Markets | NGI All News Access | NGI The Weekly Gas Market Report

Largest NatGas Marketers Lead Trading Decline in 4Q and Full Year 2013

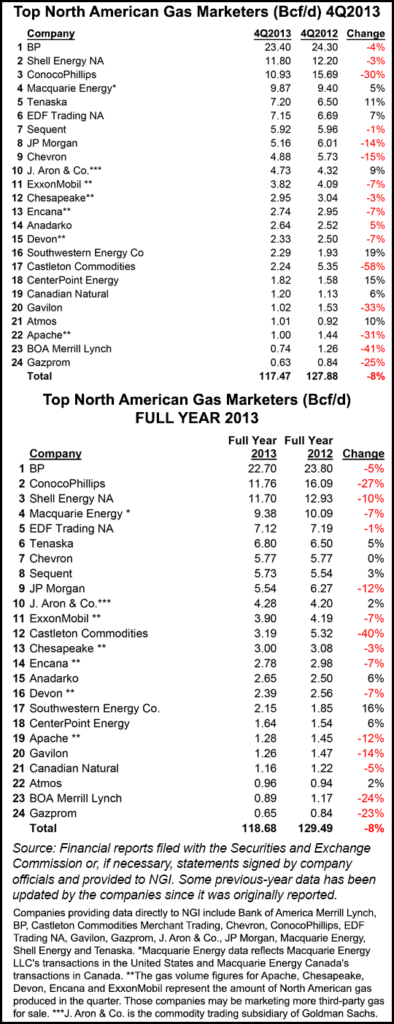

Natural gas marketers continued to report significant declines in sales in the last three months of 2013 compared with 4Q2012, and the top three marketers — BP plc, Shell Energy NA and ConocoPhillips — were among those with the largest declines, according to NGI‘s 4Q2013 Top North American Gas Marketers Ranking.

Full-year 2013 totals reflected that trend, with participating companies reporting a combined 8% decline compared to the previous year.

The fall-off in sales demonstrated a contrarian principle: more gas, less trading. Declining marketer volumes may be attributable to a variety of factors, but the North American shale gale appears to be the root cause.

“There has been a secular change in U.S. natural gas production as a result of the shale revolution, which has been led by independent producers,” said Patrick Rau, NGI director of strategy and research. “Independents now comprise a much larger percentage of U.S. gas production than they did say ten years ago. Many independents have their own direct sales forces, or simply sell their gas at index, so that helps reduce the need to employ third parties to market their gas.”

And the rapid growth of U.S. unconventional production has helped to eliminate price spikes the last few years, which makes trading less profitable and contributes to lower turnover. “The abundant gas supplies help lower volatility, and marketers and storage operators need that volatility to help create volume,” Rau said. “Lower volatility, lower marketed volumes, everything else being equal.”

Twenty-four leading gas marketers reported combined sales transactions of 117.47 Bcf/d for 4Q2013, with six of the survey’s top 10 marketers and 16 companies overall reporting lower numbers than in 4Q2012. For full year 2013, the 24 leading gas marketers reported combined sales transactions of 118.68 Bcf/d, compared with the 129.49 Bcf/d for full year 2012. Seven of the top 10 marketers and 18 companies overall posted either no change or declines year-over-year.

NGI‘s survey of North American marketers hasn’t reported an overall increase in sales compared to a year-ago period since 2Q2012, when 27 participating companies sold a total of 135.86 Bcf/d.

Perennial survey No. 1 BP plc reported 23.40 Bcf/d in 4Q2013, a 4% decline compared with 24.30 Bcf/d in 4Q2012. BP shot to the top of NGI’s Marketer rankings in 2002 with the departure of Enron and other large marketing entities. It hit its largest sales total in 2008 when it booked 30.8 Bcf/d at the same time combined marketer sales were 124 Bcf/d.

The London-based major recently said it plans to separate its U.S. onshore Lower 48 business (see Daily GPI, March 4). The move is expected to help unlock the value associated with the company’s resource position in the U.S. Lower 48 onshore, which BP currently oversees through its Houston-based North America Gas group.

Shell Energy NA reported 11.80 Bcf/d in 4Q2013, a 3% decline compared with 12.20 Bcf/d in 4Q2012. Shell is reconfiguring its portfolio, scratching both drilling in offshore Alaska this year — an endeavor on which over the past six years it has spent close $6 billion — and a proposed liquefied natural gas export project for British Columbia (see Daily GPI, Jan. 30).

For the third consecutive quarter, the largest decline came at ConocoPhillips, which reported 10.93 Bcf/d, down 4.76 Bcf/d (30%) compared with 15.69 Bcf/d in 4Q2012. A similar decline in 3Q2013 dropped ConocoPhillips to third place in the survey for the first time in nearly three years (see Daily GPI, Dec. 12, 2013; March 21, 2011). The double-digit declines, which ConocoPhillips first reported in NGI‘s 1Q2013 survey, are primarily due to the implementation of business model restructuring in North America following the spin-off of downstream operations in 2012 (see Daily GPI, April 17, 2012) and the company’s view of current market conditions.

In implementing its plan, ConocoPhillips expects less volume associated with outright trading, and less volume in noncore areas. The company began the year with the sale of its Midwest commercial and industrial natural gas portfolio to EDF Trading NA (see Daily GPI, Jan. 11).The decision to sell its refinery arm and become a pure-play exploration and production company proved its mettle in 2013, with higher output, stronger margins and solid cash flow, particularly in North America (see Shale Daily, Jan. 31). ConocoPhillips ended 2013 with 8.9 billion boe of reserves, up 3% from 2012, and sold about $7 billion in assets last year.

Other top 10 companies reporting sales declines in 4Q2013 compared with 4Q2012 were Sequent (5.92 Bcf/d, down from 5.96 Bcf/d), JP Morgan Chase & Co. (5.16 Bcf/d, down from 6.01 Bcf/d) and Chevron (4.88 Bcf/d, down from 5.73 Bcf/d).

But there was some upward momentum in the top 10, with increases compared with the year-ago period reported by Macquarie Energy (9.87 Bcf/d, up from 9.40 Bcf/d), Tenaska (7.20 Bcf/d, up from 6.50 Bcf/d), EDF Trading NA (7.15 Bcf/d, up from 6.69 Bcf/d) and J. Aron & Co. (4.73 Bcf/d, up from 4.32 Bcf/d).

Highlights of NGI‘s 4Q2013 Top North American Gas Marketers Ranking include a 5% increase for Anadarko Petroleum Corp. (2.64 Bcf/d, compared with 2.52 Bcf/d in 4Q2012), a 19% increase for Southwestern Energy Co. (2.29 Bcf/d, compared with 1.93 Bcf/d in 4Q2012), and a 15% increase for CenterPoint Energy (1.82 Bcf/d, compared with 1.58 Bcf/d in 4Q2012).

In NGI‘s Full-Year 2013 Top North American Gas Marketers Ranking, the top five companies in the survey all reported sagging numbers compared with 2012: BP (22.70 Bcf/d, down 5%), ConocoPhillips (11.76 Bcf/d, down 27%), Shell (11.70 Bcf/d, down 10%), Macquarie (9.38 Bcf/d, down 7%) and EDF Trading (7.12 Bcf/d, down 1%).

Highlights of the full-year survey include a 5% increase for Tenaska (6.80 Bcf/d, compared with 6.50 Bcf/d in 2012), a 3% increase for Sequent (5.73 Bcf/d, compared with 5.54 Bcf/d in 2012), a 2% increase for J. Aron & Co. (4.28 Bcf/d, compared with 4.20 Bcf/d in 2012), a 6% increase for Anadarko (2.65 Bcf/d, compared with 2.50 Bcf/d in 2012) and a 16% increase for Southwestern Energy Co. (2.15 Bcf/d, compared with 1.85 Bcf/d in 2012).

The face of the North American natural gas marketing industry changed rapidly over the last year. Nearly a decade after entering the U.S. natural gas trading market, Deutsche Bank in December said it was significantly scaling back its commodities business and would exit the dedicated trading desks for energy, agriculture, base metals and dry bulk (see Daily GPI, Dec. 5, 2013). That announcement followed GDF Suez Energy North America announcing it would shut down its Houston-based speculative natural gas and power trading operations (see Daily GPI, Nov. 25, 2013). Oneok closed its natural gas marketing business in a nod to the reality of flattened basis spreads and the more challenging gas trading environment (see Daily GPI, June 13, 2013), and both JPMorgan and Hess Corp. announced their exits from gas marketing for various reasons (see Daily GPI, July 31, 2013; July 29, 2013).

More recently, Gavilon LLC and Tenaska Marketing Ventures jointly applied for waivers from FERC to allow completion of a deal selling Gavilon’s wholesale gas marketing business, including transportation and storage contracts, to Tenaska (see Daily GPI, Feb. 26). The assets to be transferred include firm transportation contracts on ANR Pipeline and Midcontinent Express, and firm storage at Arlington Storage Co., Leaf River Energy Center and Perryville Gas Storage, as well as park and loan space at Leaf River. The contracts would be transferred to Tenaska, which would continue to fulfill the terms of the contracts.

The marketers survey ranks sales transactions only. Total combined natural gas purchase and sales volumes were 123,868 TBtu (Bcf) in 2012, a 0.7% decline compared with 124,752 TBtu in 2011, according to a 2013 analysis by NGI of 2012 Form 552 buyer and seller filings with the Federal Energy Regulatory Commission (see Daily GPI, June 4, 2013). Purchase and sales volumes cannot be compared with production because a single package of gas may be sold several times between the wellhead and the burner-tip.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |