NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

BNP: $4 NatGas Ceiling Through Winter; Price Recovery Possible in 2014

Barring unexpectedly cold weather this winter, rising natural gas production will prevent prices from eclipsing $4/MMBtu, but an inventory deficit is likely to reemerge by next summer, prompting a price recovery, according to BNP Paribas’ Teri Viswanath, director of commodity strategy.

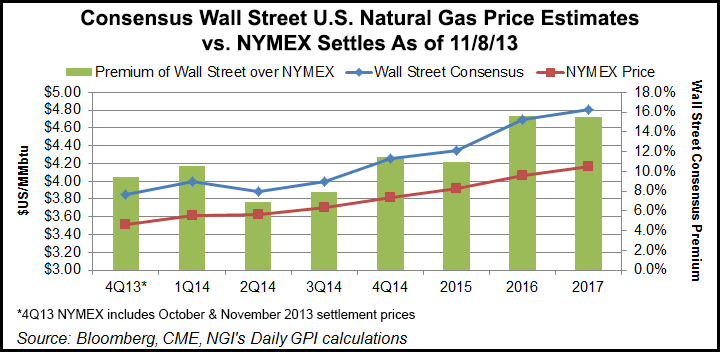

BNP Paribas’ latest price forecast sees natural gas at $3.55/MMBtu in 4Q2013, $3.90/MMBtu in 1Q2014, and $4.20/MMBtu by 4Q2014.

“Compared to last year, when imminent production declines held the limelight, current consensus has seemingly focused upon a rising surfeit that will prolong the structural imbalance in the market,” Viswanath said in a note Thursday. “With supply uncertainty significantly lessened, with the development of onshore shale resources, weather now takes on a heightened role for natural gas balances by driving the call on marginal production and hence, price changes. As such, extreme weather conditions are now required to push prices out of their current narrow-range doldrums.”

Most forecasters have not been calling for a harsh winter this year. Temperatures across the United States over the next three months will be a decidedly mixed bag, with early cold in central and eastern areas expected to fade in the first days of 2014, according to forecasters at Weather Services International (WSI) (see Daily GPI, Oct. 22). WSI’s gas-weighted heating degree day forecast numbers for November are 3% higher than the 1981-2010 average but are slightly lower than normal for December, January and February. The National Oceanic and Atmospheric Administration is expecting a normal winter over the eastern consuming region. Forecasters at the Farmers’ Almanac, on the other hand, expect the winter will be colder than normal for most of the United States (see Daily GPI, Aug. 27).

With the exception of localized spikes during periods of high demand, natural gas prices aren’t expected to increase significantly this winter, according to the Federal Energy Regulatory’s Winter 2013-2014 Energy Market Assessment (see Daily GPI, Oct. 17). And the U.S. Energy Information Administration (EIA) — which expects the Henry Hub spot price for natural gas to increase to $4.00/MMBtu next year, compared with an estimated $3.71/MMBtu this year — expects average winter temperatures this year to be roughly in line with the 10-year average (see Daily GPI, Oct. 9).

“Based on this prognosis, we see higher heating demand at the start of winter giving way to losses toward the end of the season, netting a y/y decline for this segment,” Viswanath said. “Further exacerbating this winter imbalance is our expectation of domestic production growth. In our opinion, these two factors will convert the current inventory deficit to a surplus by the end of winter.”

Working gas in storage is likely to decrease to 1.86 Tcf by the end of March, according to BNP Paribas, but an unexpected deviation from average temperatures resulting in a surge of heating demand “could force a very different storage outcome.” Significantly higher heating degree days could drive March inventories as low as 1.54 Tcf, while a warmer scenario and weaker heating demand could leave nearly 2.13 Tcf in storage at the end of winter, the analyst said.

At the end of March 2013 there was 1.69 Tcf in storage, according to EIA data, and the five-year average for the last week of March is 1.82 Tcf.

There may be some light at the end of the natgas price tunnel in 2014, according to Viswanath.

“In our opinion, low prices this winter will fuel price-induced demand that will ultimately lead to tighter balances next summer. And while this incremental demand is unlikely to counteract the effects of an extremely warm winter, the possibility of summer time re-balancing leaves the door open for price recovery…as inventories adjust to the impact of summer demand growth, we see sustained price gains emerging.”

The Wall Street consensus natural gas price runs steadily higher than the Nymex price, with the premium for 4Q2013 at 9.4%, according to Bloomberg data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |