NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Land Grab ‘Substantially’ Over as Operators Turn to Development

The U.S. land grab is “substantially” over as operators turn their focus — and the funding — to scale and efficiency, said transaction experts PLS Inc. and Derrick Petroleum Services.

Houston-based PLS and Derrick, its international partner, provide quarterly and annual analyses of merger and acquisition (M&A) activity among global upstream oil and natural gas operators. The Global M&A Database reported that deals in 2013 totaled $137.7 billion on 1,028 transactions — including 643 with values disclosed.

The top destination for dealmakers last year continued to be the United States. Going forward, however, there may be fewer big deals and more asset management. Bolt-on acquisitions also are expected to be an appeal.

“Impacting U.S. activity is the investments required behind the onshore resource plays,” PLS Inc. Managing Director Brian Lidsky said. “The land grab activity began to surge in earnest in 2008 and accelerated with the landmark $41 billion buy” of XTO Energy Inc. by ExxonMobil Corp. in December 2009.

“What we are witnessing now is the transformation of the industry from land acquisitions to derisking and development. As this trend proceeds, drilling capital intensity will increase and players will rebalance portfolios to keep their finances in order. These adjustments will continue to provide ample opportunity for dealmaking.”

On Jan. 1, the global inventory of deals in play (DIP) totaled $127 billion, down from $135 billion on Sept. 1, but above $85 billion on Jan. 1, 2013, PLS said. In the United States, the DIP tally stood at $38 billion, versus $33 billion at the end of September and $27 billion on Jan. 1, 2013.

Last year the Eagle Ford had the top transactions in price, with deal values totaling $8.8 billion. Most of the value came by way of Devon Energy Corp., which paid close to $6 billion to buy pioneering operator GeoSouthern Energy Corp. (see Shale Daily, Nov. 20, 2013).

The Permian Basin’s unconventional formations drew the second largest number of transactions in 2013 ($7.5 billion), followed by conventional deals in the Rocky Mountains ($5.5 billion); Gulf of Mexico (GOM) Shelf ($4.2 billion); and Bakken Shale ($2.9 billion). This compares with a 2012 ranking led by the unconventional Permian ($7.7 billion); deepwater GOM ($7.2 billion); Bakken ($7.0 billion); GOM Shelf ($6.3 billion); and the conventional Permian ($5.6 billion).

The second largest U.S. transaction was onshore operator Linn Energy LLC’s agreement to pay $4.9 billion to buy oil expert Berry Petroleum Co. (see Shale Daily, Feb. 22, 2013). The third largest U.S. deal was Fieldwood Energy LLC’s $6 billion transaction to acquire Apache Corp.’s shallow water assets in the GOM.

The “strong buyer theme” for 2013 was by master limited partnerships (MLP) and private equity (PE), according to Lipsky. The Linn deal was “a milestone for the M&A markets as it marks the first-ever acquisition of a public C-Corp by an upstream LLC…The second notable MLP transaction bucks the MLP buying trend and saw Pioneer Natural Resources buy back the 48% stake of its related MLP Pioneer Southwest Energy Partners that it did not own for $606 million to boost its scale and operating efficiencies in the Permian Basin” (see Shale Daily, May 13, 2013).

Two PE deals exemplifying private money were GeoSouthern’s deal, which rewarded financier Blackstone Energy Partners LP with $1.54 billion, and Fieldwood’s because it is financed in part by Riverstone Holdings LLC.

Last year wasn’t a particularly notable one in terms of eye-popping transactions, with deal values down almost half from 2012 and at the lowest level since 2008. However, that doesn’t tell the entire story.

“While the headline 2013 deal value is down 49% from the record $270.8 billion in 2012 and the lowest since $117.4 billion in 2008, PLS notes that these numbers do not properly characterize the status of the overall markets,” said researchers. “The spike in 2012 deal activity included three mega-deals (defined as more than $10 billion), which alone accounted for $97.1 billion or 36% of the 2012 total.”

In 2012 OAO Rosneft paid $61.6 billion to purchase BP plc’s TNK-BP stake in Russia; CNOOC Ltd. spent almost $18 billion for Calgary’s Nexen Inc.; and Freeport McMoRan Copper & Gold Corp. anted up $20 billion to buy Plains Exploration & Production Co. and McMoRan Exploration Co. Excluding those three 2012 mega-deals, 2013 deal value was down only 21%, the review said. The total deal count of 1,028 actually was down just 17% from 2012 and up versus the average of 1,004 for the last seven years.

“Total deal counts and average deal size for deals with prices disclosed are better gauges than total deal value to evaluate the health and trends of the oil and gas upstream M&A markets,” Lidsky said. “For example, in 2013 the headline may be that the total deal value of $138 billion is down 50% from a record 2012, but digging deeper paints a more accurate picture. 2013 actually is a year in which upstream oil and gas M&A activity by and large reverted back to the mean of the last seven years of activity, after adjusting for the mega-deals.

“Furthermore, overall the market remains healthy with ample deal flow and a host of motivated buyers. There are pockets of weakness like large North American acreage positions which may not have held to original expectations and proved undeveloped natural gas reserves. To be accurate, M&A markets did experience a hangover in the first half of 2013 but recovered in the second half.”

For perspective, the annual average deal value since 2007 is $173 billion versus 2013’s $137 billion, researchers said. “Backing out the six mega-deals since 2007 (half of which were during 2012), the $137 billion in 2013 is down just 8% from the annual average deal value of $148 billion.”

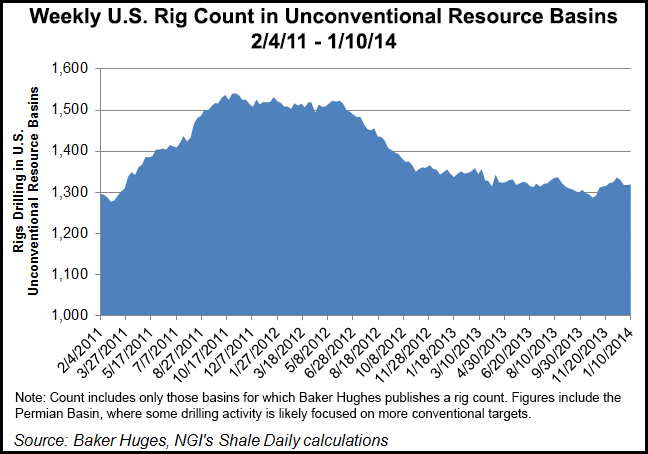

The shift in the industry is also visible in the U.S. Unconventional Rig Count. Just a few years ago, the count was spiking as exploration and production companies rushed to drill out their acreage in order to hold it by production. Lately the number of rigs operating in most unconventional basins has been in decline, highlighting the fact that those producers are no longer in the drilling phase, but have refocused their efforts on efficiencies.

The shift in the industry is also visible in the U.S. Unconventional Rig Count. Just a few years ago, the count was spiking as exploration and production companies rushed to drill out their acreage in order to hold it by production. Lately the number of rigs operating in most unconventional basins has been in decline, highlighting the fact that those producers are no longer in the drilling phase, but have refocused their efforts on efficiencies.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |