Marcellus | Bakken Shale | E&P | Eagle Ford Shale | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

EIA Pegs Marcellus Gas Production at Nearly 13 Bcf/d in December

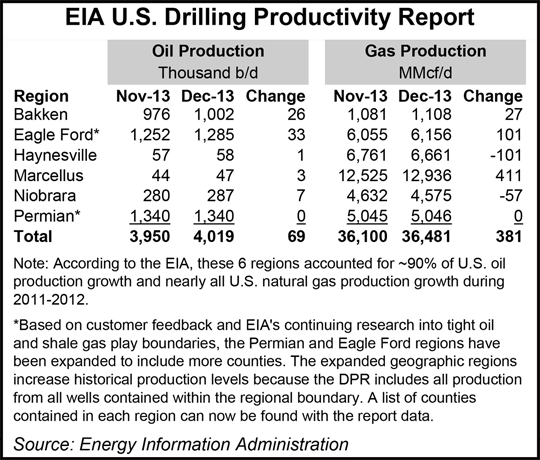

Natural gas production in the Marcellus Shale continues to surge higher, with 12.9 Bcf/d expected to come out of the prolific play in December, a 3.3% increase from 12.5 Bcf/d in November, according to EIA’s second Drilling Productivity Report (DPR) for key tight oil and shale gas regions.

At that rate, Marcellus output would be 35% of the total December production (36.5 Bcf/d) for the six formations analyzed in the EIA report — the Marcellus, Bakken, Eagle Ford and Haynesville shales, Niobrara formation and Permian Basin — which together accounted for virtually all domestic natural gas production growth during 2011 and 2012. Those regions also accounted for nearly 90% of domestic oil production growth during that period, EIA said.

Also estimated to see gas production increases in December compared to November are the Bakken (1.11 Bcf/d from 1.08 Bcf/d) and Eagle Ford (6.16 Bcf/d from 6.06 Bcf/d). EIA estimated December production in the Permian at 5.05 Bcf/d, flat compared to November, while declines are expected in the Haynesville (6.66 Bcf/d versus 6.76 Bcf/d) and Niobrara (4.58 Bcf/d versus 4.63 Bcf/d).

The Marcellus is also expected to pass a significant milestone in December, with new-well production per rig estimated to reach 6.04 MMcf/d, surpassing the 6.00 MMcf/d mark for the first time, EIA said.

The DPR estimated December oil production in the six regions at 4.02 million b/d, an increase compared to 3.95 million b/d in November, and new-well oil production per rig at 241 b/d, up from 236 b/d in November.

EIA began publishing the monthly DPR in October to provide region-specific insights into rig efficiency, new well productivity, decline rates at previously existing wells, and overall production trends (see Shale Daily, Oct. 22). While the more traditional rig count “remains one of the crucial indicators of oil and natural gas production changes…it is just not the entire story,” EIA said.

Also included in the DPR are comparisons of new-well production and legacy gas production.

“What makes this report different from other reports that are put out there by EIA or anyone else is that it takes a look at essentially how efficient or not rigs are at drilling,” said Jim Willis, editor of Marcellus Drilling News and contributor to NGI’s Shale Daily. “Are they becoming more efficient or less efficient? Are they drilling more wells per rig, or less wells per rig? — and they do that comparatively not only between now and last year at this time, but between the different shale plays.

“And they also do a similar comparison with how productive wells are…essentially, how serious are the decline rates of these wells? And one of the surprises is when you look at it in places like the Marcellus, legacy gas production actually went up this year over last year, presumably because there are more older wells now in existence. But the bottom line is that these wells are not declining perhaps as rapidly as some people thought they would.”

EIA was not the first to notice that the rig count doesn’t quite cut it in the shale era. Four years ago, Bentek Energy LLC noted per-rig efficiency gains that had been achieved by the industry when it launched its Bentek Productivity Index (see Daily GPI, Oct. 29, 2009). More recently, Raymond James & Associates Inc. said it will include well count and footage count forecasts in its analyses of capital spending plans by producers (see Shale Daily, Sept. 25). And Baker Hughes Inc., famous for its rig count, has added a well count to the slate of data it provides to the industry (see Shale Daily, Oct. 15).

In its most recent Monthly Natural Gas Gross Production Report, EIA said total U.S. natural gas production was nearly flat in August compared to the previous month, but in the Other States category, which includes shale-heavy Pennsylvania, Ohio and West Virginia, output reached 27.02 Bcf/d, a 2.4% increase from 26.38 Bcf/d in July and a whopping 17.1% increase from 23.08 Bcf/d in August 2012 (see Shale Daily, Nov. 1).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |