NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Encana to Sell, Spin Off Properties, Slash Jobs

Encana Corp. on Tuesday announced a bold strategy to move back into the winning column by focusing on only five North American onshore plays — down from 30 — requiring leasehold sales, a spinoff and a 20% reduction in jobs. The goal is to balance liquids and natural gas by 2017 from a limited number of assets, said CEO Doug Suttles.

By 2017, the Calgary-based independent expects to generate 75% of its operating cash flow from liquids prospects — a big job for a producer that today is the No. 1 gas operator in Canada and a top gas producer in the Lower 48.

“We are doing what it takes to get Encana back to winning and we have already begun executing on our strategy with some of that impact being seen in our strong third quarter results,” Suttles said during a conference call. “We have a focused long-term plan in place, the resource base to support that plan and a talented team of people with the energy and drive to succeed.”

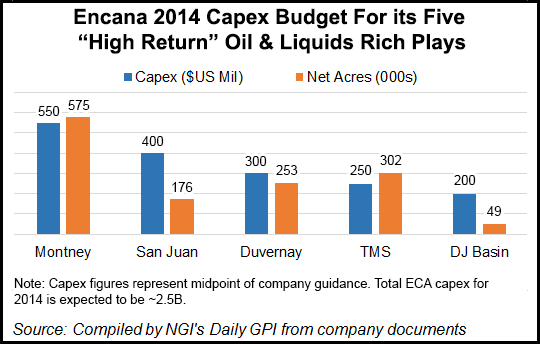

Close to 75% of next year’s capital will go to only five “high-return” oil and liquids-rich plays: the Montney and Duvernay plans in Canada, as well as the Lower 48’s Denver-Julesburg (DJ) and San Juan basins and the Tuscaloosa Marine Shale (TMS). The rest of the capital budget would go to maintain other properties, including its huge natural gas position in Canada and the Lower 48.

Preliminary capital spending for the new big five targets are Montney, $500-600 million; Duvernay, $250-350 million; DJ, $150-250 million; San Juan, $350-450; and TMS, $200-300 million.

Why were those five assets put into the opportunity set? All five are liquids/oil-rich, said Suttles. All of them generate returns of more than 40%. And there’s running room and scalability, with growth potential of 50,000 boe/d in every play. Also, the plays have the “best rocks,” he said.

The Montney formation in British Columbia, with a 60-100%-plus rate of return, generates for Encana a lot of gas and oil, with a potential of more than 2 Bcf/d and 50,000 b/d. Encana’s Duvernay position has an estimated total resource of 443 Tcf and 11.3 billion bbl of natural gas liquids and 61.7 billion bbl of oil.

“This is a huge potential growth engine for Encana,” said Suttles, with the potential for 20 rigs by 2017. The fairway is two times the size of the Eagle Ford Shale, he noted, and Encana has one-third of the liquids fairway.

The DJ Basin offers potential in the “heart” of the Wattenberg field in Colorado, with a 55-85% rate of return, while San Juan is capable of producing a 45-70% rate of return in “resource play hub mode.” TMS also has a “massive oil resource,” that’s ideal for executing at scale.

“One of Encana’s competitive advantages is our team’s ability to develop large, complex resource plays where we can implement our full resource play hub process that is proven to drive down costs and create higher returns,” said Suttles. “The five high quality liquids-rich plays we’ve chosen to focus on offer the scale and running room we need to realize that advantage.”

Management has identified “a number of assets that have considerable upside potential through a divestiture process scheduled to begin immediately.” However, Suttles said the reformed business model was not dependent on asset sales; the 2017 targets could be achieved without them.

Still, he said the gas properties hold long-term potential and there was no plan to retrain the company from continuing to be a natural gas powerhouse.

Through the new strategy, Encana should average a more than 10% compound annual growth rate in cash flow/share through 2017, said Suttles.

Among the many ways it plans to generate cash, by the middle of 2014 Encana plans to launch a public offering of its Clearwater assets in Southern Alberta, including the mineral fee title land position and associated royalty interests. The land holdings are spread across five million net acres. Encana would retain a significant stake” in the new company, Suttles said.

Other key points of Encana’s strategy are:

“Encana is focused on developing high quality resource plays in North America and continuously striving to operate in those plays more efficiently than our competitors,” said Suttles. “Our tremendous asset base offers us the opportunity to build a focused portfolio with exposure to different geographic regions and product diversity, providing quality investment options and the ability to prosper through variable commodity price cycles.”

However, with the reset comes a realignment of the workforce, he said. Close to one-fifth of the jobs are being cut, and office locations are being consolidated to Calgary and Denver. The Plano, TX, location is closing.

“In order to align our organization with our strategy, we have had to make a number of exceptionally difficult decisions,” said Suttles. “The restructuring that is underway reflects our shift from funding about 30 different plays to focusing our resources on five key areas. We will work as hard as we can to make these staffing decisions quickly and thoughtfully and we will treat everyone affected with respect as we work through this very difficult part of our transition.”

The capital program for 2014 tentatively is forecast to be about $2.5 billion; more detailed guidance is to be issued in December.

“While we have a lot of challenging work ahead of us, I am more confident than ever that we will be successful,” said the CEO.

Chairman Clayton Woitas said the board was giving Suttles its full backing. “The board is confident in this strategy because of the deep level of research and intense analysis undertaken by Doug and his team. We believe this is the right path forward for Encana.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |