E&P | Eagle Ford Shale | NGI All News Access

Pioneer Maturing in Midland Basin, Shifting to Horizontal Drilling

Pioneer Natural Resources Co. plans to keep tearing it up in the Midland Basin of West Texas, where horizontal drilling in the Spraberry/Wolfcamp, as well as in the Eagle Ford Shale of South Texas, grew reserves and production during a year that CEO Scott Sheffield said was “…the best year in Pioneer’s 17-year history.”

The company added proved reserves of 141 million boe last year from discoveries, extensions, improved recovery and technical revisions of previous estimates. Drillbit proved reserve additions equate to replacing 211% of full-year 2013 production of 67 million boe, which includes 5 million boe of production associated with assets to be sold in Alaska and the Barnett Shale, as well as production used for field fuel of 3 million boe. Drillbit finding and development costs were $19.70/boe last year.

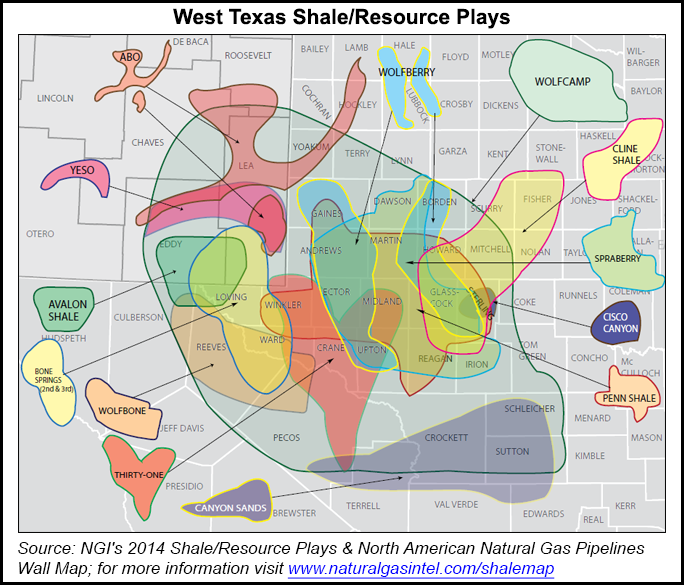

In the Midland Basin, Pioneer continues to shift from vertical to horizontal drilling in the Spraberry/Wolfcamp, where horizontal wells contributed 72 million boe of proved reserve additions last year, or 50% of the 2013 total. The company is the largest acreage holder in the play with more than 600,000 gross acres in the northern portion and more than 200,000 gross acres in the southern Wolfcamp joint venture area.

Appraisal and delineation work across Pioneer’s northern acreage position and in the southern horizontal Wolfcamp joint venture area increased the company’s resource base from 9 billion boe to 11 billion boe last year.

“By demonstrating the horizontal prospectivity of Pioneer’s northern acreage and progressing successful downspacing programs in the Eagle Ford Shale and the Spraberry/Wolfcamp, we added substantial resource potential and net asset value to the company,” Sheffield said. “We are in the process of reallocating capital to higher-return Spraberry/Wolfcamp horizontal drilling by reducing our vertical drilling activity and divesting our Alaska and Barnett Shale assets.

“Looking ahead to 2014, our main objective is to translate the resource growth we delivered in 2013 to strong production growth. To accomplish this, we are increasing our horizontal rig count in the northern Spraberry/Wolfcamp from five rigs at the end of 2013 to 16 rigs by the end of the first quarter. We will also continue an active drilling program in the southern Wolfcamp joint venture area and the Eagle Ford Shale.

“As a result, we expect a 14-19% increase in production in 2014 compared to 2013. Looking beyond 2014, we expect to continue to ramp up our horizontal rig count in the Spraberry/Wolfcamp, deliver compound annual production growth of 16-21% for the next three years and more than double production by 2018.”

The Lower Spraberry interval is estimated to contain 40 million to 60 million bbl of oil per section on Pioneer’s acreage, which is one of the highest oil-in-place intervals in the play, according to the company. Pioneer’s first five Lower Spraberry wells had an average oil content of 84%. Early production data from the first five wells suggests that wells in the Lower Spraberry will decline slower than deeper Wolfcamp interval wells and deliver estimated ultimate recoveries of 575,000 to 800,000 boe with before tax returns ranging from 45% to 100%, Pioneer said.

The five Lower Spraberry wells are in “relatively early days in their production,” said COO Tim Dove during an earnings conference call. “They do show a different sort of type curve than we see in the Wolfcamp. So it’s not just about IP [initial production] when it comes to Lower Spraberry…There is a lot of water production that’s to be gotten off the wells. The oil rate builds through time…”

Dove told analysts that appraisal of the Middle Spraberry is still under way and it is too early to talk about. “I think those wells would be expected to perform more like Lower Spraberry wells but we will have more data on that shortly,” he said. “It will be some time before we have definitive data because we will be just putting our first wells on production shortly.”

As the company transitions to a development program across its northern acreage this year, it expects to increase its rig count there from 10 at the end of last year to 16 at the end of the first quarter. The 16-rig program is expected to spud 140 wells this year with an average lateral length of 8,200 feet. Approximately 90% of the drilling program will be Wolfcamp A, B and D interval wells. The remaining 10% will be Spraberry Shale wells (Lower Spraberry Shale, Jo Mill Shale and Middle Spraberry Shale).

Pioneer said expects to spud 115 horizontal wells in the southern Wolfcamp joint venture area in 2014 with an average lateral length of 9,400 feet, an increase of 13% from the average lateral length of 8,300 feet in 2013. Three-well pads will be used to drill all of the wells. This year’s program will focus on higher0return areas in northern Upton and Reagan counties (including Giddings and University Block 2), with about two-thirds of the wells being completed in the Wolfcamp B interval and the remainder being a mix of Wolfcamp A, C and D interval wells.

Fourth quarter production from the entire Spraberry/Wolfcamp area (northern acreage and southern Wolfcamp joint venture area) averaged 80 million boe/d. Fourth quarter production was curtailed by 5 million boe/d due to severe winter weather. “Heavy icing and low temperatures across Pioneer’s leasehold position in the Spraberry/Wolfcamp area resulted in extensive power outages, facility freeze-ups, trucking curtailments and limited access to production and drilling facilities,” the company said.

Meanwhile in the Eagle Ford, Pioneer continues downspacing and staggered testing to 175 feet between wells in the liquids-rich areas of the play where the 500-foot spacing was successful. Some areas will include testing of the Lower Eagle Ford Shale interval only, while others will include a combination of the Lower and Upper intervals. Early results from the initial 300-foot downspacing and staggered test in the Lower Eagle Ford continue to be encouraging, with five downspaced wells performing consistent with offset 500-foot spaced wells, the company said.

Results from from the company’s first Upper Eagle Ford Shale well continue to be encouraging, with production in line with offset Lower Eagle Ford wells. Pioneer plans to drill 45 Upper Eagle Ford wells as part of the downspacing program this year.

Fourth quarter production from the Eagle Ford averaged a record 40 million boe/d, Pioneer said. Forty-one wells were placed on production during the quarter, predominantly weighted toward the first half of the quarter. Full-year 2013 production averaged 38 million boe/d, an increase of 35% compared to 2012.

This year Pioneer expects to drill 110 liquids-rich wells in the Eagle Ford, using mainly three- and four-well pads. This year’s program reflects longer laterals and larger fracture stimulations compared to last year. Full-year production is forecasted to range from 45 million to 49 million boe/d, an increase of 18-29% compared to full-year 2013.

Overall, Pioneer plans to spend $3 billion on drilling and $300 million on vertical integration and the construction of new field and office buildings this year. The Northern Spraberry/Wolfcamp area is to get $2.165 billion. The Southern Wolfcamp joint venture area (net of the company’s carry) will see $205 million, and the Eagle Ford will get $545 million. Other assets are to receive $100 million.

Production during the fourth quarter is expected to average 166 million to 171 million boe/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |