Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Gulfport Hits Low End of 2013 Guidance, Expects Better Things in 2014

Despite a tremendous gain in its annual production last year, Gulfport Energy Corp. said it came in at the low end of its guidance when the company announced its 2013 exit rate on Monday.

The company has a swath of land under lease in southeast Ohio that is widely believed to be among some of the best acreage of any operator in the Utica Shale play. But Gulfport, like others, continues to struggle with well completions, infrastructure buildout, weather and operational delays in the still-emerging play.

But Monday’s update was enough to keep financial analysts, and Gulfport itself, optimistic about the potential of the Oklahoma City-based company’s acreage and strategy in the play.

“We entered 2013 producing approximately 6,300 boe/d and exited the year producing 27,780 boe/d, which was over 340% in growth during this period,” said CEO James Palm. “This is a significant milestone for Gulfport employees and shareholders. We are diligently working to execute on our 2014 program and look forward to substantial growth as a company during 2014 as we continue to develop our Utica Shale assets.”

The company has a considerable position in the Canadian oilsands, and it has a patchwork of assets in the Permian Basin, Niobrara Shale and producing properties along the Lousiana Coast, but by and large, it has focused mainly on the Utica in Ohio, where it has more than 147,000 net acres under lease. The company made no change to its 50-60 million boe/d guidance for 2014, but it said 1Q2014 production would remain relatively flat compared to the 2013 exit rate as a result of scheduled downtime for well completions.

“These figures were a bit of a mixed bag as the exit rate came in at the low end of the guidance range,” said Wunderlich Securities analyst Jason Wangler in a research note. “Overall we are excited to see the company hit its exit rate, and while these figures are a moment in time, we feel they are more important than averages over a quarter at this point as the timing of these high-impact wells can dramatically move total production and are at the mercy of midstream, weather and other issues.”

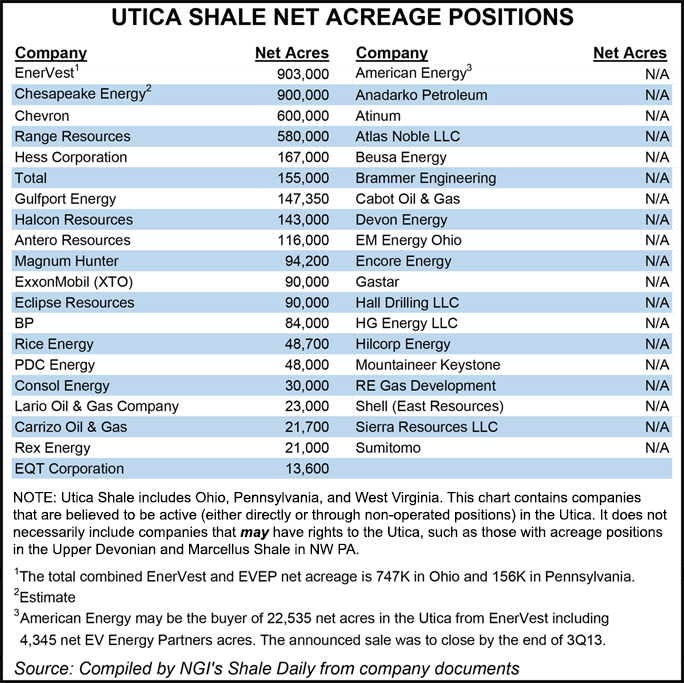

Development of the Utica Shale, which is still in its infancy compared to the neighboring Marcellus Shale, is being closely watched by the industry. With 147,350 net acres in the Utica, Gulfport is the seventh-largest acreage holder in the play according company documents and NGI’s Shale Daily calculations. The top six acreage holders in the Utica are EnerVest with 903,000 net acres, Chesapeake Energy (900,000), Chevron (600,000), Range Resources (580,000), Hess Corp. (167,000) and Total (155,000).

Last month, Gulfport said it was adding three management executives to its Ohio team in order to bolster oversight of its primary asset (see Shale Daily, Dec. 13, 2013). In its latest quarterly production report, records from the Ohio Department of Natural Resources showed that Gulfport had the highest producing oil well in Harrison County and the highest producing gas well too (see Shale Daily, Dec. 31, 2013).

Meanwhile, financial analysts expect to see a boost in the company’s Appalachian production numbers (see Shale Daily, Jan. 2), with Wangler adding Tuesday that the Utica wells are capable of adding 1,000 boe/d to overall production.

Gulfport had lowered its 2013 exit rate in October from 37,000-40,000 boe/d to 27,000-32,000 boe/d (see Shale Daily, Oct. 16, 2013), citing infrastructure constraints. Gordon Douthat, an analyst at Wells Fargo Securities, said in a note to clients on Tuesday that a “track record of downward revisions leaves risk to targets in our view.”

He added, however, that in the long-run there is significant upside potential for Gulfport as the play is further delineated and Gulfport tackles midstream issues and gains momentum in pad drilling.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |