Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access

Williston Wells Work Better with Slickwater, Halcon Finds

Houston-based Halcon Resources Corp. has raised estimated ultimate recoveries (EUR) in its Williston Basin and East Texas Eagle Ford plays through increase drilling and completion efficiencies, particularly slickwater fracks, executives said Thursday.

Besides the newly emerging TMS (see related story), this year Halcon is focused on its other two oily resource plays: the Williston and El Halcon (the East Texas Eagle Ford).

Despite weather-related impacts of about 1,040 boe/d, Halcon produced an average of 24,125 boe/d in the Williston Basin during the fourth quarter, representing an increase of 15% versus the prior quarter. Drilling and completion delays related to the inclement weather during the fourth quarter of 2013 are also expected to impact production in the first quarter.

Halcon is now using one average type curve for all Bakken and Three Forks wells drilled in the Fort Berthold area, and one average type curve for all Bakken wells drilled in Williams County. In the Fort Berthold area, the average Bakken/Three Forks type curve increased by 39% to 801,000 boe, while the average Bakken type curve EUR in Williams County was revised higher by 43% to 477,000 boe.

Wells completed with slickwater fracks in the Williston are outperforming wells completed with cross-linked gel, all else being equal, the company said. Halcon plans to complete the majority of its future operated wells in the Williston using slickwater fracks. All company-operated wells online in the Fort Berthold area that were completed via a slickwater frack are currently outperforming the new 801,000 boe type curve, and internal reserve engineers estimate an average EUR for these slickwater wells of approximately 970,009 boe, Halcon said.

Halcon said with the implementation of other cost-reduction opportunities — pad drilling/simultaneous operations, and additional completion modifications — well costs should trend down this year by 5-10%.

Early stage downspacing tests continue to yield positive results, and indicate the potential for up to 16 locations per drilling spacing unit (DSU) in the Fort Berthold area, which would more than triple the drilling inventory in the area.

Halcon has working interests in 142,000 net acres prospective for the Bakken and Three Forks formations in the Williston Basin and plans to operate an average of four rigs and spud 40 to 50 gross operated wells in 2014. The company expects to participate in 200-225 gross nonoperated wells this year with an average working interest of 3%. About 49% of the total drilling and completions budget is expected to be spent in the Williston Basin, particularly the Fort Berthold area.

There are currently 141 Bakken wells producing, 12 Bakken wells being completed or waiting on completion and two Bakken wells being drilled on Halcon’s operated acreage. Similarly, there are 39 Three Forks wells producing, seven Three Forks wells being completed or waiting on completion and two Three Forks wells being drilled on operated acreage.

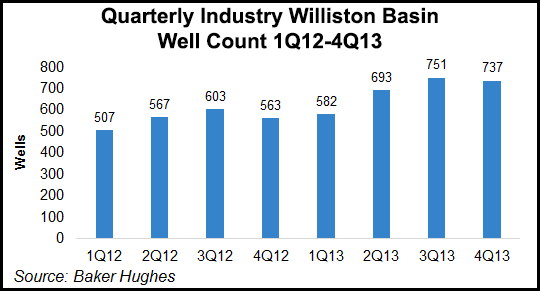

There were 737 wells producing in the Williston Basin in 4Q2013, according to Baker Hughes, which was down from 751 in 3Q2013 but still significantly more than the 563 wells there in 4Q2012.

Fourth quarter production from El Halcon averaged 7,138 boe/d, representing an increase of 43% compared to the third quarter. “The company has made meaningful progress toward identifying an optimal well design and continues to modify its completion techniques,” Halcon said. “Testing is under way on a number of completion design variations to reduce cost and increase performance, some of which include modifying perforated cluster density, varying proppant types and altering the fluid systems.”

Well results show that lateral length in the play directly correlates to EUR for wells that are completed with a sufficient volume of proppant, Halcon said. The company is working to find the most economic lateral length and said it expects to drill wells with an average lateral length of 7,500 feet this year. Improved well results prompted Halcon to raise its El Halcon type curve EUR estimate by 22% to 452,000 boe. This is based on well spacing of 750 feet and completions using at least 1,200 pounds of proppant per lateral foot. Well spacing pilot tests continue.

Halcon has working interests in 100,000 net acres prospective for the Eagle Ford formation in East Texas and believes a majority of its acreage is in the core of the play. It plans to operate an average of three rigs and spud 40 to 50 gross operated wells this year and spend about 40% of its total drilling and completions budget in the play.

There are 45 Eagle Ford wells producing, 10 wells being completed or waiting on completion and four wells being drilled.

Overall production for the fourth quarter and full year increased by 119% and 254% to 40,217 boe/d and 33,329 boe/d, respectively, compared to the same periods of 2012. The company reported full-year production near the high end of guidance, despite a 1,220 boe/d curtailment related to weather downtime, primarily in the Williston, during the fourth quarter. Production was 84% oil, 6% natural gas liquids (NGL) and 10% natural gas for the quarter and 83% oil, 6% NGLs and 11% natural gas for the year.

Halcon generated revenues of $289.3 million compared to $124.8 million for the fourth quarter of 2012. Revenues for the full year were $999.5 million, compared to $248.3 million for the full year 2012.

The company reported a net loss available to common shares of $415.3 million (minus $1.01/share) for the quarter and $1.2 billion (minus $3.25/share) for the year. The amounts for the quarter and the year include non-cash pre-tax impairment charges of $238.9 million and $1.4 billion, respectively. For the year ago quarter the company reported a net loss of $8.04 million (4 cents/share) and for 2012 reported a net loss of $142.3 million (91 cents/share).

After adjusting for selected items primarily related to non-cash impairment charges and the non-cash impact of derivatives, net income was $4.1 million (1 cent/share) and $67.7 million (15 cents/share) for the fourth quarter and full year, respectively.

As of Dec. 31, the company had undrawn capacity on its senior secured revolving credit facility and cash on hand of about $700 million. Pro forma for the East Texas asset sale and the related $100 million reduction to the revolver borrowing base that is expected, Halcon had undrawn capacity on its senior secured revolving credit facility and cash on hand of $1.1 billion at year-end.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |