Markets | NGI All News Access | NGI Data

Futures Rally Off Lows Following EIA Storage Stats

Physical gas for delivery Friday fell hard and fell often in Thursday’s trading. No points made it to the positive side of the ledger, and the greatest losses occurred in New England and the Mid-Atlantic.

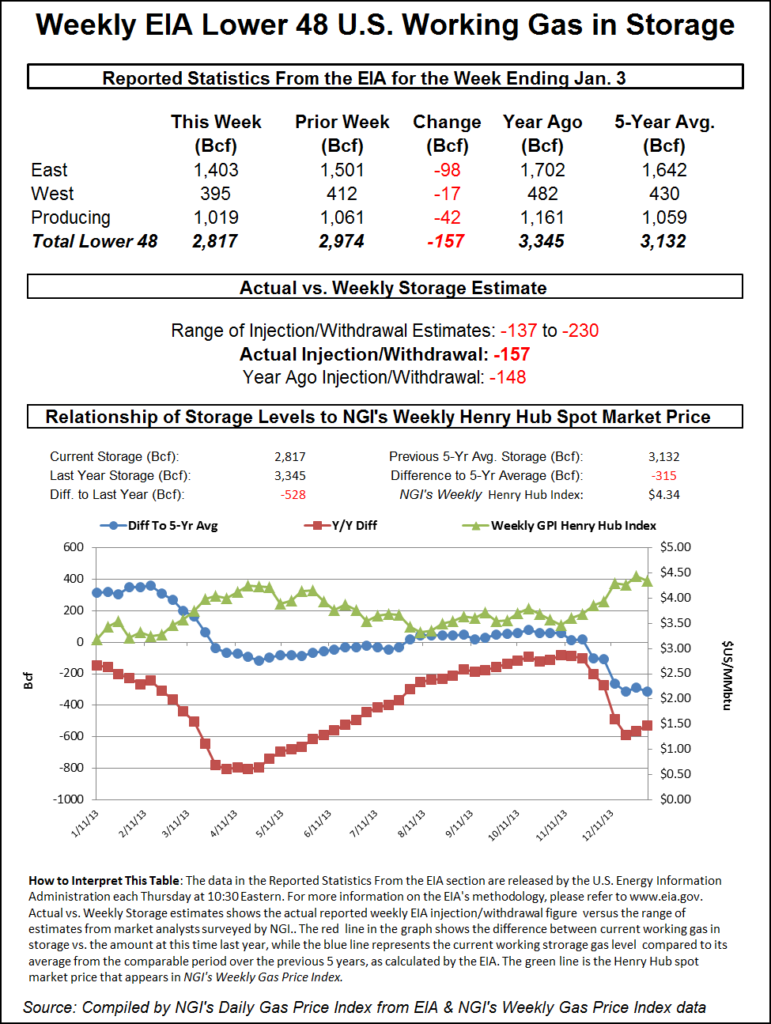

Eastern prices continued their pattern of multi-dollar losses as forecasts called for a warming trend, but losses at other points of a quarter or more were common. The Energy Information Administration (EIA) reported that storage inventories for the week ending Jan. 3 fell by 157 Bcf, slightly more than what was expected, but futures took the occasion to swan-dive lower. At the close, February was down 21.1 cents to $4.005 and March had dropped 19.3 cents to $3.982. February crude oil retreated 67 cents to $91.66/bbl.

Prices at Northeast and eastern locations plunged as temperatures were forecast to be as much as 20 degrees above normal for the weekend. AccuWeather.com meteorologists said, “After an Arctic blast had tens of millions people shivering this week in the East, a dramatic temperature turnaround will bring a break from winter’s grip this weekend. Temperatures have already begun to trend upward Wednesday and Thursday. However, by Saturday some record highs may be challenged along the I-95 corridor from the mid-Atlantic to New England.

“The record high Saturday in New York City’s Central Park is 60 degrees set in 1876. Temperatures are forecast to reach at least into the middle to upper 50s around the Big Apple. Other cities, including Washington, DC, Baltimore, Philadelphia, Hartford and Boston, could challenge record highs this weekend. This only a few days after many areas from the Midwest to the South and and East set record lows Tuesday morning.

“Even if temperatures fall short of reaching record highs, in some cases actual temperatures will be 40 to 60 degrees higher Saturday, compared to the morning lows Tuesday, and it could feel 60 to 80 degrees warmer factoring in [wind chill] temperature changes. Temperatures during much of next week will average above normal. AccuWeather.com meteorologists are watching the potential for another outbreak of Arctic air beginning around next weekend.”

AccuWeather.com predicted the high in Boston Thursday of 30 would jump 10 degrees Friday and reach 56 on Saturday. The normal high in Boston is 36. New York City’s high Thursday of 32 was anticipated to rise to 40 Friday and 56 Saturday. The seasonal high in the Big Apple is 38. Philadelphia’s 35 high Thursday was anticipated to reach 43 Friday and 60 on Saturday. The normal early January high in Philadelphia is 40.

Along with the moderating temperatures, demand has dropped across key consuming regions. According to Genscape, “Appalachia demand decreased to 15.8 Bcf/d in [Thursday’s] nomination from the high of 19.8 Bcf/d on Jan. 7 as weather starts to return to normal. Imports dropped by 1.5 Bcf/d as demand waned.” In the Midwest, demand dropped to 15.1 Bcf/d in Thursday’s nomination after the high of 19.5 Bcf/d on Jan. 6, Genscape said. The decrease in demand reflected the decrease in storage withdrawals and decrease in imports.

Gas at the Algonquin Citygates for Friday delivery tumbled $9.34 to average $9.01, shedding a whopping 74% of its value from Monday’s $34.14 average. At Iroquois Waddington, next-day gas fell $3.75 to $5.24, and on Tennessee Zone 6 200 L deliveries swooned $11.28 to $9.31.

In the Mid-Atlantic, deliveries on Tetco M-3 Delivery dropped $1.06 to average $4.06, or a 87% drop in value from Monday’s $31.86 average, and gas headed for New York City on Transco Zone 6 dropped $5.20 to average $4.26, a 93% decline from Monday’s $56.59 average. Gas at Transco-Leidy was down 28 cents Thursday to $3.29, and deliveries to Dominion shed 37 cents to $3.43.

Other market points across the country were hit hard as well. In the Midcontinent, deliveries to Northern Natural Ventura fell 33 cents to $4.39, and Friday gas on ANR SW came in 29 cents lower at $4.14. On Oklahoma Gas Transmission, deliveries for Friday were seen at $4.13, down 24 cents, and on Panhandle Eastern Friday packages changed hands at $4.09, down 32 cents. Gas at the NGPL Midcontinent Pool fell 25 cents to $4.09.

In spite of the bone-chilling cold raking Midwest and eastern energy markets, “prices could only make it to resistance, not through resistance, and that’s a pretty significant development,” said Walter Zimmermann, vice president at United ICAP. “It wasn’t just a cold snap, it was the coldest weather in decades in terms of its reach, it’s breadth, its intensity and duration and it only reached into key resistance, which is not only a wave-count target, but the head and shoulders target was $4.54 and it got to $4.532.

“Now we are in a situation where we take another look at the head and shoulders neckline level and that is around the $3.83 level. That is also the 50% retracement of the whole move up from $3.129 to $4.532,” said Zimmermann.

Forecaster WeatherBELL Analytics is looking for cooler near-term temperatures. Following a brief warm up, in its morning 20-day forecast within the six- to 10-day period it shows above-normal temperatures from New England extending as far south as Virginia, covering the southern Plains and California. Below-normal readings are seen from Minneapolis to Buffalo and extending as far south as central Illinois. It predicts an accumulation of 160.2 heating degree days (HDD) in the East, just slightly above the 30-year average of 158.8 HDD and well above last year’s 129.4 HDD.

Recent volatile weather was translated into a wider variation than normal in the expectations for the Thursday release of storage data. According to Energy Metro Desk (EMD), “The temperature swings we’ve already seen, week-on-week, have set a new standard of sorts; a 25 Bcf range in forecasts is now the norm — that is, it doesn’t necessarily hint at a possible surprise out of EIA. However, the 5.8 Bcf difference between the three categories we track certainly does point to a surprise. Combine the two with some post-holiday residual funniness, and we’d say a 5-plus Bcf surprise is definitely in the cards for [Thursday].”

John Sodergreen, EMD editor, predicted a pull of 149 Bcf. Last year 191 Bcf was withdrawn, and the five-year average stands at 131 Bcf. Sodergreen contends that next week’s report could push 300 Bcf.

IAF Advisors forecast a decline of 144 Bcf, and a Reuters survey of 27 observers was spot on showing an average 157 Bcf draw with a range of 137 Bcf to 230 Bcf. Bentek Energy calculated a 151 Bcf pull.

Adherents of Market Profile such as Tom Saal of INTL FC Stone in Miami said Wednesday’s retreat called into play the “weekly break-down rule.” It shows weakness and a test of the 50% target at $4.178. “Back years, Cal’15, Cal’17 and Cal’19, show mixed signals,” Saal said in a Thursday morning note to clients.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |