Marcellus | E&P | NGI All News Access

Marcellus Helps Drive Range to New Heights

Heavy investments and a strong focus in the Marcellus Shale play have landed Range Resources Corp. a place in the 1 Bcfe/d club.

The company announced the net production milestone on Tuesday, posting positive results in the Midcontinent and West Texas, but above all else, the Marcellus is driving returns at Range. Additional capacity, greater processing and enhanced drilling techniques — primarily in the wet gas window of southwest Pennsylvania — have helped to exceed type curves and drive up estimated ultimate recovery (EUR), with Range’s gross Marcellus production reaching 1 Bcfe/d.

Range said it was producing 200 MMcfe/d when it drilled the first modern horizontal Marcellus well in 2004. Gross production in Appalachia has increased from 35 MMcf/d at the end of 2008 to the 1 Bcfe/d figure it announced Tuesday, representing a 96% compounded annual growth rate for the last five years.

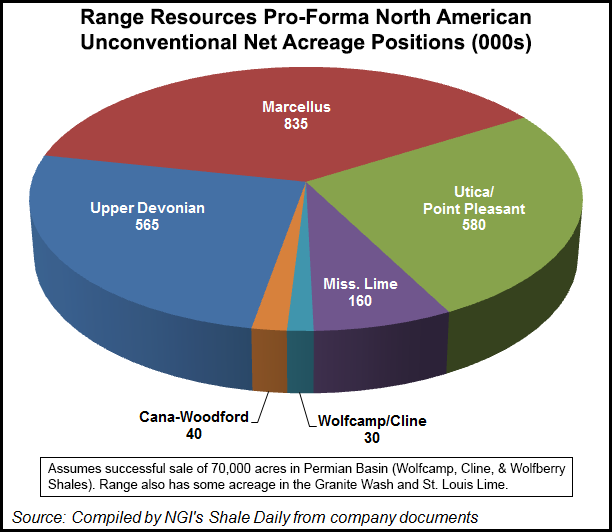

“The success of our drilling program is keeping us on track to achieve the high-end of our production growth target of 20-25% for 2013 and we expect to continue our outstanding growth in proved reserves for the year as well,” said CEO Jeff Ventura in commenting on the milestone. “Our sizable acreage position in the Marcellus Shale, coupled with the Upper Devonian and Utica/Pt. Pleasant Shales in southwest Pennsylvania, gives us confidence that we can continue to deliver growth of 20-25% for many years.”

Range holds about 540,000 Marcellus acres in southwest Pennsylvania, where drilling is intensifying as results improve and more pipelines come online to service the proliferation of wet gas being produced there (see Shale Daily, Dec. 12). Across that 540,000 acre position, Range has said that 93% is held by production or expected to be drilled under current lease terms.

As previously reported, the company’s 17 super-rich vintage wells that it drilled in 2012 are outperforming a 1.32 million boe type curve by 40%. Many of those wells have been online for 250 days or longer and the company attributes improved EURs to better well completions. Another 22 wells that the company turned to sales this year, with longer laterals and more hydraulic fracturing (fracking) stages, are producing at 74% above projected type curves. In all, the 22 wells are producing 476 bbl/d of condensate, 1,149 bbl/d of natural gas liquids (NGL) and 5.2 MMcf/d.

Range said it expects to go above its completions this year, with 2014 wells slated to reach an average lateral length of 4,500 feet and completed with 22 frack stages.

David Tameron, a financial analyst at Wells Fargo Securities, said in a research note that it was encouraging to see a larger exploration and production company “point to rather than hint towards future EUR increases,” which he said analysts have seen a lot of from smaller companies.

With the help of the Mariner West pipeline (see Shale Daily, Sept. 8, 2011), which delivers ethane from a MarkWest plant in southwest Pennsylvania to Canada, and enhanced de-ethanizer capabilities in the southwest portion of the play, Range anticipates that it will also be able to avoid future dry gas purchases required to blend gas for meeting pipeline requirements. The Appalachia-to-Texas Express pipeline (see Shale Daily, Dec. 5), expected to begin commercial service next month, will also aid the company in taking ethane off the gas stream.

Tuesday’s results included an update from Range’s Conger properties in the Permian Basin, where the company is actively marketing 70,000 net acres for sale (see Shale Daily, Dec. 3). A Wolfcamp well is testing at an initial production rate of 1,096 boe/d, while a Cline well recently turned into sales had a 24-hour peak rate of 989 boe/d. Both wells are producing a mix of about 60% oil and 80% liquids, which analysts said should help the company to sell the properties.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |