NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

U.S. E&P Financial Chiefs More Optimistic about 2014

U.S. energy financial chiefs are feeling more optimistic than they did a year ago about the domestic economy and what’s ahead for the oil and natural gas sector in 2014, BDO USA LLP reported Monday.

Of 100 energy CFOs questioned in BDO’s energy outlook survey, 63 said they were more confident now than they were in early 2013, a number that’s up by more than half (54%) (see Daily GPI, Jan. 10, 2013). Optimism was attributed to a sense there would be continued profitability for the unconventional exploration and production (E&P) sector. The survey, conducted by telephone from September through November, sampled CFOs at E&Ps with revenues ranging between $76,000 and $1.2 billion and an average revenue of $154 million.

“Nonconventional resources remain lucrative and continue to expand the United States’ share of the international energy market,” said BDO Natural Resources practice leader Charles Dewhurst. “But energy executives also know that this highly volatile industry is vulnerable to global events, and are therefore thinking carefully about their contingency plans should the price environment take a turn for the worse.”

One-third (32) of the CFOs said oil and gas prices would be the most important factor driving overall U.S. growth as the country continues to sell “inexpensively produced resources at high international prices.”

The dynamics of supply and demand appear to favor the domestic energy sector, said CFOs. Three-quarters expect to see accelerated domestic natural gas (73%) and oil (76%) output. Higher demand also is forecast, with 62% predicting more gas demand this year and 66% seeing more demand for U.S. oil. About the same number also predicted higher demand overseas.

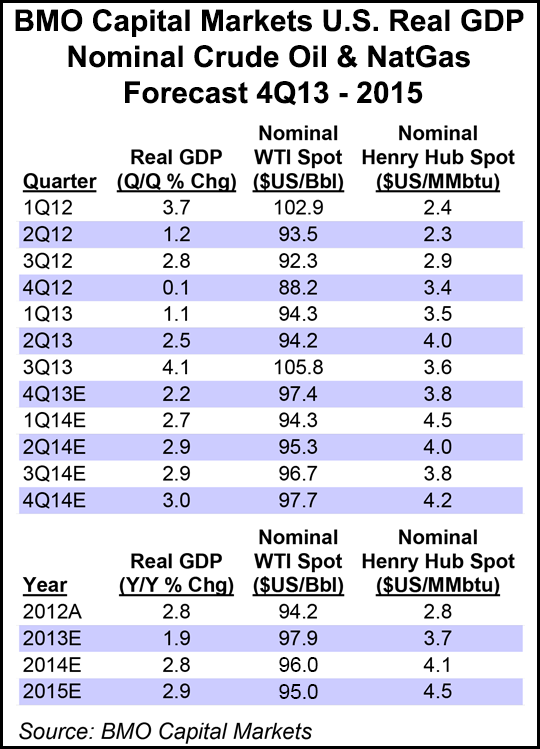

U.S. GDP increased an estimated 1.9% in 2013 compared with 2012, according to BMO Capital Markets, which forecast GDP to increase 2.8% in 2014 and another 2.9% in 2015. Nominal Henry Hub spot prices, which hit an estimated $3.70/MMbtu in 2013, are expected to increase $4.10/MMbtu this year and $4.50/MMbtu in 2015, BMO Capital Markets said.

While energy CFOs are confident that opportunities for growth would continue, they remained conscious of challenges facing the industry, with more than half 53% indicating that legislative changes would be the top factor inhibiting overall industry growth in 2014, up 6% from a year ago.

CFOs also are concerned about the impact of international events on oil prices, with 46% citing ongoing turmoil in the Middle East. CFOs also expressed concern that economic growth in Asian countries would cause price fluctuations, with one-quarter citing it as a top factor, more than a three-fold increase from last year.

The financial bosses said they would be watching Washington, DC, on concern that an uncertain legislative and regulatory agenda could hamper operations. More than one-third (36%) cited regulatory changes as a top political concern for 2014, followed by 26% concerned about industry-targeted tax proposals such as intangible drilling costs (IDC).

“The regulatory uncertainty the energy industry experienced in the run-up to the 2012 election has only slightly abated,” said BDO’s Clark Sackschewsky, who also works in the Natural Resources practice. “The IDC deduction is one of the largest tax breaks available to these companies, and as budget debates continue on the Hill, energy executives are concerned that it might end up on the chopping block.”

Executives are accepting environmental responsibility in their corporate plans, the survey found. More than half (54%) plan to focus risk management activities on environmental regulations this year, “suggesting that they recognize and accept the need to address the environmental effects of ramped-up energy production.” Many of the biggest producers, including ExxonMobil Corp., now are incorporating the cost of a potential carbon emissions tax in their long-term financial plans (see Daily GPI, Dec. 5, 2013).

Nearly one-in-three surveyed cited the impact of hydraulic fracturing (fracking) as a primary environmental concern this year.

“With new shale plays gearing up for drilling, including the Tuscaloosa Marine Shale, energy companies are seeking ways to maximize production while securing buy-in from the government — state, local and federal — as well as local communities,” the report noted. “Carbon emissions are a lesser concern for CFOs at this time, with only 17% citing it as a top environmental challenge. Though concerns about climate change are unlikely to dissipate any time soon, it is clear that energy CFOs prioritize the more immediate issue of fracking.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |