M&A | NGI All News Access | NGI The Weekly Gas Market Report

Amec, Foster Wheeler $3.2B Tie-Up to Create Upstream, Downstream Services Giant

Natural gas and oil engineering giant Amec plc has an offer on the table to acquire Foster Wheeler AG for $3.2 billion, a merger that would create an upstream and downstream oilfield services behemoth.

London-based Amec plans to seek a listing on the New York Stock Exchange once the deal is completed, which is scheduled for the second half of the year.

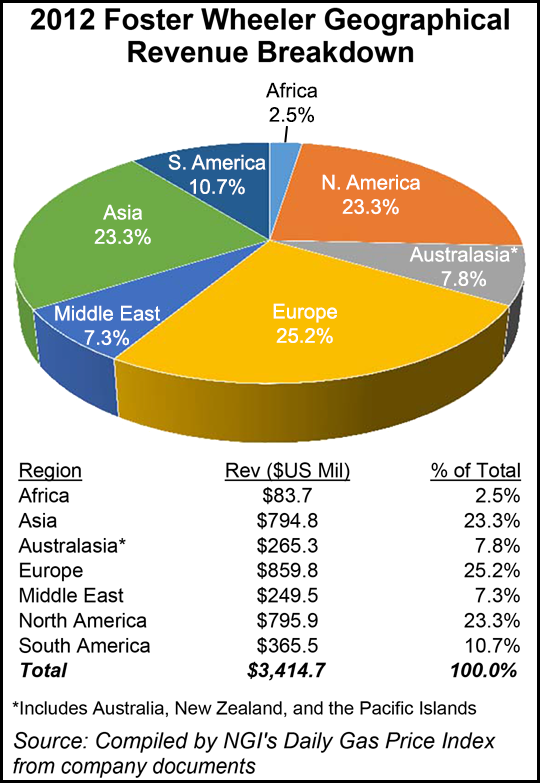

Amec, which today is focused on upstream engineering services, would gain a bigger foothold in the Americas and the Middle East with the merger.

“The most important thing this deal is about, if you look at gas prices and monetization, is growing markets in the U.S. and the Middle East,” CEO Samir Brikho said during a conference call on Monday. “This deal enhances our positions in both.”

Amec already partners with the oil majors and independents in North America. Among other things, it was selected by the Marine Well Containment Co. (MWCC) to design and deliver components for operators in the Gulf of Mexico (GOM). The MWCC was founded in 2010 following the Macondo well blowout to ensure offshore compliance by ExxonMobil Corp., Chevron Corp., ConocoPhillips and Royal Dutch Shell plc (see Daily GPI, July 23, 2010). Membership is open to all operators.

Amec also served as project manager for all aspects of BP plc’s $1 billion-plus Mardi Gras Transportation System in the GOM, which serves five deepwater fields in Green Canyon and Mississippi Canyon blocks. Amec’s main work focused on the Shelf and onshore pipelines associated with the Mississippi Canyon development.

In addition, Amec spearheaded the environmental impact assessment for the still-proposed Mackenzie Gas Project from 2001 to 2008. The now questionable project was designed to carry once-needed gas from Canada’s Mackenzie Valley (see Daily GPI, Dec. 27, 2013).By acquiring Swiss-based Foster Wheeler, whose largest U.S. office is in Houston, Amec’s revenue in growth regions would double, said Brikho.

The merger “would be financially and strategically attractive,” he said. “I believe it would be a compelling proposition for our shareholders, customers and employees.”

Foster Wheeler provides engineering and construction (E&C), and project management services through two groups. The E&C Group designs, engineers and constructs processing facilities and related infrastructure for the offshore and onshore, as well as services for liquefied natural gas/gas monetization, refining, chemicals/petrochemicals, and environmental and power industries. The Power Group provides combustion and steam generation technology.

Last July Foster Wheeler signed a master service agreement to support the North American capital project program for a subsidiary of midstream giant Enterprise Products Partners LP. It also is providing engineering services for Dow Chemical Co.’s LA-3 Crack More Ethane Project at the Plaquemine, LA, petrochemical facility. Also last summer the company became the direct supplier for FW Graf Wulf for circulating fluidized scrubber technology to the North American market. In Canada, Foster Wheeler provides services for heavy oil operators and provides steam assisted gravity drainage, which is used in bitumen production.

With the merger, Foster Wheeler investors would receive about $16.00 in cash and 0.9 of a new Amec share, equivalent to around $32.00, for every share they hold. Existing shareholders would own about 23% of the combined company.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |