significant crude production growth is also expected from West Texas and Gulf Coast tight/shale plays.” Exports from Canada’s west coast also are seen increasing by more than 2 million b/d from 2020 through 2035.

New oil infrastructure expectations through 2035 include more than 10 million b/d in oil transmission capacity; 730 miles/year or more in oil transmission lines; 35 miles/year in laterals for storage; 7,800 miles/year in oil gathering lines; and more than 6 million b/d in storage capacity.

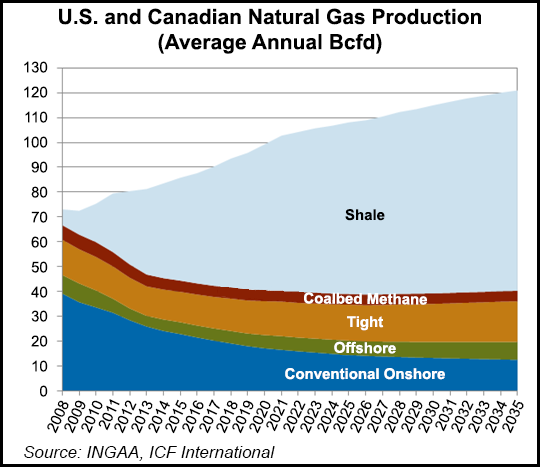

U.S. and Canadian natural gas production is projected to grow from an average of 83 Bcf/d in this year to more than 120 Bcf/d in 2035, adequate to meet projected gas market needs in 2035. Unconventional natural gas supplies account for all of the incremental supply as production from conventional areas declines. Unconventional supplies (mostly shale plays) will account for approximately two-thirds of the total gas supply mix in 2035. Shale gas production is expected to exceed half of the total production over the next few years.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |