E&P | NGI All News Access | NGI The Weekly Gas Market Report

Barnett Permitting Lowest in Decade, But Production Still Strong

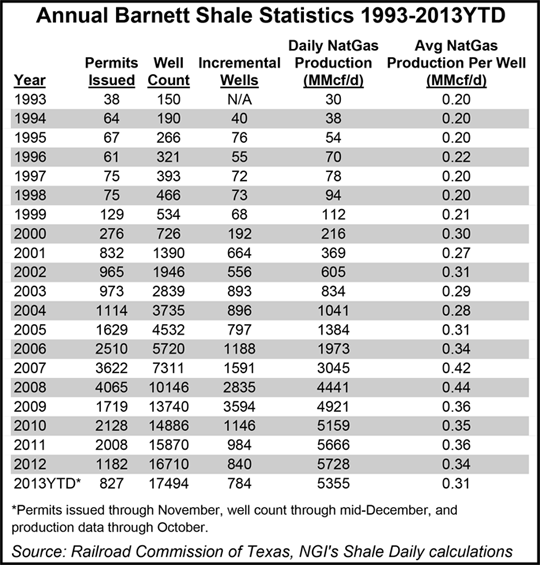

Rigs and drilling permits in the Barnett Shale — the original dry shale gas play — have been dropping like flies, while the well count has continued to rise and dry gas production has demonstrated a staying power that one observer calls “amazing.”

The Barnett rig count has been hovering mainly within the 30-35 rig range for a while. That’s down substantially from the 2008 peak when there were about 200 rigs running in the play at any time.

Drilling permitting activity is down sharply from 2008, too. January through November the Railroad Commission of Texas (RRC) issued 827 Barnett permits compared to 4,065 permits during 2008, the peak for permitting activity. Not since 2003 has permitting been below 1,000 in the Barnett, according to RRC data. This year is on track to surpass the 832 permits issued in 2001, but not by much.

The Barnett well count continues to climb, posting gains every year since it was at 150 in 1993 through this year when as of Dec. 13 there were 17,494 wells in the Barnett, according to the RRC. Production has also climbed every year since 1993 but has begun to plateau lately.

In 1993, Barnett production was 30 MMcf/d. Last year it was 5,728 MMcf/d, up from 5,666 MMcf/d in 2011. Through October of this year production has been 5,355 MMcf/d.

“While the drilling activity has fallen a lot from its peak, one amazing part of the Barnett Shale…is that production has remained surprisingly strong,” said Ed Ireland, executive director of the Barnett Shale Energy Education Council. “When you look at somewhere between 5.3 to 5.6 or more Bcf/d [of production], that’s amazing really.

“When you look at the exponential decline rate of shale gas wells that’s normally expected, with such low levels of drilling you would think that production in the Barnett Shale would be declining much faster than it is. To me, the question is why is that happening.”

The answer, according to Ireland, is longer laterals and the increasing number of hydraulic fracturing stages used on wells. Technology and accumulated know-how among operators are squeezing more out of each well. “An average natural gas well now that’s coming in, in years past might have been considered a ‘monster’ natural gas well, but now that’s just what they are,” Ireland said. “They’re just better at the whole technology of drilling shale wells.”

The counties considered to be in the core of the Barnett by the RRC are Denton, Johnson, Tarrant and Wise. Tarrant was the top Texas gas-producing county in October based on preliminary production statistics, according to the RRC. Johnson was No. 2 while Wise came in sixth and Denton seventh. There are 21 counties considered to be noncore in the Barnett but none of these made the list of October’s top gas producers.

One of the 21 counties, Montague, is home to the Barnett combo play, which besides dry gas yields natural gas liquids and some light oil, Ireland said. Montague did not make the list of top oil-producing counties; competition from big producing counties in the Permian Basin and Eagle Ford Shale was way too much.

Producers that have dry gas holdings, in the Barnett or Haynesville Shale, for instance, have been saying for a while now that before they return to drilling the dry plays in earnest, gas prices will have to consistently chart in the $4.50-5.00 range. Ireland agreed that this is what he’s been hearing, too. “I think that’s just what it’s going to take,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |