E&P | NGI All News Access | NGI The Weekly Gas Market Report

Halliburton, Baker Modestly Optimistic About North American Onshore

Baker Hughes Inc. and Halliburton Co. both see signs of improvements in well services in North America’s onshore, but the pressure pumping market still will be oversupplied through the year, management said Tuesday.

Schlumberger Ltd. expressed similar views Friday (see Daily GPI, Jan. 17).

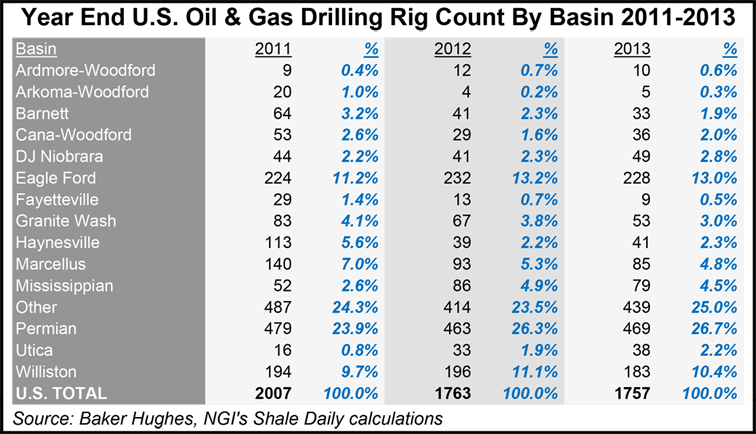

Baker, which provides a weekly rig tally, is forecasting a flat U.S. rig count but a higher well count from 2013. Halliburton, the No. 1 oilfield services provider in North America, expects to see a higher rig count, driven primarily by the Permian Basin as operators switch to horizontals from verticals.

Baker management reported earlier this month that the U.S. onshore well count in 4Q2013 rose 5% year/year to 9,056 wells (see Shale Daily, Jan. 10). The average U.S. onshore rig count, however, fell sequentially by 12 rigs to 1,697. Expect that trend to continue, with more onshore wells on fewer rigs, CFO Peter Ragauss told analysts.

“For the U.S. onshore, we anticipate that the rig count will be essentially flat compared to last year to a final 2014 exit rate of 1,710 rigs composed of approximately 1,350 oil rigs and 360 gas rigs,” Ragauss said. “Despite the flat rig count forecast, as a result of continued drilling efficiencies, we anticipate that the U.S. onshore well count will increase 5% compared to last year.” The U.S. offshore rig count is forecast to increase 5% from 2013 to 60 rigs.

Although dry natural gas drilling in the U.S. onshore remains stagnant, Canada’s gas drilling has rebounded, Ragauss said.

“In Canada, the rig count in 1Q2014 “is expected to reach peak levels for the year with 550 average rigs, including 180 gas rigs and 370 oil rigs. This would be slightly above the average rig count from 1Q2013, driven by a 35% in gas-directed rigs, offset by a 5% rig reduction in oil-directed rigs.

“The average Canadian rig count for 2014 is expected to be 370 rigs, a 5% increase compared to 2013.”

Halliburton CEO Dave Lesar and crew expect the U.S. land rig count to rise “modestly” this year, “driven primarily by the continued shift to horizontals in the Permian Basin. The Permian started 2013 with less than 35% of the rig count running horizontally, although we anticipate more than half the rig count will be horizontal by the end of 2014.”

Like Baker, Halliburton expects drilling efficiencies to continue to be the name of the game.

“We…expect to see a continued trend in higher well efficiencies due to increased pad drilling, more 24-hour operations, rig fleet upgrades and significant advancements in drilling and completion technology,” Lesar said. “In 2013 we saw average drilling days for horizontal wells drop by approximately 14% compared to 2012. We anticipate horizontal drilling and drilling efficiencies to again improve in the mid- to upper-single-digits in 2014.”

Producers now have settled into their operating zones. Unlike two years ago, there no longer is a frenzy to switch drilling targets and crews and the onshore environment is more stable, said Lesar.

While “the low-hanging fruit has been picked” in the onshore basins, producers today want the best wells at the best prices. Halliburton can do that, said the CEO.

The company has been recontracting of late, which has cut into its revenues, but Lesar thinks the company will more than make it back down the line.

“I don’t see any reason why we won’t get year-over-year efficiencies” again in 2014. “We are starting to see a massive upgrade to rigs…a move to more pad drilling that began last year,” and a continued turn to new technologies.

“I don’t see any end to it at this point in time,” said Lesar. There may be fewer rigs operating, but the wells have “more stages, bigger stages,” and “more things around completions.”

Halliburton began renegotiating onshore contracts in the final quarter of 2013, some of which already have begun to take effect. Lesar was asked about how competitive it is in the United States to secure deals and hold or increase market share.

“With respect to market share gains, it’s not coming out of our hide, that’s for sure,” Lesar said of losing any part of the market. “Yes, there is plenty of stacked equipment out there. There’s a bit of flight to quality that goes on in this kind of market and even though pricing is challenged…and there is some market share shift going on, it’s sure not coming out of ours.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |