Markets | NGI All News Access | NGI Data

Futures Little Changed Despite Storage Finishing January at a 10-Year Low

Physical natural gas prices for Friday delivery fell hard and fell often in Thursday’s trading as weather forecasters called for warming trends in the Midwest, East and California.

With the exception of a few points on the East and West coasts, all market points suffered losses ranging from a quarter to double-digit dollars in the Midcontinent, Rockies and California, despite the fact that regional electric transmission operators in Texas and California were calling for conservation due to extreme cold.

The Energy Information Administration (EIA) reported a storage withdrawal of 262 Bcf for the week ending Jan. 31, and after traders added in an 8 Bcf revision that effectively made it a 270 Bcf draw, prices made only nominal moves. Futures finished mixed. March fell 9.9 cents to $4.931 and April rose 1.6 cents to $4.562. March crude oil gained 46 cents to $97.84/bbl.

Midwest prices fell sharply as weather forecasters called for a modest warming trend and demand was expected to ease. Temperatures were still expected to stay well below seasonal norms, however. AccuWeather.com’s Kristen Rodman said “dangerously cold air will return and stay in the [Chicago] area through the weekend [and] late-week temperatures will drop with Thursday being the coldest day as temperatures plummet nearly 15 degrees from Wednesday.

“Over the weekend, temperatures will rise back to the 20s and be accompanied by some snow flurries. However, temperatures on Monday will drop again and hover around 10 F for the start of next week. The city’s next chance for some sunshine will come on Thursday.”

Gas was quoted on Alliance for Friday delivery at $9.45, down $10.88, and deliveries to the Chicago Citygates dropped $18.36 to $9.09. Gas on Northern Natural Ventura tumbled $34.58 to $9.24, and at Demarcation gas for Friday changed hands at $8.92, down $27.19. Packages on ANR SW fell $17.02 to $8.87.

Weakness in Midwest market areas reverberated to the producing basins of the Midcontinent and Rockies. Gas on CIG Mainline tumbled $18.65 to $7.90, and deliveries to the Cheyenne Hub fell $26.29 to $8.10. At Opal, parcels were seen at $7.91, down $22.27, and on Northwest Pipeline Wyoming gas for Friday delivery tumbled $15.95 to $7.64.

Forecaster Wunderground.com predicted that Thursday’s high of 11 degrees in Chicago would rise to 13 Friday and make it to 20 by Saturday. The normal high in Chicago is 33. Indianapolis’ Thursday high of 11 was also forecast to reach 13 on Friday and 22 on Saturday. The normal high in Indianapolis is 38.

Industry consultant Genscape calculated a decrease in demand for the Midwest. “Pipelines are anticipating and preparing for below-normal temperatures to last through to Feb. 11. AccuWeather is forecasting the biggest temperature drops to hit the Midwest region, although Midwest demand has yet to meet the demand seen in the previous cold spells,” the company said in a Thursday morning report. “This week, Midwest demand has averaged 14.8 Bcf/d, which is a -2.0 Bcf/d decrease from last week’s average of 16.8 Bcf/d. However, multiple pipelines throughout the region immediately sent out notices regarding the imminent cold front.”

The Midcontinent also saw precipitous price drops. Deliveries to the NGPL Midcontinent Pool fell $16.00 to $8.24, and gas on OGT tumbled $24.88 to $7.95. On Panhandle Eastern next-day gas shed $28.48 to $8.52.

Changes in producing areas such as the Rockies and Midcontinent also impact California markets. SoCal Border traded about 31 cents over SoCal Citygates, and typically that relationship is reversed to allow economical transport of gas from SoCal Border points into the market zones of southern California.

“If you are transporting gas from West Texas over to California and you can get a better deal by keeping it there and selling it, then you will buy your obligation back at the border, and it doesn’t affect the Citygate,” said a gas buyer for a San Diego-based power generator. “Prices at SoCal Citygate are left to the demand at Citygate, and that is where the markets decouple. If it’s the other way around and there is strong demand at Citygate, then Citygate will run up and pull the Border higher.

“Since prices have been so strong east of California, we have brought in the least amount of gas in seven or eight years, and our draws on both PG&E and SoCal have been the strongest in seven or eight years. We’ve had one of the mildest winters in 10 years and yet the strongest draws in that period,” he said.

“The big utilities own the gas, and they own the transport to bring the gas in, but if there are better deals, the gas will go elsewhere.”

Prices at California points lost no time following the lead of the Midwest, Rockies and Midcontinent. Deliveries to PG&E Citygates dropped $15.40 to $7.24, and gas at the SoCal Citygates lost $4.53 to $7.24. At the SoCal Border, Friday packages went for $7.55, down $12.14, and on El Paso S Mainline Friday packages came in at $8.96, down $19.40.

Falling gas prices in California and elsewhere around the country seemed a bit peculiar as a number of regional grids made special pleas Thursday for conservation due to tight supplies. The California Independent System Operator issued a statewide Flex Alert Thursday, citing a shortage of natural gas triggered by extreme cold weather in much of the United States and Canada that is impacting fuel supplies to Southern California power plants and reducing electricity generation. Customers in both Southern and Northern California were asked to reduce their energy use between 1:00 p.m. until 10:00 p.m.

Meanwhile, in Texas the Electric Reliability Council of Texas (ERCOT), grid operator for most of Texas asked electric consumers to reduce electric use from 5 p.m. Thursday through noon on Friday.

“With the cold weather that began last night, we already saw electric demand close to our winter record this morning,” said Dan Woodfin, ERCOT director of System Operations. “We are expecting cold weather to continue through tomorrow morning’s high demand period, and some generation capacity has become unavailable due to limitations to natural gas supplies.”

ERCOT peak demand Thursday morning exceeded 57,000 MW and Woodfin warned it could reach or break its 57,277 MW record before the current winter weather leaves the region.

An industry veteran remarked that “it will be interesting to see how this all plays out. Storage is going to be a big driver this summer, and if we get mild weather prices won’t push up one way or the other. Any kind of hot weather that drives power prices is likely to drive natural gas, but if prices get too high, everyone will switch to coal and prices will come back down. Some people are calling for $6 gas, but I think it will be more like $5 on a month-to-month basis for the summer.”

With Wednesday’s gargantuan trading range of 75 cents just one day away, the Thursday morning release of storage figures by EIA had traders seeking volatility on the edge of their seats. The report was anticipated to show withdrawals well above historical norms. Last year, 129 Bcf was withdrawn and the five-year average stands at 151 Bcf. Analysts at United ICAP projected a pull of 280 Bcf, just shy of the record 287 Bcf for the week of Jan. 10. A Reuters survey of 25 traders and analysts revealed an average 270 Bcf with a range of 250 Bcf to 282 Bcf. Citi Futures Perspective analyst Tim Evans predicted a 258 Bcf drop.

Analysts are quick to point out that with storage currently at 1,923 Bcf and 200-plus Bcf draws anticipated for the next two weeks, mid-February is looking like inventories will be drawn down to about 1,500 Bcf. Add in some 100 Bcf pulls for late February and early March and suddenly you are looking at storage at 1,100 Bcf or less by the traditional March 31 end of withdrawals. The last year stocks were drawn down that much was in 2004, when ending inventories tallied 1,058 Bcf. The EIA projects 2014 season-ending inventories at 1,541 Bcf.

In its weekly storage report, EIA reported a revision to inventory levels of 8 Bcf making the reported 262 Bcf withdrawal in effect 270 Bcf. Prices moved relatively little following the release of the data and “It was just an initial jerk reaction until people realized the 8 Bcf revision. That brought the market back to unchanged. “I’m thinking $5 is support and $5.50 short term resistance,” said a New York floor trader.

“The 262 Bcf headline figure was less than expected, but the 8 bcf downward revision brings the total down 270 bcf from the previously reported figure, bringing the net change back in line with expectations. Although there’s room for confusion off the data and a ‘sell the news’ reaction like last week, this was still a fundamentally supportive report, with the draw far above the five-year average of 151 Bcf, said Tim Evans of Citi Futures Perspective.

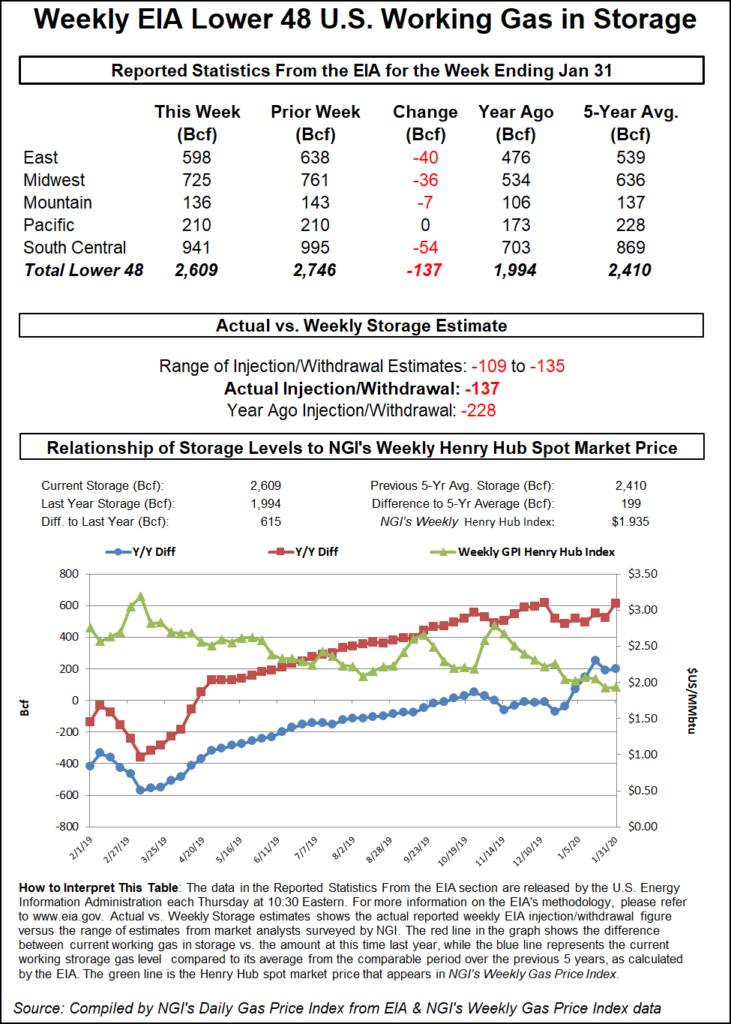

Teri Viswanath, director of Commodity Strategy, Natural Gas for BNP Paribas, noted that current storage inventories finished January at a 10-year low. “EIA revised last week’s stockpiles lower, from 2,193 to 2,185 Bcf,” she said. “The 8 Bcf reduction means that despite a slightly lower than anticipated draw last week, total inventories are roughly in line with market expectations. What’s more, this is the lowest ending stock level for end January since 2004!”

Considering the low level of inventories, Viswanath said the March contract’s decline Thursday might not make sense to some. “It appears to us that the direction of natural gas futures is slightly off-kilter given developments unfolding in the physical market this week. While the slight warm-up in the weather forecasts certainly translates to reduced heating demand ahead, the North American pipeline network is now clearly showing signs of deliverability stress as traditional sources of swing supply have been depleted. Translation? There are still significant upside risks for March gas deliveries and, hence, futures prices.”

Inventories now stand at 1,923 Bcf and are 778 Bcf less than last year and 556 Bcf below the five-year average. In the East Region 143 Bcf was withdrawn and in the West Region 26 Bcf was pulled. Inventories in the Producing Region fell by 93 Bcf.

The Producing region salt cavern storage figure dropped by 41 Bcf from the previous week to 137 Bcf, while the non-salt cavern figure fell by 52 Bcf to 565 Bcf. Resubmissions of data resulted in lowering estimates of working gas stocks in the Producing salt region by approximately 8 Bcf for the week ending Jan. 24, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |