Markets | NGI All News Access | NGI Data

Record Cold Equals Record Prices: Near $100 Gas Traded On Transco

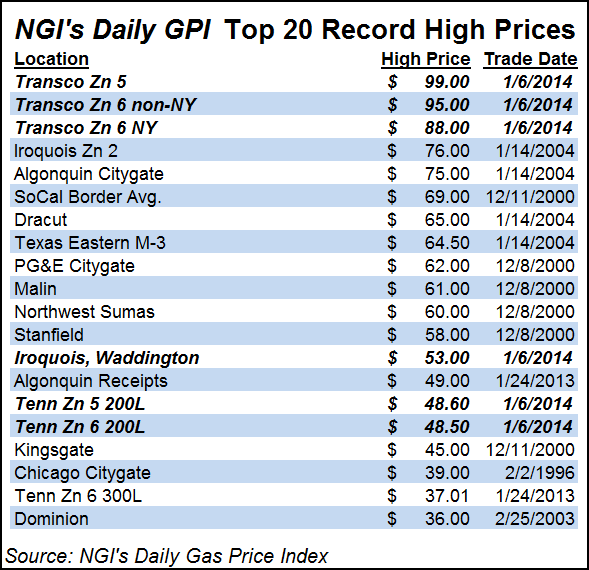

Prices for physical natural gas traded Monday for Tuesday delivery spiked in response to a Polar Vortex and record cold temperatures sweeping across the country. The day recorded the three highest prices ever published in NGI’s Daily Gas Price Index (see chart). Biggest gainers on the day proved to be points in and around New York City.

New England locations also vaulted higher, jumping back above $30, and the only significant drops were seen in the Midwest at Chicago Citygates and points west. Some Northeast physical prices jumped $30-$60 higher per MMBtu, perhaps to avoid overdraw penalties Tuesday when demand was expected to peak (see related story).

Futures traders were not interested in the hyper-volatility of the physical market. February added 0.2 cents to $4.306 and March also gained 0.2 cents to $4.284. February crude oil was down 53 cents to $93.43/bbl.

Short-term weather volatility was the driving force behind the day’s titanic advances. “By Tuesday morning residents and visitors to New York City will wonder what hit them when they step outside,” said AccuWeather.com meteorologist Alex Sosnowski. “It will feel about 60 degrees colder Tuesday morning, compared to the morning drive Monday, [and] motorists and pedestrians should be on the lookout for icy patches Monday evening as Arctic air blasts quickly into the region. In some cases, ice can form before paved, concrete and wooden surfaces have a chance to dry out…”

Industry consultant Genscape reports demand in the Midwest has reached a historic high. “With much colder than normal weather in Midwest, Midwest demand reached [a] historical high at 18.7 Bcf/d compared to last week’s average of 13.2 Bcf/d. Midwest relied heavily on storage withdrawals and imports to meet demand. Imports increased to 17.0 Bcf/d compared to 13.6 Bcf/d last week.”

Quotes at the Algonquin Citygates for Tuesday gas jumped $18.25 to $34.14, and deliveries upstream at Iroquois Waddington added $26.00 to $36.50. Gas on Tennessee Zone 6 200 L rose $18.28 to $34.59.

Prices at Mid-Atlantic points had a similar response to the volatile temperature changes. Nowhere did prices jump as much as on Transco Zone 6 non-NY and Transco Zone 6 New York where high prices reached $95 and $88, respectively (see related story). High prices on Transco Zone 5 reached $99.

The Transco figures are the highest prices at those points recorded since NGI began keeping figures in February 1998 for Transco Zone 6 prices and August 2004 for Transco Zone 5 pricing.

There may be more at work than market forces. Transco issued an operational flow order to maintain pipeline integrity and shippers may have paid the high prices to avoid penalties. “Temperatures well below normal are again forecasted for most of Transco’s market area this week. All shippers are requested to manage their system requirements to ensure a concurrent balance of receipts and deliveries.

“In order to ensure system integrity, manage imbalances on its system and handle within-the-day volatility, effective with the beginning of gas day Monday, Jan. 06, 2014 Transco is issuing a system-wide Imbalance Operational Flow Order (OFO),” the company said on its website.

“This OFO is directed to Buyers (Shippers) consistent with Section 52 of Transco’s FERC Gas Tariff General Terms and Conditions with a minimum $50/Dt penalty. This OFO will continue until further notice and requires that all buyers ensure that their daily ”Due From Shipper’ imbalance (i.e. short to the pipeline) be no greater than 5% or 1,000 Dths whichever is greater, for each gas day during the effectiveness of the OFO. Buyers with imbalances greater than the allowed tolerance will be subject to penalties specified in section 52.5 of Transco’s FERC Gas Tariff General Terms and Conditions.”

Perhaps paying $90 for gas to avoid paying a $50 penalty doesn’t seem so bad when the market price is well north of $40.

Quotes for Tuesday gas on Transco-Leidy rose 71 cents to $2.77, and deliveries on Dominion added 44 cents to $4.25. Gas on Tetco M-3 Delivery soared $33.44 to $43.05, and packages on Transco Zone 6 New York rose $42.77 to settle at $56.59. Deliveries to Transco Zone 6 non-NY rose by $59.76 to $70.66.

In the Midwest, prices came off from Friday’s elevated levels. Quotes on Alliance were seen at $7.11, down $1.07, and parcels at the Chicago Citygates fell $6.48 to $7.49. At Northern Natural Ventura, Tuesday gas tumbled $2.83 to $7.55. Gas at Demarcation added 84 cents to $6.71, and on ANR SW gas changed hands at $5.61, up 69 cents.

“It’s not surprising the cash market went bonkers with the expected weather, but the futures didn’t react,” said broker Steve Blair with Rafferty Technical Research in New York. “Nothing really surprises me with the natural gas market anymore, but I think we have [technical] support in the low $4.20s then you get closer down to $4 before you get any major support again.”

Longer term forecasts are calling for brutal cold to settle in over the Midwest in the next couple of days. “The coldest air seen in a few decades is overwhelming the Midwest, South and East here in the short term, offering some impressive coverage of sub-zero and single-digit temperature readings over especially the next 24-48 hours,” said Matt Rogers, president of Commodity Weather Group, on Monday morning.

“The pattern then relaxes to allow for a massive moderation in temperatures with widespread above to much above normal temperatures expected to dominate the six-10 day with well below normal demand levels. By the late six-10 day into the 11-15 day range, the models start the task of rebuilding West Coast ridging back toward the Gulf of Alaska area to start generating and sending colder pushes of air south again.

“The initial pushes should be on the weak side, but they may be enough to lean the Midwest and East back toward seasonal levels again by late period.”

Even with all the cold weather in play, analysts are not optimistic that prices can rise much further. “Fundamentally, we feel there is not much upside above the mid $4.00 level in natural gas. We would use rallies above the mid $4.00 level as an opportunity to add to forward sales,” said DEVO Capital President Mike DeVooght. “Cold and snow in the Midwest and East helped support the gas market this past week [and] the weekly gas storage numbers showed a considerably smaller than anticipated draw. The market slipped on the news, but was supported by the cold and snow in the East.”

For trading accounts, DeVooght recommends holding on to short February $4.50 calls established at $4.50 for 20 cents. He also suggests holding short March futures at $4.40-4.50. End-users should stand aside, and those with exposure to lower prices should hold short the balance of a November-March strip at $4.50-4.60. He also recommends selling the April-October strip at $4.20-4.30. Friday the April-October strip settled at $4.195.

Wind chill temperatures were forecast to be below zero most of the day Tuesday.

“Despite bright sunshine, actual high temperatures will be in the lower teens across the metro area,” said Sosnowski. “Tuesday will be the coldest day since Feb. 5, 1996 over much of the coastal mid-Atlantic. Conditions outdoors Monday night through Tuesday will make it dangerous to be outdoors for long periods of time without being properly dressed.”

There are some warmer temperatures ahead, however. “Temperatures will slowly trend upward later this week and could touch 50 degrees in some locations this weekend,” he said.

The high temperature in Boston Monday of 56 degrees was forecast to plummet to 20 Tuesday and then to 25 on Wednesday; the normal high is 36, according to AccuWeather.com. New York City’s 55 high on Monday was predicted to drop to 13 Tuesday and back up to 25 Wednesday. The seasonal high in New York is 38. Philadelphia’s 57 on Monday was anticipated to fall to 11 on Tuesday before climbing to 26 on Wednesday. The normal early January high in Philadelphia is 40.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |