Markets | NGI All News Access | NGI The Weekly Gas Market Report

Analysts See Big Storage Draws Coming, Possible Drop to 1.2 Tcf by April

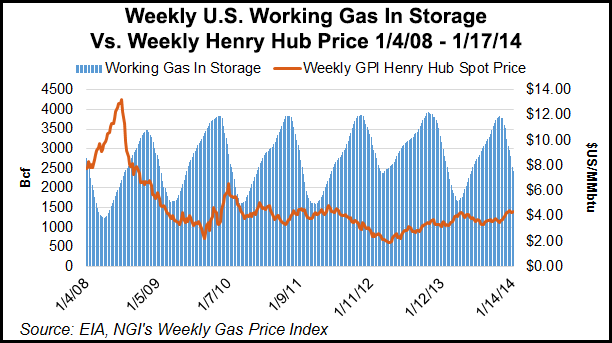

U.S. natural gas storage could fall to 1.2 Tcf by the end of withdrawal season, which could boost prices through the first half of the year, energy analysts said Friday.

Stephen Smith, who shares storage and pricing insight through Stephen Smith Energy Associates, talked with NGI on Friday about a new storage model he ran earlier in the day. The numbers, like the weather, “keep changing quickly,” he said.

“Basically, we thought that this polar vortex business would last through the end of January,” Smith said. The National Weather Service [NWS] “not too long ago was predicting that February would be milder than normal…But other forecasters now say February is looking colder than normal.”

Natural gas futures surged on Wednesday to two-year highs after the NWS revised weather forecasts showing below-average temperatures across the eastern half of the United States in its six- to 10- and eight- to 14-day forecasts. On Thursday private weather forecasters showed the current cold weather likely would persist across the eastern half of the country through the beginning of February.

Smith, who admitted he’s not a weather forecaster, said overall, the models indicate cold weather through February at least. In any case, the latest storage model indicates some well-above-normal withdrawals over the next two weeks.

“I had been running 1.4-1.5 Tcf for the end of heating season, the start of April. Now, it’s starting to look like 1.2 Tcf, based on the latest numbers.”

The lower storage forecast is based in part on the 285 Bcf draw for the second week of December, followed by a 287 Bcf draw four weeks later.

For the week ending Friday (Jan. 24), Smith’s preliminary modeling indicates that “it’s going to be a 225-230 Bcf draw…on the 2006-2010 norm, it might have been 190. So we’re maybe 40 over normal.”

For the week ending Jan. 31, preliminary modeling “looks like another one of those 280 Bcf-type weeks. That might be a little strong, but even so, that’s versus a 160 Bcf typical [draw] on the 2006-2010 norm,” he said.

“So there you have…a case where you’re adding about 100 Bcf in one week to an already upwardly pressured deficit…Based on this forecast, all of February looks colder than normal, and I end up at about 1.2 Bcf at the beginning of April.

“That would be a shortfall of about 450 Bcf versus what we normally see, maybe 1.65 Tcf, the average for the last five years.”

The storage deficit points to higher prices than Smith’s 1Q2014 forecast of $4.30/Mcf and that price could hold for a longer period.

“In the weather forecast that I’ve guided in my storage model right now, at 1.2 Tcf I think the number’s bigger than $4.30/Mcf [and] will last more into the year. Now just how long depends on what kind of summer we see.”

The big questions after the cold weather is gone are summer weather and production levels. Those two issues will impact prices through the rest of the year.

BNP Paribas also expects storage levels to end close to 1.2 Tcf.

Analyst Teri Viswanath, who directs natural gas commodity strategy, said her new models on Friday indicated “end-March inventories slipping to just 1.22 Tcf, representing the lowest level in the past decade. Should the industry replenish working gas in storage at the pace of the five-year average, a normal winter stock reduction next season would threaten to leave a dangerously low carry-out level (sub 1 Tcf) by end-March 2015.”

The upcoming summer injection season means “the necessary reset in the balances will have to come from adjustments to domestic production,” she said. “This is a changed dynamic, especially for a market that has been in structural surplus since 2008.

“Production gains are now being driven by market conditions rather than the need to hold acreage or possibly a valuation incentive. The challenge, of course, is to reach a price level that will encourage the appropriate level of drilling while not overwhelming nascent demand growth,” Viswanath added.

The recent price gains mostly have centered on the “very front of the strip, suggesting that the market is primarily concerned about meeting current winter demand requirements. In order to provide the necessary incentive for a ramp-up in drilling activity, we think that the back of the curve will need to rise commensurate with producer expectations.”

BNP has increased its 2014 price forecast to $4.60/Mcf from $4.20 “to reflect the economics which are necessary to bring the industry back into equilibrium,” said Viswanath. “Our earlier recommendation of pre-positioning ahead of the upcoming injection season is still warranted. Hence, we would advise holding onto the October ’14 position and advantageously adding to summer contract length upon a pullback.”

The chance for $5.00 gas prices this winter appeared prescient earlier this month, but the BNP analyst now thinks there is little chance of reaching that lofty mark before winter begins to wind down.

Genscape Inc. analyst Wei Chien said the firm’s modeling is sympatico with the end-of-storage models by Smith and BNP, but she’s uncertain whether there will be whopping storage draws two weeks in a row.

“We are seeing 1.2 Tcf for end of March balance due to much colder than normal weather we have experienced,” she told NGI. “I would agree with the next storage withdrawal being above 200 Bcf but the one after will be dependent on weather and it’s too early to say if it will be above 200 Bcf.”

Patrick Rau, NGI’s director of Strategy & Research, shares analyst concerns about the outlook for summer weather, and as important, how much gas production there will be this year.

The question, Rau said, is whether operators “struggle to fill storage before summer rolls around. It’s not a big draw on storage as the winter, but it matters.”

Two things, he said, will affect operators’ ability to expand production before next summer and to the start of heating season in November: coal versus natural gas demand for power generation, and the price of gas.

“Power generation consumes up to 40% or so of natural gas use. Higher gas prices mean more switching to coal, everything else being equal. More coal usage forces more gas in the ground.

“Natural gas use for power generation became negative year-over-year in October, and if that trend continues, that will help refill storage, at least to some degree.”

Genscape data indicates that Lower 48 state production increased by 1.5 Bcf/d year/year for the first three weeks of January, Chien noted.

“Although it may seems like the much colder than normal winter should support gas prices in the second quarter, the market may be forgetting the impact of coal-to-gas switching driven by lower gas prices in the past two years. Without heating demand and price-induced power burn demand, we may be seeing inventory increasing at a remarkable rate as Marcellus Shale production growth continues in the spring.

“Fundamentally we don’t see more price support for the second quarter at this point.”

Most producers already have set their capital spending budgets for 2014, but they can change, said Rau. “For example, WPX Energy Inc. said it could ramp up production in the Piceance on a dime. So can Southwestern Energy Co. in the Fayetteville.

“If companies take advantage of the higher future/forward curve by layering in even more hedges, then they can increase their production without fear of what that will do to prices,” he said. “History suggests that some producers will do just that. It would be interesting to see how much open interest among commercial users, as designated by the Commodity Futures Trading Commission, has increased in the last few weeks. That is what would indicate an increase in hedging.”

The NWS now is forecasting warmer than normal temperatures from May through August. And the consensus is that production likely will edge up as more infrastructure (pipelines) helps carry constrained output from the Appalachian Basin, said Smith. That constrained output includes a slew of uncompleted wells that would begin to flow.

“I think we’re probably going to see some more growth” production-wise, he said. However, Smith has “no strong opinion” about the summer.

“We’ve tended to have warm summers. But when you start introducing things like the polar vortex, you wonder if the summer hasn’t changed too…Bottom line is it looks to me like the current strip is being too conservative. If you’re sitting at $4.90 now, and you could end up with a 1.2 Tcf [in storage], or even maybe a little lower in the worst case, it seems to me the market…might not get back to $4.30 as quickly as it looks like.”

The continued onslaught of cold weather indicates that “there’s no reason to be so confident” about where storage and pricing are headed, Smith said. Not as a weather forecaster but “from an engineering perspective, one would say, if something is anomalous, how can one expect to have any great precision about when that the anomaly is going to end? Clearly, the norms have broken down a little bit in terms of the cold…

“I don’t know that I would have a lot of confidence. There was nobody that was calling this kind of weather in advance, at least I haven’t seen it. Put me down in the skeptical camp that the $4.30 is going to be the price by the time we get to the second quarter and into June.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |