E&P | NGI All News Access | NGI The Weekly Gas Market Report

Lucius Production Ramping Up in Third Quarter, Says Freeport-McMoRan

The deepwater Gulf of Mexico (GOM), and in particular Keathley Canyon, should add substantial U.S. reserves by the second half of this year when the Lucius platform ramps up, a major stakeholder said Wednesday.

Lucius, which would deliver up to 80,000 b/d of oil and 450 MMcf/d of natural gas, is set to begin operations in the third quarter, Freeport-McMoRan Copper & Gold Inc.’s Jim Flores said. Flores, co-CEO, presides over the oil and gas operations, known collectively as FM O&G. He and co-Chairman Richard Adkerson held court with analysts for more than an hour to discuss the conglomerate’s quarterly and year-end 2013 results, and to offer their forecast for 2014.

This is the year when all things oil and gas begin to fall in line, Flores said. It’s been a bit of a struggle for Arizona-based Freeport over the past year (see Daily GPI, Oct. 22, 2013). The company has had its hands full completing a friendly mega-merger with Plains Exploration & Production Co. and McMoRan Exploration Co., which brought a boatload of GOM and onshore assets, as well as $22 billion of debt (see Daily GPI, Dec. 12, 2012).

However, all of the sweat and tears won’t be for naught, said Flores, who formerly led Plains. Among the many assets that had been in Plains’ portfolio was the Lucius prospect, operated by Anadarko Petroleum Corp. (see Daily GPI, Aug. 15, 2012; Dec. 16, 2011).

“Our Lucius development project is one of those areas where, as we continue to get closer to production, we’re able to add reserves. We’ve delineated the Pliocene reservoir and we have more to do in the deeper Miocene reservoir” but “Lucius is on schedule.”

Flores disclosed that there have been some “pipeline delivery issues” for the project. Last year the Federal Energy Regulatory Commission authorized Williams-owned Discovery Gas Transmission LLC to construct platform and pipeline facilities in South Timbalier Block 283 to extend its system and provide capacity for about 405,000 Dth/d of firm transportation for new gas sources in the southeast quadrant of Keathley Canyon (see Daily GPI, May 30, 2013). In addition to Lucius, other Keathley prospects include ExxonMobil Corp.’s Hadrian North (see Daily GPI, June 9, 2011); and BP plc’s Kaskida (see Daily GPI, Sept. 3, 2009).

Anadarko, said Flores, “has done a masterful job in overcoming [pipeline issues] to keep it on schedule. It costs a little more money, but on top of that it’s a rounding area when you put on 80,000 b/d and 450 MMcf/d of gas that the facility’s going to process in the third quarter of this year…Fingers’ crossed on that, but the project continues to move along just as planned.”

For its entire global operations, Freeport’s 4Q2013 profits totaled $707 million (68 cents/share), down from year-ago earnings of $743 million (78 cents). The final three months of 2013 included one-time charges of 16 cents/share related to negative hedging impacts. Revenue year/year increased 30% to $5.89 billion.

Sales from O&G operations during 4Q2013 totaled 16.6 million boe, including 11.7 million bbl of crude oil, 22.9 Bcf of natural gas and 1.1 million bbl of natural gas liquids (NGL). Realized revenues for O&G operations totaled $1.2 billion ($73.58/boe) and cash production costs totaled $293 million ($17.63/boe).

Average realized natural gas prices in 4Q2013 were $4.06/MMBtu, but excluding the impact of derivative contracts, the average price fell to $3.77.

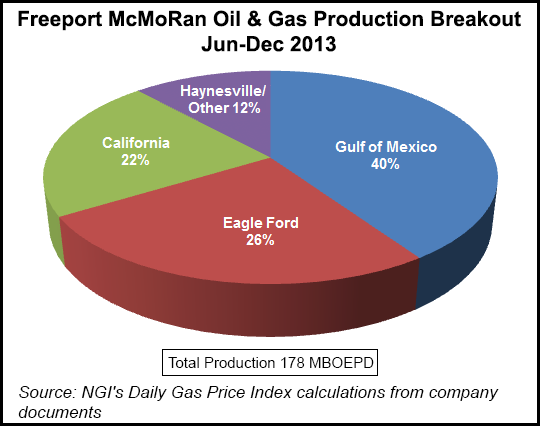

For the seven-month period of 2013 following the dual acquisition date, realized O&G revenues came in at $2.9 billion ($76.87/boe) and cash production costs were $653 million ($17.14/boe). FM O&G generated operating cash flows in the seven-month period of $1.8 billion, which exceeded capital expenditures of $1.45 billion.

Total capital spending for 2014 is estimated to increase to nearly $7 billion, with $3 billion earmarked for O&G. In 2013, Freeport spent a total of $5.3 billion. Sales volumes from O&G operations are forecast to average 170,000 boe/d in 1Q2014 and 166,000 boe/d for the full year, about 70% weighted to oil, 24% to gas and 6% to NGLs. Volumes this year are expected to be impacted in 3Q2014 by planned platform maintenance and subsea tieback upgrades on the Marlin facility in the GOM.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |