Markets | NGI All News Access | NGI Data

East, Northeast Lead Weather-Driven Gains; Futures Romp Higher

With below normal temperatures expected to make a return Tuesday and Wednesday, physical gas for delivery Tuesday rose sharply in Monday’s trading, with only a handful of points nationally trading lower.

The Midwest was higher by about 30 cents, but the Northeast and East were able to match that and raise with gains at some locations of more than $1.00. At the close of futures trading February had vaulted 22.1 cents to $4.274 and March was up 20.3 cents to $4.224. February crude oil fell 92 cents to $91.80/bbl.

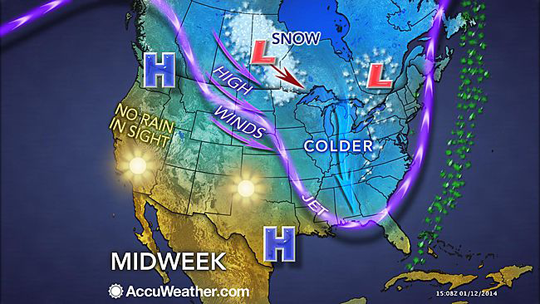

Physical prices rose Monday as weather forecasters called for temperatures to drop 20-30 degrees over the next two days. AccuWeather.com’s forecast shows a large Arctic system pushing south from Canada and enveloping much of the eastern half of the United States in a wintery mix of precipitation along with below normal temperatures.

Wunderground.com predicted that the high in Chicago Monday of 51 degrees would sink to 34 and hit only 20 on Wednesday. The seasonal high for mid-January in Chicago is 31. Detroit’s high on Monday of 47 was seen sliding to 35 Tuesday and down to 27 Wednesday; the normal high is 30 this time of year. In Pittsburgh, Monday’s 56 was expected to fall to 45 then decline to 34 on Wednesday; the seasonal high is 34.

The primary forecast concern in the nearterm is the “energetic clipper crossing the area” into Tuesday, according to the National Weather Service (NWS) in suburban Chicago. Meteorologists said it was “a bit tough to pin down exactly how much snow might be produced as the low swings through…but much of the area will experience the combination of strong northwest winds with snow and blowing snow on Tuesday.

“A series of additional clippers passing to our north will bring periodic lesser chances of snow through the remainder of the week and into the weekend. Temperatures follow the corresponding roller coaster path…with multiple periods of non-diurnal trends likely.”

Gas for Tuesday delivery on Alliance rose 29 cents to $4.56, and Chicago Citygates parcels were $4.55, up 31cents. On Northern Natural, Ventura gas changed hands at $4.48, up 30 cents. Demarcation prices rose 32 cents to $4.49, and on ANR SW, gas came in at $4.23, up 28 cents.

A series of weather fronts and systems was expected to pummel the Mid-Atlantic. The NWS in New York City said a cold front over the Ohio Valley on Monday night was continuing to work its way east, “moving across the Tri-State area Tuesday afternoon. A wave of low pressure will develop along the front near the middle Atlantic coast Tuesday morning and then pass east of Long Island by early evening.

“Weak high pressure briefly builds in behind the system Tuesday night. A series of weather systems will impact the area from the middle of the week into the weekend. High pressure builds in on Monday.”

Temperatures in the East were expected to be a bit more moderate. Wunderground.com predicted Monday’s 50 in New York City would ease to 46 Tuesday before sliding to 44 on Wednesday. The normal high is 38. Philadelphia’s high Monday of 51 was expected to ease to 48 through Wednesday; the seasonal high is 40.

Gas at Algonquin Citygates rose by $1.10 to $5.74, while Iroquois Waddington added 39 cents to $4.98. On Tennessee, Zone 6 200 L next-day parcels finished $1.42 higher at $6.13.

Transco Leidy Tuesday deliveries were seen at $3.61, up $1.16, and Dominion next-day parcels rose 48 cents to $3.77. At Tetco, M-3 Delivery gas changed hands at $4.22, up 43 cents and gas bound for New York City on Transco Zone 6 rose by 43 cents to $4.36.

Traders and risk managers aren’t quite ready to initiate short hedges. “If we can get closer to $4.20-4.30 in the summer and $4.40 for the balance of the winter, those are the levels I would be looking for,” said DEVO Capital President Mike DeVooght. “I’ve been shooting for $4.30-4.40 in the April -October when it was up around those highs, but just missed it. Then I dropped the target down to $4.20-4.30 and it really just got there last [week]. It has to pop up a bit.” The April October strip finished Monday at $4.07.

“Fundamentally, we feel there is not much upside above the mid $4.00 level in natural gas,” DeVooght said in a note. “We would use rallies above the mid $4.00 level as an opportunity to add to forward sales.”

In its Early View Storage Survey, Energy Metro Desk calculated an average withdrawal for the week ended Jan. 10 of 300 Bcf. Fifteen market cognoscenti were polled and the range on the survey was 255 Bcf to 320 Bcf. The Energy Information Administration will release its figures 10:30 a.m. EST Thursday.

WeatherBELL Analytics in its Monday six- to 10-day outlook forecast a cold incursion into the East with above normal temperatures in the Plains, desert Southwest, and California. The below normal temperatures include portions of New England and a patchwork arrangement extending from Wisconsin to West Virginia to Florida. Most of the Mid-Atlantic was seen as normal. East heating-degree-days are expected to tally 179.8, above last year’s 143.1 and the thirty year average of 162.3.

“There is more major cold on the way and the idea from last week that a major trough would develop this week, but without the arctic connection we will have with the late month trough, looks good,” said meteorologist Joe Bastardi. “The confidence is high that once again, a stand against warmth was a good idea.

“The fact is that an outbreak is on the table for the end of the month from the Plains east as severe as the opening of the month. While the cold coming this week is formidable, it is not the magnitude of what has happened or is going to happen. I have beaten this horse into the ground, but I think we are going to see a textbook demonstration again of what source regions can do.”

Addison Armstrong of Tradition Energy expects traders to focus on “strengthening seasonal demand factors, increasing industrial demand, and expectations for what will likely be a new all-time record storage withdrawal later this week. But near-record production levels of gas are likely to provide resistance to rising gas prices if temperature forecasts moderate in the coming weeks.”

Industry consultant Genscape reported Monday that “Midwest demand decreased by 2.4 Bcf/d week-on-week to 13.8 Bcf/d, [and] Appalachia production decreased by 0.9 Bcf/d week-on-week to 12.5 Bcf/d due to freeze-offs. More than half of the freeze-offs have returned online.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |