E&P | NGI All News Access | NGI The Weekly Gas Market Report

Encana Onshore Liquids Output Jumps by 82%

A strategy shift by natural gas heavyweight Encana Corp. helped the independent to increase its onshore liquids output in the final period of 2013 by 82%, with full-year production 74% higher.

The turn to oil and liquids targets has been a slow progression over the past two years as the once mighty North American gas producer saw prices fall to 10-year lows in 2012. CEO Doug Suttles unveiled a more focused production business in November, cutting the 30 gas-weighted onshore targets to only five. The workforce has been slashed by 20%, dividend payments are lower, assets are for sale, and a proposed spin-off is in the works for a royalty business to boost cash flow.

“The fourth quarter of 2013 was a transformational time for Encana,” Suttles said during a conference call Thursday. “In a six-week window, we launched our new strategy, completed an organizational restructuring and announced our 2014 budget…We finished 2013 strong and we’re well positioned to deliver on our priorities and objectives in 2014 with our new strategy very much under way.”

Cash flow, a key indicator of the ability to pay for new projects and drilling, fell 16% to $677 million in 4Q2013. The net quarterly loss widened to $251 million from $80 million in 4Q2012. Excluding one-time items, which included an unrealized hedging position and higher administrative expenses associated with cutting the workforce, Encana posted operating profits of $266 million (31 cents/share), versus $296 million (40 cents) in the year-ago period.

Suttles, a former operations chief at BP plc, took over the ailing Calgary producer last June (see Shale Daily, June 12, 2013). Since his arrival, he’s reshuffled the management team, sold assets and most significantly, has sped up Encana’s shift to liquids drilling.

This year liquids production is expected to be 30% higher than last year. Average gas production volumes were at guidance of 2.78 Bcf/d in 2013, and even though volumes should be lower this year, liquids growth may keep production flat on a total equivalency basis. Encana has reduced the capital it spends on its proved undeveloped (PUD) reserves “outside of the core areas,” that is, gassy leaseholds, said Suttles. “The gas associated with PUDs hasn’t disappeared, but it’s been recategorized. The size of our economic resource is unchanged from a year ago.”

Proved gas reserves have been cut by 11% to about 7.9 Tcf because primarily they are dry gas PUD reserves, he said. Proved liquids reserves rose 5% to about 220 million bbl. Overall, proved reserves at the end of December under U.S protocol fell 9% to around 9.2 Tcfe. All of the PUDs are scheduled for development within five years.

The pullback in gas drilling will keep Encana’s capital spending flat from 2013 at $2.7 billion, $400 million less than original guidance.

“With the focus being on the development of liquids such as light oil and condensate, combined with lowering its cost structures, Encana believes the result will be higher margins and improved netbacks, in line with the company’s stated objective to value profitability over production volumes,” Suttles said.

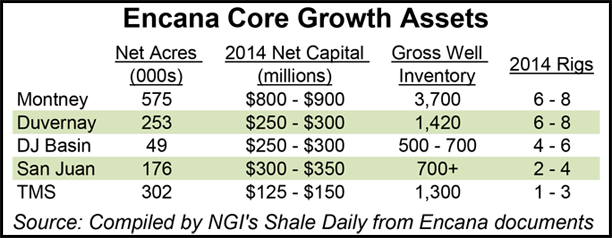

The strategy makeover was launched in November, taking the company from funding about 30 onshore targets, mostly gas-weighted, to five oily formations: the Denver-Julesburg (DJ) and San Juan basins, Tuscaloosa Marine Shale (TMS), and the Montney and Duvernay plays in Canada (see Shale Daily, Nov. 5, 2013). Previous to the shift, the five plays had captured only 40% of the capital budget on average.

“Hitting our 2013 targets while at the same time reducing our overall capital investment is a reflection of our focus on efficiency and profitability,” said Suttles. “There’s a sense of renewed energy across our business as we work collectively to become the leading North American resource play company.”

Liquids output in 4Q2013 averaged 66,000 b/d, up 82% from 4Q2012, with annual output up 82% at 53,900 b/d. That’s only the beginning, Suttles told analysts.

Encana “clearly has some momentum from changing to liquids,” with output now receiving an uplift from natural gas prices. “The big shift, though, is that the real uptick in volumes in 2014 will come in the second half of the year as a result of reallocating capital.”

Capital allocated in 2013 to a “number of plays was not core to growth. Some didn’t meet materialization; some were ethane barrels versus other higher priced barrels.”

The CEO provided an overview of how Encana expects its five core plays to perform in 2014:

In the Duvernay, Encana has moved into full resource play mode in the Kaybob area, the northern portion of the play, with the first multi-well pad under construction and two of the eight wells planned now production. The remaining six wells are to be initiated in March. Encana now has five rigs running in the Duvernay; the company is moving toward commerciality in the southern Willesden Green area.

The DJ Basin has six rigs in operation, up from two in 2013. The most recent well set a company record of eight days from spud-to-rig release, down from a 13-day average. Encana also captured a year/year 34% reduction in hydraulic fracturing costs.

Encana is running one rig in its re-emerging San Juan operations. The latest well had a 30-day initial production rate of 450 b/d. Encana also is working with the U.S. Bureau of Land Management to streamline the permitting process and accelerate development.

The Tuscaloosa Marine Shale has two rigs running as the company “advances its appraisal program. “

The legacy Deep Panuke gas field offshore Nova Scotia, which started up in 4Q2013, is producing “at or near” full capacity of 300 MMcf/d.

CFO Sherri Brillon told analysts that Deep Panuke gas is being “sold into the premium Northeast daily spot market” at Algonquin, which helped Encana improve 4Q2013 gas pricing by 20 cents.

Asked whether Encana may increase its gas production if prices remain high, Suttles said it would require a “reliable weather forecaster…The good news is, if you’re company has a lot of gas production, cold weather is pulling a lot of demand and strong pricing…It’s incredibly difficult on the weather and pricing volatility to know where this is going to land.”

Encana has hedged about 2.14 Bcf/d of expected 2014 gas production at a price of $4.17/Mcf, with another 825 MMcf/d hedged for 2015 at a price of $4.37. Around 95,000 b/d of expected 2014 oil output is hedged at an average of $94.19/bbl West Texas Intermediate.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |