Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access

Marathon Oil CEO ‘Encouraged’ by Crude Export Talk

Marathon Oil Corp. has not been pursuing a swap or permit arrangement that would allow it to export domestic oil production, CEO Lee Tillman said Thursday. However, the leading Eagle Ford Shale producer is carrying the torch for the pro-export cause and watching attitudes toward crude exports evolve.

“Clearly, it’s encouraging to us as a company to see the crude export issue being out there and discussed openly now. If you rewind back not so long ago, that was not the case,” Tillman told analysts during an earnings conference call. “…[N]ow I think there is some traction in the political circles. I still think it’s a challenge to move it all the way to a full opening of exports, but some of the swaps and some of the export permits that folks are talking about, we’re monitoring that.”

Export of domestic crude oil to foreign countries is generally forbidden; however, there are options to secure permission to export under existing law (see Shale Daily, Jan. 23).

“…[W]e’re spending our time with the influence leaders and policymakers to ensure that they have the facts, they understand how [crude exports] will positively impact the overall situation here in the U.S., whether you take a look at it from a consumer position and price at the pump or whether you look at it from a balance of trade standpoint,” Tillman said.

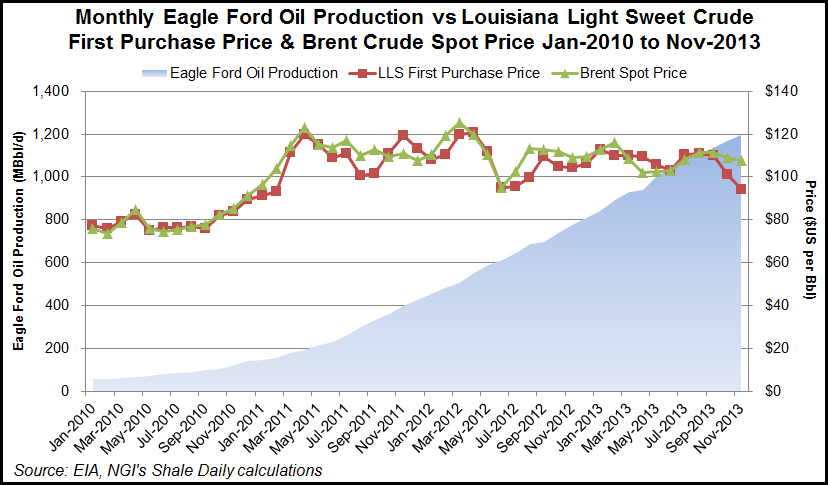

The value of Marathon Oil’s Eagle Ford crude production is driven by the price of Louisiana Light Sweet (LLS) crude. During the fourth quarter the LLS-Brent spread “was under some challenge,” Tillman said.

Fourth quarter U.S. liquid hydrocarbon realizations fell almost 12%, and synthetic crude oil realizations declined 23% compared to the third quarter of 2013, the company said.

“What we saw was from the third quarter when LLS and Brent were essentially at parity, we saw that really widen to about an $8 differential between LLS and Brent,” said Howard Thill, vice president of investor relations. “…[I]n January we’ve already seen that discount close from that $8 down to about $4, so it continues to narrow.

“From what we’ve seen, that was really driven by the opening up of the southern leg of Keystone XL as well as the reversal of the Ho-Ho line…” Ho-Ho Pipeline operator Shell reversed the system to provide U.S. Gulf Coast refineries pipeline access to additional sources of growing crude production from the Eagle Ford, Bakken and other shale regions.

“So what you had was that bottleneck really moved from a WTI price at Cushing to a Gulf Coast price, LLS, and as that’s been absorbed,” Thill said. “Then you’ve seen those differentials really start to close and maybe not back to normal, but getting back to more of where we were on a pre-fourth quarter basis.”

CFO J.R. Sult said Marathon Oil is looking at options to lift the value of its domestic crude, such as additional market outlets. “On the financial focus, of course, we have had in the past and we will continue to look for opportunistic financial hedging potential.”

Marathon Oil’s North America exploration and production (E&P) segment reported income of $125 million in the fourth quarter, compared to $242 million in the third quarter of 2013. The decrease was primarily due to lower liquid hydrocarbon price realizations and higher exploration expenses, partially offset by volumes growth from U.S. resource plays.

For full-year 2013, North America E&P segment income was $529 million, compared to $382 million in 2012. The increase was primarily a result of higher liquid hydrocarbon volumes from the Eagle Ford, Bakken and Oklahoma resource basins.

Production from the Eagle Ford averaged almost 90,000 net boe/d in the fourth quarter, an increase of 8,000 net boe/d from the third quarter. For the final two weeks of 2013, production averaged more than than 100,000 net boe/d. Approximately 65% of fourth quarter net production was crude oil/condensate, 17% was natural gas liquids (NGL) and 18% was natural gas.

Bakken Shale production averaged 40,000 net boe/d during the fourth quarter, up from 38,000 net boe/d in the prior quarter. Bakken production averages 90% crude oil, 4% NGLs and 6% natural gas.

Unconventional Oklahoma production averaged almost 14,000 net boe/d.

The company increased U.S. resource play average net production 86% from 2012 overall. Company-wide 11% overall production growth (excluding Alaska and Libya) exceeded 2013 guidance. “In particular, our strong year-over-year net production growth in the top U.S. liquids resource plays — 136% in the Eagle Ford, 34% in the Bakken and 68% in the Oklahoma resource basins — demonstrated our ability to drive superior operating results,” Tillman said.

Reserve replacement last year was 194%, excluding dispositions, at a finding and development cost of about $16/boe. “We ended 2013 with net proved reserves of approximately 2.2 billion boe, an 8% increase from 2012, topping the 40-year proved reserves record set last year,” Tillman said.

For the fourth quarter adjusted net income was $418 million (60 cents/share) compared to $617 million (87 cents/share) for the third quarter of 2013. Fourth quarter net income was $375 million (54 cents/share) compared to $569 million (80 cents/share) in the third quarter.

Full-year adjusted net income was $1.87 billion ($2.64/share) compared to $1.74 billion ($2.45/share) for 2012. Full-year 2013 net income was $1.75 billion ($2.47/share) compared to $1.58 billion ($2.23/share) in 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |