Natural Gas Price Forecasts Revised Higher

The below-normal temperatures and deep freeze across the country led two analysts on Monday to revise upward their forecasts for U.S. natural gas prices in the first quarter.

Credit Suisse analysts lifted their 1Q2014 forecast by 20 cents to $4.30/MMBtu. Raymond James & Associates Inc. now expects prices between January and March to average $4.25/MMBtu. The “winter upside” still hasn’t been priced in, but there are roadblocks beyond winter demand, Credit Suisse analysts said.

“Early winter cold sent December draws to three-year highs, leading the January contract to trade to levels just shy of $4.50/MMBtu,” the Credit Suisse team said in a note. “Outside of our Q1 upward revisions, our remaining 2014 forecast is plagued by continued supply growth and too little structural demand tightening.” Although the first half of this year should see gas prices averaging “over the $4.000 mark,” the second half of 2014 should average about 20 cents lower at $3.80.

Even though gas production surged in late 2013, the winter demand takeaway could lead to end of season (EOS) storage levels by March could fall to five-year lows, Credit Suisse analysts said.

“Since our last update, we’ve revised our winter production forecast higher by 0.6 Bcf/d as we expect average supply growth of 1.5 Bcf/d over the season,” said the Credit Suisse team. Industrial and power demand gains help, “but weather remains the largest risk factor to our calls for a 1.46 Tcf inventory by April with ‘normal’ weather. Adjusting for outliers, our coldest winter weather scenario could send inventories as low as 1.34 Tcf while our mildest scenario could still see a 1.8 Tcf EOS inventory based on our projected supply/demand.”

Storage deficits won’t last long, though, as more supply growth in the second half of 2014 mutes price gains and pushes next winter’s inventories “just shy of 3.7 Tcf and in line with historical averages.”

The recent frigid weather led Raymond James analysts to raise their expectation for the first three months. However, analysts still expect 2014 gas prices to average $3.75.

“Despite the recent weather-driven rally to the mid-$4.00 range, we think that holding our 2014 forecast at $3.75 is the right call amid the competing forces of robust gas supply growth (2-3 Bcf/d over 2013) and modest gas demand growth…

“Yes, we know the 2014 gas futures strip has surged well above $4.00 as cold weather has drawn inventories sharply lower…But we cannot assume that colder than normal weather will continue through the remainder of winter. Therefore, we remain of the view that strong U.S. gas supply growth will outpace slowly improving gas demand over the next two years.”

Raymond James analysts specifically are looking for Henry Hub prices to average $3.75/Mcf in 2014 and 2015.

“Obviously, weather will continue to drive volatility, but the fundamentals suggest U.S. gas should trade mostly between $3.25 and $4.25. Beyond 2015, faster expansion of natural gas-consuming infrastructure in the U.S. should allow gas prices to slowly drift higher. Our long-term U.S. gas price deck remains $4.25/Mcf.”

With three winter months still ahead, “weather anomalies” remain a key risk that could alter prices and supply significantly, Barclays Capital analysts said last week (see Daily GPI, Jan. 2).

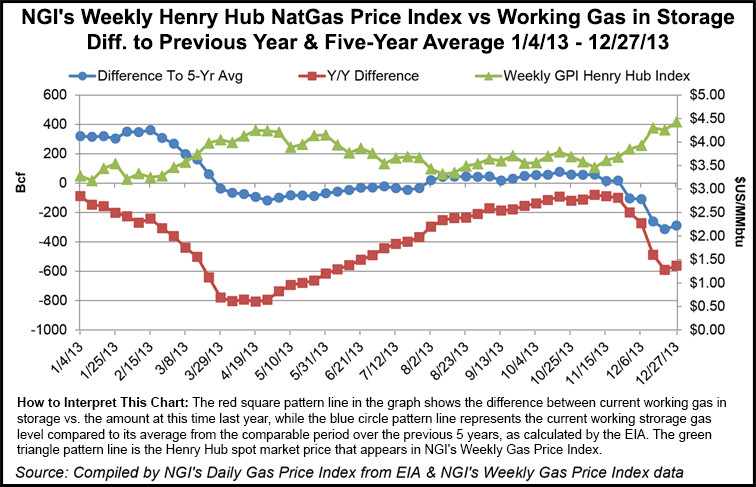

NGI’s Weekly Henry Hub natural gas price was $4.43/MMbtu for the week ending Dec. 27. Working gas in storage for that same week was 562 Bcf less than at the same time in 2012 and 289 Bcf less than the 5-year average, according to Energy Information Administration data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |