Markets | NGI All News Access | NGI Data

Gulf Leads Broad Decline; Expected Storage Build Derails Futures

Physical natural gas prices for Wednesday delivery on average overall fell a nickel in Tuesday’s trading. Most major market centers were well into the red, and Gulf Coast points were on the losing side of the trading ledger as well.

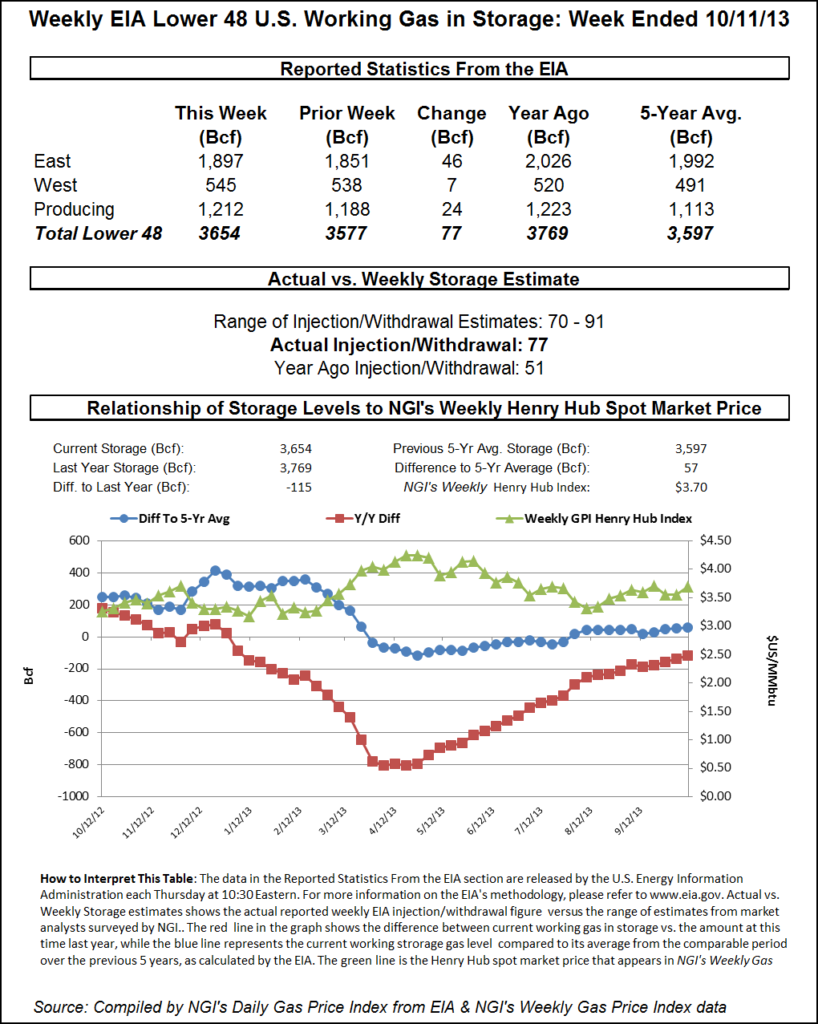

Eastern and Northeast points scored most of the day’s gains as the near-term outlook called for below-normal temperatures. The Energy Information Administration (EIA) reported a 77 Bcf build for the week ended Oct. 11 and futures prices initially were unimpressed, but by the end of the day November had fallen 8.7 cents to close at $3.581 and December was down 8.7 cents as well to $3.706. November crude oil tumbled $1.42 to $97.80/bbl.

A couple of New England cash points managed to score double-digit gains as the weather outlook turned cooler and next-day power prices provided a solid rationale for Wednesday gas purchases. Forecaster AccuWeather.com said the Tuesday high in Boston of 70 would plunge to 50 Wednesday before reaching 53 on Thursday. The normal mid-October high in Boston is 59. Providence, RI’s Wednesday high of 67 was expected to sink to 52 Wednesday and rise to 54 on Thursday. The normal high in Providence this time of year is 61. Hartford, CT’s Tuesday maximum of 67 was predicted to fall to 52 also and climb to 53 on Thursday. The seasonal high in Hartford is 61.

Next-day power prices rose for both New England and the Mid-Atlantic. IntercontinentalExchange reported that next-day peak power deliverable to the New England Power Pool’s Massachusetts Hub added $3.64 to $43.23/MWh and next-day peak power at the PJM West Interconnect gained $4.45 to $44.49/MWh.

Gas was quoted for Wednesday delivery at the Algonquin Citygates at $4.07, up 20 cents, and deliveries to Iroquois Waddington slipped a penny to $4.02. Gas on Tennessee Zone 6 200 L was seen at $4.18, up 24 cents.

Forecasters called for a chill to settle in around the Mid-Atlantic. “[T]he weather will feel more like Thanksgiving around Philadelphia through the end of the week,” said Alex Sosnowski, AccuWeather.com meteorologist. “While the atmosphere can kick out a touch of rain at times through Wednesday afternoon, the balance of the week will be dry. Temperatures will be more typical of mid- to late-November with highs Wednesday through Saturday forecast to be in the low to mid-50s.”

Mid-Atlantic quotes were firm but not at the level posted by New England. Packages on Dominion came in at $3.62, 2 cents higher, and on Tetco M-3 gas rose a penny to $3.84. Gas on its way to New York City via Transco Zone 6 rose 4 cents to $3.94.

Gulf Coast locations were down between a nickel and a dime. Quotes on ANR SE skidded 8 cents to $3.60, and deliveries to Columbia Gulf Mainline shed 6 cents to $3.69. At the Henry Hub Wednesday parcels changed hands at $3.70, down 8 cents, and on Tetco E LA next-day gas was 3 cents lower at $3.61. On Tennessee 500 L gas for Wednesday delivery dropped 9 cents to $3.67.

Other major exchange points lost ground as well. At the Chicago Citygates gas for Wednesday shed 14 cents to $3.95, and on El Paso Permian gas came in at $3.64, down a penny. Deliveries to Opal were off 5 cents to $3.73, and at PG&E Citygates next-day gas was a dime lower at $3.97.

Traders uninspired by Tuesday’s “catch-up” storage report covering the week ended Oct. 11 will have another chance to trade storage data covering the week ended Oct. 18 on Thursday.

The 77 Bcf was what the market was expecting. Tim Evans of Citi Futures Perspective expected the report to show an 80 Bcf build, and a Reuters survey of 24 traders and analysts revealed an average 80 Bcf with a range of 73 Bcf to 91 Bcf. Analysts at United ICAP also were also looking for a build of 80 Bcf, and Bentek Energy’s flow model calculated a 70 Bcf increase. The Energy Metro Desk poll came up with an average 76 Bcf. Last year, 54 Bcf was injected and the five-year average stands at 75 Bcf.

Jim Ritterbusch of Ritterbusch and Associates sees the storage report Tuesday and Thursday as driving the storage shortfall to last year sharply lower. “This market appeared to be driven south [Monday] by some weekend adjustments from some private weather forecasters predicting temperature moderation by next week. Although most forecasters are still anticipating below-normal patterns across the eastern half of the U.S., deviations from normal appear much smaller than had been widely anticipated last Friday. Additionally, the market has been forced back to the realization that more contraction in the year over year deficit likely lies ahead, not only within [Tuesday’s] EIA release but also out of Thursday’s report. By the end of this week, there is a strong likelihood that the supply shortfall against last year will have narrowed to less than 100 Bcf.”

Inventories now stand at 3,654 Bcf and are 115 Bcf less than last year’s record-setting build and 57 Bcf above the five-year average. In the East Region 46 Bcf was injected, and in the West Region 7 Bcf was added. Inventories in the Producing Region increased by 24 Bcf.

The Producing region salt cavern storage figure rose by 7 Bcf from the previous week to 294 Bcf, while the non-salt cavern figure rose by 17 Bcf to 918 Bcf. The EIA first split Producing Region facility types in storage report footnotes in March 2012 in an effort to give analysts and industry more comprehensive information on the relationship between natural gas inventory changes and types of storage facilities (see Daily GPI, March 26, 2012).

Addison Armstrong of Tradition Energy saw the market looking past near-term cold “and instead focused on the more than ample supplies of gas in storage and expectations of increasing output in the Marcellus and Utica shale regions.”

Additional supplies are right around the corner. Tennessee Gas Pipeline’s Northeast Upgrade Project, is expected to start operations on Nov. 1 and would carry an additional 636,000 Dth/d of natural gas from the Marcellus Shale to Northeast markets this winter. The Kinder Morgan pipeline got clearance to start up Loops 317, 321 and 325 of the project last week, as well as its Compressor Stations 321 and 325. The agency approved Tennessee’s request to place Loop 319 in service earlier this month.

The Federal Energy Regulatory Commission has also approved Tennessee Gas Pipeline’s request to place into service the remaining facilities of its MPP Project in Pennsylvania, which would provide producers with an additional 240,000 Dth/d of takeaway capacity to transport gas to Northeast markets (see related story).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |