NGI Archives | NGI All News Access

Halliburton Sees No Meaningful Uptick in U.S. Gas Activity

The North American oilfield services market is showing a marked improvement in margins, with more upside to come, but there are still no positives for the natural gas market, Halliburton Co. CEO Dave Lesar said Tuesday.

Last year North America “played out as we predicted,” said the CEO. “We saw a market driven by increased drilling and completion efficiencies with a relatively flat overall rig count and industry overcapacity.”

Over the course of this year, Halliburton’s North American margins should add about 200 basis points. But it won’t be from gains in the natural gas patch.

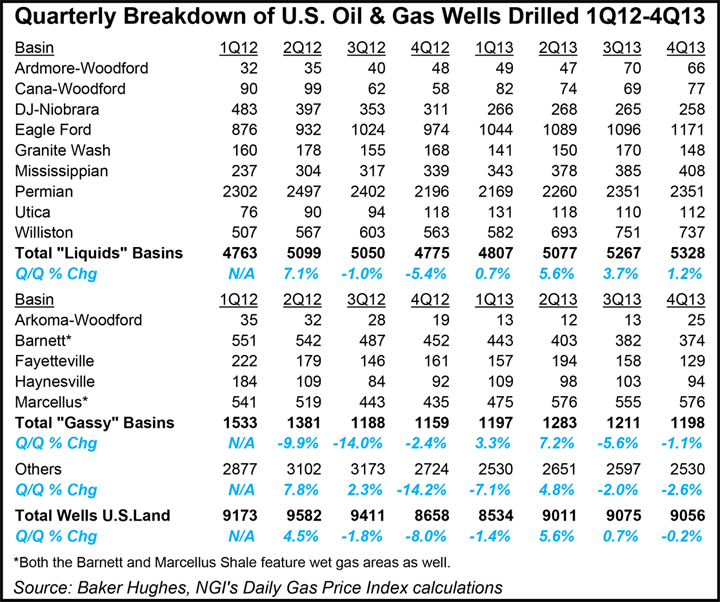

“Storage levels are back near the five-year average, but production levels remained elevated both with associated gas in the liquids plays, as well as some continued robust activity in the Marcellus basin,” said Lesar. “Continued strength in natural gas prices could provide some upside potential, but we are not optimistic there will be a meaningful uptick in gas activities in the near term.”

Schlumberger Ltd. executives said much the same last week (see Daily GPI, Jan. 17). Lesar, who helms the leading North American oilfield services provider, discussed 4Q2013 and full-year results during a one-hour conference call.

Producer spending in the United States and Canada overall for drilling and completions is expected to be “a bit lower” in 2014, but Halliburton’s revenue growth could approach double-digits, with overall margins “a step higher…”

The once volatile U.S. oilfield sector today is more stable.

“In the fourth quarter of 2012, if you recall, we called the bottom on our North America margins, and we were right,” Lesar said (see Daily GPI, Jan. 28, 2013). “We’ve seen a marked improvement in margins since that time.”

U.S. spending by explorers this year should increase “in the mid-single digit range based on recent moderations in liquids pricing outlook. Of course, we naturally believe our growth rates will exceed that increase in customer spend, given our strong position in North America.”

Well count efficiencies are forecast to be higher, in the mid to upper single-digit range. Because of Halliburton’s dominant position, “we believe…our position in North America is going to exceed whatever the market gives us,” said Lesar. “All we can do at this point is gauge off what our customers are telling us what they’re going to spend and what they say is sort of the mid single-digits. As I said, we will beat that because of our position.

“We know the rig count will go up a little. We know that efficiency is going to be better. All of that bodes well for us…”

Weather-related activity disruptions in November and December resulted in a sequential drop for Halliburton in both revenue and operating income, said COO Jeff Miller. “However, activity levels were stronger than expected during the holiday season, which helped to minimize that sequential decline. We executed our highest U.S. base count of the year in the month of October, and activity levels remain strong throughout most of September before declining during the holidays.”

Revenues and profits in the Gulf of Mexico (GOM) are improving as well on rising drilling activity and the return to service of one of Halliburton’s large stimulation vessels. Scheduled to arrive in GOM’s deepwater this year are 14-16 rigs, with Halliburton slated to capture a big share of the business.

Revenues are growing for other service providers as well, Lesar acknowledged. But because of its position with not only services but technology and hardware, “whatever the market is, we’re going to outgrow it.”

Pricing pressure will continue for hydraulic fracturing services, and in particular pressure pumping, said CFO Mark McCollum.

“We’re seeing continued pricing pressure certainly in the market. So as we go into looking at contracts and pricing, one of the first things we look at are the customers where we can be the most efficient and execute our value proposition. But the market is clearly competitive.”

The Houston operator earned $793 million (93 cents/share) in 4Q2013, versus $669 million (72 cents) in 4Q2012. Income from continuing operations was $770 million (90 cents/share); minus one-time charges it was 93 cents.

Total quarterly revenue rose 5% year/year to $7.664 billion from $7.29 billion.

North American revenue was up 2% from a year ago but was down 1% sequentially on weather disruptions and holiday closures. North American operating income in 4Q2013 rose from a year earlier to $644 million from $465 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |