NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Cimarex Spending $1.8B on Capex, Focusing on Wolfcamp in 2014

Cimarex Energy Co. plans to grow production this year to an average 760-800 MMcfe/d, spending most of the $1.8 billion earmarked for capital expenditures (capex) in the Delaware Basin, a subbasin of the Permian Basin, and opportunities in the Wolfcamp Shale.

The Denver-based company plans $1.4 billion for capex in the Permian, a 40% increase from the $1 billion spent there in 2013. About $1.2 billion would go toward drilling and completing wells, including $600 million in the Wolfcamp. Another $375 million would be devoted to drilling in the oil-rich Bone Spring Sands, and $175 million would be directed drilling in the Avalon Shale.

Cimarex also plans to spend $350 million in the Midcontinent, including nearly $250 million in the Cana-Woodford Shale.

“Cimarex uncovered significant, new high rate-of-return opportunities in the Delaware Basin during 2013, particularly in the Wolfcamp Shale,” said CEO Tom Jorden. “Our goal this year is to more fully understand this large resource and how best to develop it. We have multiple pilot programs planned that are designed to do just that.”

In the Wolfcamp, the company currently has four downspacing pilot programs in Texas — two in Culberson County and two in Reeves County. A four-well, 80-acre spacing pilot program was under way in Reeves, and drilling is set for a similar pilot in Culberson later this month. Meanwhile, a stacked lateral pilot was also under way in Culberson, with another planned for Reeves during this quarter.

One of its test wells targeting the Wolfcamp in Culberson — the Twenty Grand 26 Fee #1H well — had an average 30-day peak production rate of 1,251 boe/d, including 672 b/d of oil; the well is 54% weighted to oil. The well was drilled using a 5,000-foot lateral and an upsized completion, hydraulic fractured with 20 stages.

In a note Tuesday, analysts with Tudor, Pickering, Holt & Co. (TPH) said the results from the Twenty Grand 26 Fee #1H well look “encouraging” and production “rates could support [a more than] 900,000 boe type curve.”

The company also announced that it had completed another well targeting the Wolfcamp in Reeves County, the Marmot 55-14 Unit #1H well. that had an average 30-day peak production rate of 6.4 MMcfe/d, including 465 b/d of oil (44% weighted to oil). A second well has also been completed and production testing started in Ward County, TX.

“Going forward, it is expected that all of [our] Wolfcamp wells will be completed with upsized fracks.” Specifically, Cimarex said its upsized fracks would include about 20 stages per 5,000-foot horizontal.

Cimarex said it is currently operating 12 horizontal rigs in the Permian Basin. It expects to increase the rig count to 16 by the end of January.

TPH said “equity remains attractive” with Cimarex, adding that it “would be buying shares after [the] recent pullback on a combination of valuation trading…and coveted balance sheet strength.

“Delaware Basin results may show the most improvement [year over year] as operators standardize towards long laterals, higher stage count and more sand. Results to date have posted strong early production data with [initial production] rates generally [more than] 1,000 boe/d on 4,500- to 5,000-foot laterals.”

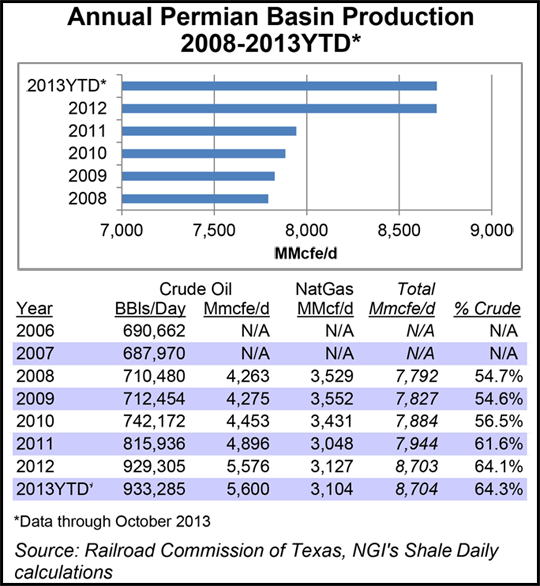

Production in the Permian on an MMcfe/d basis through the first 10 months of 2013 was almost exactly what it was in all of 2012, except that crude oil made up a little bit more of the 2013 year-to-date total, according to Railroad Commission of Texas data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |