Markets | NGI All News Access | NGI The Weekly Gas Market Report

Northeast to Remain Colder Than Normal Through April, WSI Says

Most of the United States will experience a reprieve over the next three months from what has been an unusually harsh winter, but big natural gas demand areas across the Northeast can expect temperatures to average below normal until May, according to forecasters at Weather Services International (WSI).

The winter of 2013-2014, which will be remembered for a recurring polar vortex, propane shortages in the Midwest and Northeast and a worsening drought in southern California, isn’t about to loosen its grip, according to WSI Chief Meteorologist Todd Crawford.

“After a brief respite from the cold winter pattern recently, all signs point to a return to a much colder pattern as we march toward March. The forcing from organized clusters of tropical thunderstorms in the western Pacific will likely return, resulting in another amplification of the jet stream in the eastern Pacific and allowing for cold air to return to the northern and eastern United States for March. We expect the bulk of the above-normal temperatures to be confined to the drought-plagued Southwest for much of the spring, and we are monitoring the possible development of an El Nino event for clues to the upcoming summer forecast,” Crawford said.

March will average colder than normal in the East (except Florida) and North Central area, while the rest of the country can expect warmer-than-normal temperatures, WSI said in a seasonal forecast released late Monday. That should lead to “very firm” natural gas prices, according to Energy Securities Analysis Inc. (ESAI) Senior Analyst Chris Kostas.

“Coming on the heels of three colder-than-normal months, unseasonably cold temperatures in the Northeast and Midwest in March would draw natural gas inventories to the lowest level since 2004 (when inventories ended the withdrawal season at 1,014 Bcf),” Kostas said. “Regional gas prices in New England and New York should run exceptionally firm if the cold temperatures materialize as expected. PJM gas prices would also continue to carry a premium to Henry Hub despite the large year-over-year gains in Marcellus shale-gas production. Power and gas prices in Texas and California will likely be buoyed by firm Henry Hub prices in March but should be moderated by the warmer-than-normal temperatures and below-normal heating demand expected in those regions.”

There may be a bit of a warm-up in the Southeast in April, but the Northeast and North Central regions will continue to average colder than normal, the WSI forecasters said.

“While weather-related demand is typically soft in April, colder-than-normal temperatures during the first week of the month could extend the withdrawal season into April and help to bolster gas prices during the first half of the month,” Kostas said. “The start of generator maintenance and low inventory levels should help to support natural-gas prices in April. Slack demand in the South and West should help to offset these bullish pressures and help to soften energy prices as the month progresses, however.”

The Northeast could finally see some relief in May, when temperatures there are expected to average warmer than normal. Only the North Central area will still be caught in a colder-than-normal cycle at that point, the WSI forecasters said.

“With slightly warmer-than-normal temperatures expected over much of the country in May, power and gas prices are likely to find continued fundamental support,” Kostas said. “Generation maintenance, combined with slightly higher-than-normal electrical loads, should help to support implied market heat-rates throughout the country, but particularly in Texas, where the cooling season starts earlier. Natural gas storage injections will likely run 2.0 to 2.5 Bcf/day over last year’s level; increasing year-over-year demand and directionally supporting prices. Increased natural gas production and higher year-over-year coal-fired generation should help to offset some of the increased demand and prevent prices from running to the upside, however.”

Multiple polar vortices and stubbornly cold weather in general this winter have had a number of adverse effects, including record natural gas storage withdrawals, which has reintroduced price volatility to the market. The American Public Gas Association this week asked the Commodity Futures Trading Commission to look into a 10% price spike in the February New York Mercantile Exchange (Nymex) Henry Hub contract Jan. 29, and FERC has scheduled a technical conference to evaluate the U.S. electric grid’s performance and review interaction between the natural gas and electricity markets this winter(see Daily GPI, Feb. 24a; Feb. 24b; Feb. 20).

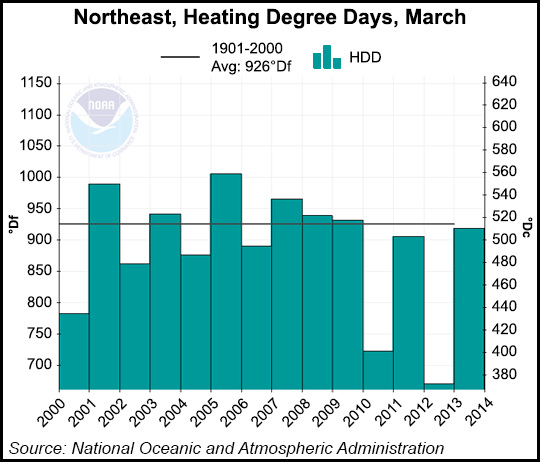

The number of recorded heating degree days has been driven to unusual highs, according to National Oceanic and Atmospheric Administration data (see Daily GPI, Feb. 6).

Earlier this month the Federal Energy Regulatory Commission invoked for the first time its emergency authority under the Interstate Commerce Act to help alleviate “dangerously low” propane supplies in the Midwest and Northeast (see Daily GPI, Feb. 11; Feb. 10).

The heavy pull on natural gas and gas storage caused by extended extreme cold across much of the northern part of the United States and Canada prompted the California Independent System Operator (CAISO) earlier this month to issue a conservation alert because of a shortage of gas supplies that underpin much of the state’s power generation (see Daily GPI, Feb. 7). CAISO said there were constraints on natural gas supplies coming from the Southwest, the Rockies and Canada. Conservation efforts would free up both natural gas-fired power and hydropower generation, which has become vulnerable during the state’s worsening drought. The final month of 2013 was the driest December ever recorded in the California, leaving nearly 60% of the state in extreme drought conditions, according to the Energy Information Administration.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |