E&P | NGI All News Access | NGI The Weekly Gas Market Report

EnerVest ‘s $1B/Year Asset Acquisition Strategy Continues in 2013

EnerVest Ltd. reported Monday that it is on target to clear more than $1 billion in oil and natural gas asset acquisitions within the United States for the fourth year in a row. In 2013 the company is adding to its Midcontinent, Barnett Shale and San Juan Basin acreage, in addition to snapping up its first piece of the Uinta Basin in Utah.

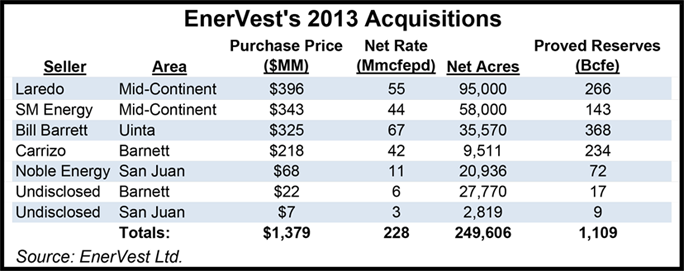

In seven separate transactions with seven sellers that include Laredo Petroleum Holdings (see Shale Daily, May 23), SM Energy (see Shale Daily, Nov. 7), Bill Barrett, Carizzo Oil and Gas Inc. (see Shale Daily, Sept. 10) and Noble Energy, EnerVest and its affiliates have agreed to acquire 249,606 net acres with 1,109 Bcfe of proved reserves — producing 228 MMcfe/d — for $1.38 billion.

Broken down, the deals include:

Houston-based EnerVest said the acquisitions provide the company with additional long-life base production and development drilling opportunities in areas where the company has sizeable asset positions and substantial experience. In addition, the company believes the assets provide a significant opportunity for future production growth through development of the large acreage position. The acquisitions are still subject to customary closing conditions.

“These deals are consistent with our stated strategy of establishing and building upon dominant positions in proven resource basins,” said EnerVest CEO John B. Walker. “We also are pleased to add the Uinta Basin in Utah as a new operating region. We now serve as operator in 15 states and have an interest in properties in 17 states.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |