NGI Archives | NGI All News Access

Ultra Turns on Mojo, Reduces Pinedale Well Costs 14%

Ultra Petroleum Corp., whose fortunes long have been linked to onshore natural gas, still is struggling a bit to recover from the “train wreck” that was 2012, and in the third quarter it got its mojo on track, with drilling efficiencies improving enough to allow the operator to reduce 2013 capital spending by $30 million, while still maintaining production forecasts.

CEO Michael Watford and his management team discussed the results with analysts during a conference call. Not only are drilling efficiencies kicking in, but so are the changes that Watford had promised to implement earlier this year, when he described 2012 as a train wreck after the company wrote down about $3 billion on the value of its gas assets. He promised in February that the company would turn things around (see Shale Daily,Feb. 20).

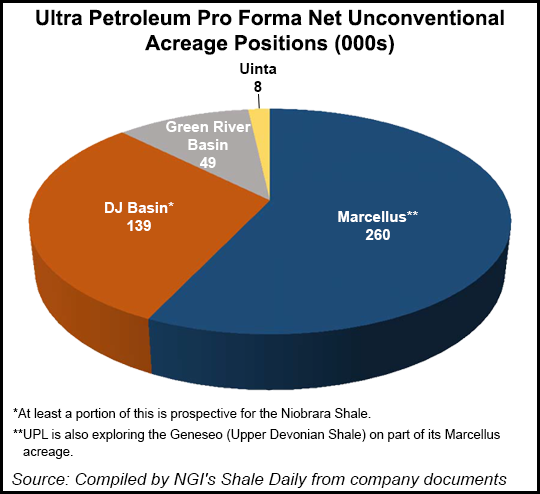

Last month Ultra paid $650 million to acquire its first big oily asset, a chunk of leasehold in the Uinta Basin (see Shale Daily,Oct. 22). The properties could hold 173 million bbl of “resource opportunity,” said the CEO.

“We are maintaining exposure to 100% of our low-cost, long-life natural gas assets while adding a high-returning oil project that complements our technical skills,” Watford said. “The project will provide exceptional returns even at realized oil prices of $60.00/bbl.”

The natural gas assets haven’t disappeared, but investments have been trimmed. Management has been working overtime since last year to make those assets profitable in a low-price world. And Ultra remains bullish on U.S. natural gas. because the market is near a peak in terms of production.

“If we compare 2012 average production of what, 64.2 Bs a day to 2013 average of year-to-date production of 64.6 Bs a day, it’s gone up, but it’s not a big mover,” said Watford. “Again, domestic production has been pretty flat since…well over a year ago. And again, I think, we’re getting through some of the uncompleted, unconnected wells in Marcellus, and I guess we have that in Utica.

“But I think that backlog disappears first half of 2014 or reduces significantly, and the current drilling paces won’t maintain this level of production.”

Ultra still is struggling to keep its head above water while it waits out the market, but it has turned things around since a year ago. Net earnings came in at $63,910 (42/cents) in 3Q2013, versus year-ago losses of $602,146 (minus $3.94).

Gas volumes fell year/year to 55.718 MMcf from 61.206 MMcf. Oil liquids also were down from a year ago to 297,329 bbl from 309,573 bbl. Total volumes for the latest period came in at 57.502 MMcfe from 63.064 MMcfe. However, gas and oil revenues rose to $221,205 from $196,375. Gas sales climbed to $191,453 from $169,594; oil sales were $29,752 from $26,781. Per-unit all-in costs also declined fell to $2.80/Mcfe from $2.88. There were positive margins in the period of 54% for cash flows and 26% on net income.

Ultra took took it on the chin regarding gas price differentials in its cash-cow, Wyoming’s Pinedale Anticline on planned seasonal infrastructure maintenance, and in the Marcellus Shale, where basis widened because of capacity constraints. As a result of the “temporary pricing dislocations,” about 0.8 Bcfe of Ultra’s output was curtailed between July and September. No output now is shut in, Watford said.

In the Rockies, where 70% of company production is based, basis differentials averaged Nymex less 18 cents. In the Marcellus, with 30% of total company output, the average discount in the quarter to New York Mercantile Exchange (Nymex) prices was 54 cents.

“On a combined basis, the company’s average corporate-wide differential to Nymex was 7%, or 26 cents for the quarter,” said the CEO. “Considering the majority of our production is priced outside of the Northeast, we are anticipating a company-wide realized price for the fourth quarter 2013 of Nymex less 5-7%.”

While Ultra can’t control the basis discount, it can control some of its drilling costs, and it has. From the end of June through September, Ultra reduced well costs in the Pinedale Anticline by 14%, to $3.8 million/well from $4.4 million. Those efficiencies have allowed Ultra to reduce 2013 capital spending by $30 million to $385 million from $415 million.

“More importantly, this represents a 19% well cost reduction from the average cost to drill and complete a well in 2012 of $4.7 million,” Watford said of the drilling efficiency gains. “Continued completion design optimization was the primary driver of the $900,000 per well cost savings over the course of the year.”

A milestone also was achieved in the Pinedale during 3Q2013, with 81% of the operated wells drilled on average in 9.3 days, spud to total depth. Total days per well, as measured by rig-release to rig-release, averaged 11.3 days. A total of 17 net (35 gross) wells was drilled by Ultra and partners at the Wyoming Lance site, and another 16 net (39 gross) wells ramped up at average initial production (IP) rates of 7.7 MMcfe/d. Net output from the field during the three-month period averaged 450 MMcfe/d.

In Pennsylvania, Ultra participated in four net (eight gross) horizontal Marcellus wells with first production from three net (six gross) wells.The wells that came online had average IP rates of 7.6 MMcfe/d. Net production in the period averaged 175 MMcfe/d. A few completions were notable in Pennsylvania, said Watford, including a three-well pad in Tioga County that came online with an average IP rate of 9.2 MMcf/d per well. The average 30-day production rate for the pad was 21.6 MMcf/d in the quarter.

Since the end of September, an extension well, or step-out, came online in Centre County initially at a constrained IP rate of 9.2 MMcf/d per well, an issue since resolved with new pipeline capacity takeaway. “This step-out well to the southwest of our development focus area in Lycoming County further validates the quality of the Marcellus resource across our acreage position,” said Watford. Ultra also has a leasehold in the Utica Shale, but it is waiting to see the results as other operators draw closer to its holdings.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |