NGI Data | NGI All News Access

Weekly National Average Ends About Where It Started Following Polar Vortex

The polar vortex that ripped through the Midwest and East causing hardship and much discomfort had an impact on the natural gas market similar to an entry-level earthquake. Lots of shaking and movement, but overall in the end everything was left standing about in the same place. For the week ended Jan. 10 the NGI Weekly Average Spot Gas Price eased all of a penny to $5.40. Variation about that average was high with the Northeast posting a trade range of $2 to $99 before averaging $9.43, up $1.09. The Midwest and Midcontinent posted losses of 55 cents and 42 cents, respectively, to average $5.21 and $4.76.

Of the actively traded points the Northeast was home to the greatest gainers and losers with Iroquois Waddington giving up $6.16 to $15.16 and packages on Transco Zone 6 non NY adding $10.60 to average $22.23. On Monday the highest price ever recorded by NGI was made at Transco Zone 5 of $99.00.

Elsewhere price changes for the week were benign. South Louisiana and East Texas fell 3 cents to $4.26 and $4.22, respectively and California and South Texas eased 2 cents to $4.50 and $4.18, respectively. Rocky Mountain prices added 3 cents to $4.41.

February futures fell 25.1 cents for the week to $4.053, aided in part by the Energy Information Administration’s (EIA) Thursday report that storage inventories for the week ending Jan. 3 fell by 157 Bcf, slightly more than what was expected.

In Friday’s trading, gas for weekend and Monday delivery continued it’s downward spiral, losing a half dollar on average. Not a single point escaped the cleaver. New England locations suffered the greatest drops, losing more than $4 at some points. The East was down deep double-digits and the Rockies lost over a dime. At the close of futures trading, February had gained 4.8 cents to $4.053, and March was higher by 3.9 cents to $4.021.

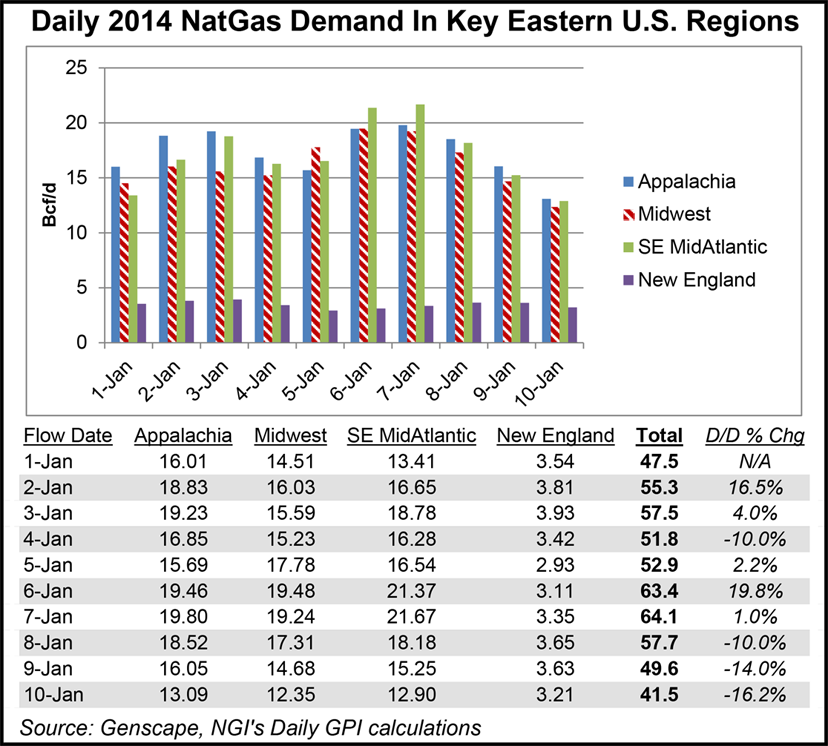

With the week’s polar vortex firmly in the past, gas consumption was returning to seasonal norms. Demand in the eastern U.S. kicked into overdrive after New Year’s Day, rising from 47.5 Bcf/d on Jan. 1 to more than 63 Bcf/d on both Jan. 6 and 7, according to flow data from Genscape. Usage has leveled off in the days since, so much so that eastern demand for gas day Jan. 10 was down to just 41.5 Bcf/d, the lowest total of the year. The New York City metropolitan area, which saw spot prices rise to as high as $95/MMBtu last week, is included in the Appalachia column of the adjoining table.

Interestingly, the bitter cold temperatures didn’t cause extreme spikes in demand in the New England region, primarily because of a lack of pipeline infrastructure in that area limits just how much pipeline gas customers in those six states can burn. But the cold did add to volatility in New England prices last week, with Algonquin Citygate deliveries reaching $50/MMBtu for Wednesday delivery.

The week’s early teeth-rattling cold has analysts pondering a record storage withdrawal for the week ending Jan. 10. At present the highest withdrawal was made just a month ago for the week ended Dec. 13 at 285 Bcf. John Sodergreen, editor of Energy Metro Desk in his early assessment of next week’s storage says “the vast majority of estimates are coming in at over 300 Bcf, and the range of estimates is over 50 Bcf,” one of the highest he has seen.

That is likely to offer trading opportunities. “That [report] would be a short term rally, and look for the market to be a little overbought,” said a New York floor trader. “I think traders will rally the market all next week, and then they will take it down.”

Analysts see the Wednesday-Thursday price decline as an opportunity to step up and take a long position going into the latter half of the heating season. “With the winter-to-date gains unwound and yet still more than half of the heating season ahead, we are growing more positive on gas prices,” said Teri Viswanath, Commodities Strategist with BNP Paribas. “A very cold start to the season has boosted heating demand, rapidly depleting inventories to levels that suggest that the prolonged slackness in the balances has been eliminated. The consequent sizeable y/y storage deficit implies a significantly reduced baseline from which working gas in storage would seasonally build next summer.”

She recommends “early positioning on the next injection season in the wake of this week’s sell-off. Buy out-of-the-money calls on Oct ’14 and/or sell puts on Q2 ’14. [T]he current price dip presents an opportunity to initiate trading positions based on more constructive fundamentals ahead,” she said in a morning note to clients.

Others aren’t so sure of a long position. “We feel that the highs for this year were likely placed late last month at the $4.58 area and that this week’s chart damage will likely be restricting upside price progress from here to about the $4.20 area unless a major and unusual cold event is seen again,” said Jim Ritterbusch of Ritterbusch and Associates. “However, such a development appears unlikely as this winter period proceeds and days become longer. We will further emphasize that the dynamic of supply deficit expansion that drove the November-December 25% price advance is likely to be stabilized following next Thursday’s storage outlier.”

A Rocky Mountain observer Friday thought the market reaction Wednesday and Thursday was overdone to the downside. “I don’t care what the weather is like next week as long as it doesn’t stick around. I think we are due for a ‘pop’ higher,” said a Denver producer.

“I think the market got a little ahead of itself and the milder weather, a rebalancing by index funds, and the fact that commodity funds are now the most bullish they have been since about 2007 was enough to correct the market. Also, weather forecasts are due to turn cooler.”

Joe Bastardi of WeatherBELL Analytics is looking for cold about the end of the week. “Source regions are crucial over the coming 20-30 days. The ‘relaxation’ of the major eastern trough is short-lived, as a major buckling evolves with successive stronger troughs digging into the eastern U.S. in the coming eight days, culminating in a power trough over the East by next weekend,” he said in a morning report to clients. “The Dam across Alaska now prevents true Siberian air from getting into these troughs, so the air masses are Pacific in origin through the middle of next week, then due to have some arctic air in them.”

For the moment, though, weekend and Monday prices throughout the Rockies took it on the chin. Gas delivered to CIG Mainline dropped 17 cents to $3.93, and gas at the Cheyenne Hub fell 16 cents as well to $3.97. Deliveries to Opal shed 14 cents to $3.97, and on Northwest Pipeline Wyoming weekend and Monday gas was seen at $3.94 down 15 cents. Gas at El Paso non-Bondad dropped 16 cents to $3.89.

New England points led the parade lower as forecast temperatures by Monday were expected to reach 14 degrees above normal. Wunderground.com forecast that Boston’s Friday high of 36 was expected to rise to 56 Saturday and reach 49 by Monday. The normal high in Boston this time of year is 36. Hartford, CT’s Friday peak of 36 was seen rising to 54 Saturday and slide to 48 by Monday, still 14 degrees above normal. The high Friday in Providence, RI also of 36 was predicted to jump to 57 Saturday before dropping to 44 Monday. The normal high in Providence in early January is 37.

The National Weather Service in southeast Massachusetts said, “light rain and snow showers…along with a few pocket of light freezing drizzle…will push offshore during this afternoon [Friday]. Overnight drizzle…changing to rain is expected as temperatures rise. Locally heavy rainfall and strong winds expected late Saturday into Saturday evening. Low pressure racing across Canada will swing a cold front across New England on Tuesday, [and] Low pressure crossing the Midwest will bring another chance of rain or snow midweek.”

Weekend and Monday packages at the Algonquin Citygates plunged $4.376 to $4.64, and gas upstream at Iroquois Waddington fell 65 cents to $4.59. On Tennessee Zone 6 200 L gas dropped $4.60 to $4.71.

Although short-term prices have plummeted, more deferred pricing has held up reasonably well. A Houston pipeline analyst said, “It’s a little warm and gas on Algonquin at about $4.50 is pretty low. Balance of the month on Algonquin is going for $15,” he said.

Other points in the East also fell. Deliveries to Transco-Leidy retreated 84 cents to $2.45, and on Dominion weekend and Monday gas was seen at $3.29, down 14 cents. At Tetco M-3 Delivery gas changed hands at $3.78, down 27 cents, and on Transco Zone 6 New York gas came in at $3.93, down 33 cents.

Weather forecasters call for some incoming cold, though nowhere near as severe as the juggernaut that marched through the Midwest and East earlier this week. In its six-to 10-day outlook, Commodity Weather Group shows a below-normal temperature ridge extending from South Carolina north to Illinois and bounded on the East by Virginia and the West by Mississippi. New England is seen above normal, and the Mountain West is forecast to be under a ridge of above-normal temperatures extending from Montana to the desert Southwest including California.

“Plenty of detail challenges exist next week as a storm and then a transient cold push engage eastern North America. There are still colder risks around the storm system mainly due to dynamic cooling effects behind it for the Midwest and South toward middle next week, while a transient cold push late week could be a bit stronger,” said Matt Rogers, president of the firm.

“The models agree that the cold push is shorter-lived, with warmer weather returning faster in the second half of the holiday weekend. The 11-15 day continues to be a massive challenge. The American models still favor a much warmer pattern, while the European ensembles edged slightly warmer today, but rebuild the Alaskan ridge by days 14-15 (which would lead to colder 11-15 day changes by this Sunday and Monday’s updates). We leaned more toward the Euro.”

Following Thursday’s storage report, February futures went on to close down 21.1 cents to $4.005 and March dropped 19.3 cents to $3.982.

One school of thought had it that the figure was right on target. “As the 157 Bcf net withdrawal was in line with market expectations, the report mostly removes the risk of surprise from the market for another week,” said Tim Evans of Citi Futures Perspective. “Trade should quickly revert from reaction to the number to the debate over whether this week’s cold or next week’s warmer temperatures should have a larger impact on prices.”

After the report traders were pondering a new set of resistance and support numbers. “You have got to look around the $4.10 level for support and $4.25 is resistance on the upside,” said a New York floor trader.

Inventories now stand at 2,817 Bcf and are 528 Bcf less than last year and 315 Bcf below the 5-year average. In the East Region 98 Bcf were withdrawn and in the West Region 17 Bcf were pulled. Inventories in the Producing Region fell by 42 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |