Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Sees Jobs, GDP Benefits from Growth in Oil/Gas Sector

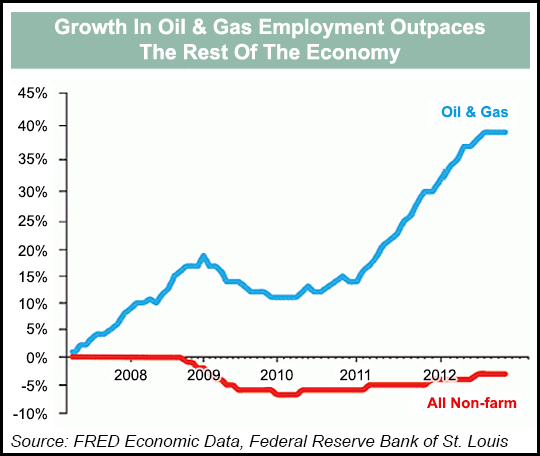

While the number of U.S. jobs has yet to regain pre-recession levels, the oil and natural gas sector has seen a 40% increase in jobs from 2008, with one million Americans now working directly in the industry, and a total of 10 million associated jobs, according to a recent report by the Manhattan Institute for Policy Research.

“The shale oil and gas revolution has been the nation’s biggest single creator of solid, middle-class jobs — throughout the economy, from construction to services to information technology,” said the report, “Where the Jobs are: Small Businesses Unleash Energy Employment Boom.”

The growth can be attributed to more than 20,000 small and mid-size businesses operating in a widely dispersed area. Ten states are at the epicenter of the boom in oil and gas industry-related jobs, but identifying those 10 is not a slam-dunk since the benefits of development in one state tend to boost employment in its neighbors. Texas tops the list, followed by California, Oklahoma, Louisiana, Pennsylvania, New York, Illinois, Florida, Ohio and Colorado.

Ninety percent of the jobs created are in firms of fewer than 20 employees; 10% are in firms of 20-500 employees and less than 1% are in companies with more than 500 employees.

The study estimates that the hydrocarbon boom has added $300-400 billion annually to the economy in recent years, helping to lift the nation out of the recession.

“Without the contribution, GDP growth would have been negative and the nation would have continued to be in recession,” the report authored by Mark P. Mills, senior fellow at the Manhattan Institute.

Hydraulic fracturing and horizontal drilling are only part of the story behind the industry advance. The report credits technology advances in general and “smart drilling” in particular as a driving force.

Over the past five years, technology has improved the productivity of the typical oil or gas rig on America’s shale fields 200–300%, funded by oil and gas firms, major banks and funds, and “a remarkable influx of foreign direct investment (over $200 billion in the last several years alone).” Also, “an often overlooked but major source of hydrocarbon investment capital has come from individual private citizens and small investment partnerships.”

Over the past five years, publicly traded limited partnerships, often referred to as MLPs or master limited partnerships, have invested nearly $90 billion in capital projects associated with U.S. shale oil and gas production, including pipelines, processing plants, storage, terminals and distribution facilities. Eighty percent of the money in MLPs comes from individual investors, the Manhattan study said.

“This virtuous circle — redolent of Adam Smith’s ‘invisible hand’ of individual investors, small businesses, and innovators — is at the center of the biggest economic and job-creating revolution in oil and gas in a century,” said the Mills report.

The report recommends lower taxes, removal of regulatory barriers and increased freedom to export to world markets as the way to ensure the industry and the economic success it has created continues to thrive. The Manhattan Institute is a right-leaning group promoting free enterprise and less government control.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |