Infrastructure | NGI All News Access

Northern Gateway OK Bodes Well for Canada’s LNG Projects

Industry won a hotly contested test case of ability to build pipelines and tanker ports in sensitive Canadian territory when federal authorities Thursday approved a new oilsands conduit from Alberta to the northern Pacific Coast of British Columbia (BC).

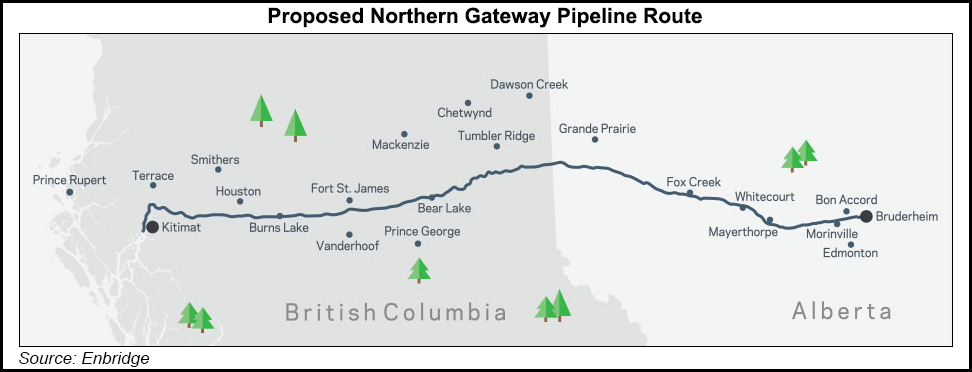

“Canadians will be better off with this project than without it,” said the verdict on Enbridge Inc.’s C$7.9 billion (US$7.5 billion) Northern Gateway proposal for a 1,178-kilometer (707-mile) pipeline to a new export terminal at Kitimat.

A joint review panel of the National Energy Board (NEB) and Canadian Environmental Assessment Agency (CEAA) handed down the ruling after a two-year period of hearings that drew 1,790 participants. By headcount, environmental and aboriginal activists dominated the events in 17 northern BC and Alberta communities.

While Northern Gateway is an oil project, the natural gas side of the Canadian petroleum industry watched the case closely as a landmark that foreshadows the fate of critical elements in its development. Last year it was apparent that Native interests looked more favorably upon projects to carry natural gas for liquefaction and export than a crude oil export pipeline (see Daily GPI, Feb. 6, 2012).

A long lineup of liquefied natural gas (LNG) export projects relies on construction of similar jumbo pipelines proposed by TransCanada Corp. and Spectra Energy (Westcoast) from remote shale deposits in northern BC and Alberta to new terminals at Kitimat and Prince Rupert.

The TransCanada and Spectra plans are in early stages of federal and provincial environmental, native and economic regulatory review processes. All the gas projects, like Northern Gateway, involve introducing heavy industry into rugged foothills, mountains and muskeg swamps studded with wary native communities and defended by vigorous eco-stalwarts from across Canada. If built, Northern Gateway will be the first significant new pipeline installed in BC since construction of a natural gas line from the mainland to Vancouver Island and expansion of the Alberta-to-California gas export system a quarter-century ago.

Only two days before the Northern Gateway decision, the NEB awarded 20- to 25-year export licenses to four LNG projects. Counting three previously issued licenses, the decisions raised the total authorized volume of gas earmarked for overseas tanker exports to 139.6 Tcf or 14.5 Bcf/d (see Daily GPI, Dec. 18).

The LNG plans call for virtually all the gas supplies to be obtained with horizontal drilling and hydraulic fracturing (fracking), which is igniting eco-protest across Canada. As in the United States, pipeline projects have been singled out as the environmental battlefront against accelerating use of unpopular production methods as well as industrial disruption and potential pollution.

The Northern Gateway ruling dismissed protests against upstream production systems that filled long hours of the review panel’s hearings as irrelevant to the pipeline case.”We did not consider that there was a sufficiently direct connection between the project and any particular existing or proposed oilsands development or other oil production activities to warrant consideration of the effects of these activities,” said the decision.

The most strident aboriginal resistance met the same fate because the fiercest opponents often chose to boycott years of consultation efforts by Enbridge as well as the hearings, saying they distrusted industry and regulatory agencies alike.

Echoing Canadian law court rulings on cases involving aboriginal rights claims, the Northern Gateway review panel said it had to rely on testimony and exhibits presented to it, with the material’s sponsors or authors made available for cross-examination.

“Some parties chose not to participate because they had concerns about the regulatory process or were opposed to the project,” the panel said. “They lost the opportunity to present their views to us and have them considered during our deliberations.”

Enbridge offered a 10% share in the project’s ownership equity collectively to 40 native groups along the pipeline route, the panel said. A majority — 26 communities, including 11 in BC and 15 in Alberta — took the company up on the offer. Identities of the collaborators and agreement details have been kept confidential at their request.

Enbridge will lend its aboriginal partners about C$280 million (US$266 million) to cover costs of their equity purchases, only require repayment from their shares in future toll revenue, and ensure they are legally exempt from liability for accidents or damages.

Tolls have not yet been established. Although Enbridge has collected nonbinding commitments to use all of Northern Gateway’s initial capacity for 525,000 b/d, negotiation of transportation contracts awaits further refinement of cost estimates and service options.

Among 209 conditions attached to the approval, the review panel stipulated that construction will only be allowed to begin when firm contracts are signed for a minimum 60% of the pipeline’s capacity.

The conditions range from highly detailed environmental damage prevention and mitigation requirements to special engineering such as pipe walls 20% thicker than current Canadian standards and purpose-built, extra-strength tugboats equipped with fire-fighting equipment to escort a forecast 220 oil tankers per year sailing at tightly restricted speed in and out of the new Kitimat terminal.

In addition to the conduit for crude, Northern Gateway includes a parallel second line for imports of 193,000 b/d of condensate, which is in high demand from the entire oilsands sector as diluent that its molasses-like output requires to flow in all pipelines. Project conditions include bonds of C$950 million (US$902 million) against pipeline or terminal spills, and C$1.35 billion (US$1.3 billion) for tanker spill cleanups and damages.

Like the NEB’s LNG export licenses, the Northern Gateway decision only goes into force if the federal cabinet ratifies it. Government officials said the verdict, including its conditions, will be carefully studied before the final stamp of approval is granted. Aboriginal and environmental groups promptly fired off fresh protests against the review panel’s verdict.

The Conservative government in Ottawa has repeatedly described the westbound oil conduit and tanker export terminal as being in the national interest, to diversify Canadian markets, especially since the Obama administration held up approval of further import lines into the United States, Enbridge forecasts that western Canadian production, chiefly from oilsands, will more than double from 2.8 million b/d to 6.2 million b/d by 2035.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |