NGI Archives | NGI All News Access

Oxy in 2013 Boosts Reserves, Permian and California

Ending last year at an all-time high for booked reserves at 3.5 billion bbl, Los Angeles-based Occidental Petroleum Corp. (Oxy) plans to continue to increase its oil production in the Permian Basin and California this year, boosting overall capital spending to $10.2 billion, compared to $8.8 billion in 2013, according to Oxy CEO Stephen Chazen.

Chazen reiterated the strong growth potential in California and the need for those assets to be operated as a separate company.

Speaking on a 4Q2013 earnings conference call Thursday, Chazen reported increased quarterly and full-year net income compared to comparable periods in 2012. Oxy’s income was $1.6 billion ($2.05 cents/share) in 4Q2013, compared with $336 million (45 cents/share) in 4Q2012, when there was an after tax charge of $1.1 billion. For all of 2013, net income was $5.9 billion ($7.35/share), compared to $4.5 billion ($5.72/share) for all of 2012.

As part of asset sales and stepped up operational strategies announced last fall (see Daily GPI, Oct. 29, 2013), the company should look “significantly different” by the end of 2014, said Chazen, while not specifying if that means completing the previously announced spin off of the company’s $16 billion of California assets (see Daily GPI, Oct. 30, 2013).

Oxy is targeting $2.2 billion in capital expenditures (capex) this year in the Permian Basin and over the next three years the company expects to double its production there from 64,000 boe/d to more than 120,000 boe/d, said Vicki Hollub, executive vice president for domestic operations.

In California, Hollub said Oxy spent $1.5 billion in capex last year and achieved all of its goals, including creating a “predictable” outcome for its assets in the state, advancing low-risk projects that contribute to long-term growth, reducing its cost structure, lowering base reserve declines, creating a more balanced portfolio and testing new exploration/development concepts. The result was 154,000 boe/d production last year, while lowering its operating costs by more than $4/boe, or 20%.

This year, Oxy is planning to invest up to $1.9 billion in its California plays: 40% on water floods; 20% on steam floods and the rest on unconventional and other developments. “We expect to average about 27 rigs in California in 2014, compared to about 20 rigs this past year,” Hollub said. The company wants to drill 1,050 wells in 2014, compared to 770 in 2013.

Hollub said the company thinks its production in California can grow to 190,000 boe/d in 2016 with steam and water flood projects contributing the bulk (80%) of that projected growth.

“California, the Permian and the rest of the company are quite different businesses,” Chazen said. “California could benefit a lot from higher capital spending and it will generate more growth. I think [the assets] could be managed differently than we would.”

Chazen said California holds “good prospects,” but it needs a management team that is composed of more risk-takers, or what he called “more aggressive growers.” It should be run more like a small exploration and production company, he said. “So, it is probable that [California operations] should be separate.”

He said it is obvious that as a separate entity, the California business would “spend more money and drill more wells.” A separate company that competes with other medium-size producers obviously is an entity that Chazen thinks is a “pretty complete business.”

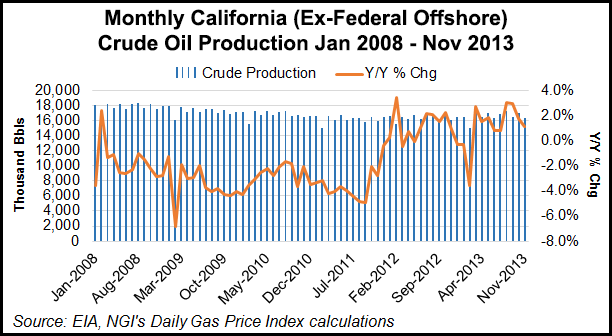

Monthly crude oil production from the California field, while lower than the levels it reached in 2008, has recovered over the past year, with every month between March and November 2013 increasing at least 0.8% compared with year-ago levels, according to Energy Information Administration data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |