NGI Archives | NGI All News Access

Chaparral Doubles Marmaton Position with Cabot Deal

Oklahoma City-based Chaparral Energy Inc. is doubling its position in the Marmaton Play in the Texas Panhandle and divesting noncore assets in the Ark-La-Tex region and Permian Basin as it transitions to a pure-play Midcontinent company in anticipation of an initial public offering (IPO) late next year.

Chaparral is buying 66,000 net acres in the Marmaton with 2,000 boe/d of net production from Cabot Oil & Gas Corp. for $160.1 million. The deal essentially doubles the company’s holdings in the play to 126,000 acres as it focuses on “high-quality oil plays with excellent well economics.”

Located in Beaver and Texas counties, OK, and Ochiltree County, TX, production from the assets is 81% oil with proved reserves estimated to be 8.4 million boe and unproven reserves estimated to be 24 million boe.

“We have a deep understanding of the geology and economics of this proven play located in our core Midcontinent operating area where we have consistently demonstrated success in the exploration for and drilling of significant quantities of oil and natural gas,” said Chaparral CEO Mark Fischer. “As a result, this particular acquisition gives us the largest position in this active play where we can use our existing presence and success to leverage the efficient development of this additional acreage.”

The Cabot acquisition increases Chaparral’s growth potential through the addition of 450 drilling locations targeting the Marmaton Lime formation, which typically generate rates of return of 40-70%, the company said. Potential upside comes from the opportunity to drill numerous horizons in the stacked-pay environment. The purchase includes significant infrastructure, including saltwater disposal wells and electricity, which will generate operating efficiencies and economies of scale, Chaparral said.

“When this particular acquisition came up, we saw it as a real opportunity to really create focus for the company being a pure Midcontinent player,” Fischer told NGI’s Shale Daily.

Chaparral has three growth drivers: CO2-enhanced oil recovery, horizontal drilling in the Northern Oklahoma-Mississippi Play (NOMP) and horizontal drilling in the Marmaton in the Panhandle, he said.

“…[W]e saw [the Cabot acquisition] as a real opportunity to basically focus the company and position us, if you will, for a potential public offering. Selling off the Ark-La-Tex and the Permian, I think, provides additional capital that we’re going to need eventually to not only fund the acquisition but to develop that acreage. We think it’s a tremendous fit for us as a company.”

Currently, the IPO is targeted for early in the fourth quarter of 2014.

The Midcontinent offers multiple stacked-pay horizontal drilling opportunities, Fischer said, “whether it be the Chester, the St. Louis, the Marmaton, Thirteen Finger Lime and maybe one or two others that we generally believe will hold horizontal drilling-type potential. They’re in the early stages of review and analysis. Most of those have already had vertical-type completions in them, but other than the Marmaton and potentially the St. Louis, there’s not been a whole lot of horizontal activity. But they fit the mold for horizontal-type plays, so it’s something that we see and things that we will be developing over the next number of years.”

Horizontal drilling is poised to turn the Midcontinent into the new Permian. In other words, horizontal drilling is about to remake another old oilfield. “Where it’s going to go time will tell, but that opportunity is clearly there,” Fischer said.

“You are seeing a number of players, I want to say, taking public routes. Jones Energy [Inc.] being one of the newer ones, I guess. Midstates Petroleum [Co. Inc.] being another one. All of those having horizontal-type applications in their portfolio. Chaparral will be right in there also.

“I think you’re going to see an evolution over the next five years of substantial step-up. You’ve already got some very significant players in Devon [Energy] and Newfield [Exploration] that are developing different plays, the Woodford, for instance, and plays like that. It’s definitely coming and it’s a matter of just how quick people start jumping on it.”

Fischer said Chaparral plans to end next year with seven to eight rigs running in the Marmaton: four on the acreage acquired from Cabot and three or four on the company’s previously held acreage. “As we move on down the road that number will probably continue to grow,” Fischer said.

Wells in the NOMP offer rates of return of 40-70%, Fischer said. Chaparral has never been above the 350,000-360,000 bbl range for estimated ultimate recovery (EUR) for a NOMP well. “Economics are great at that level. We think that’s a tremendous story in itself.”

The Marmaton offers lower recoveries, but it’s oilier. EURs range 160,000-170,000 bbl, but it’s practically 90% oil, Fischer said, whereas NOMP wells may produce 40-50% oil.

“The economics actually are a little better, I think, drilling the Marmaton than they are the NOMP,” he said. “But both of them generate high rates of return, and it’s something we think the investment community is going to like. I think the upside associated with other horizons, the stacked-pay type environment is going to be very intriguing. We’ve got significant positions in the Woodford and Oswego and several others. We think that story hopefully will be very well received.”

The acquisition of Cabot’s Marmaton assets is scheduled to close on Dec. 18.

Chaparral also said it is divesting noncore assets in its Ark-La-Tex and Permian Basin areas. Proceeds are to be used to reduce credit facility debt and fund increased drilling associated with the acquired Cabot acreage.

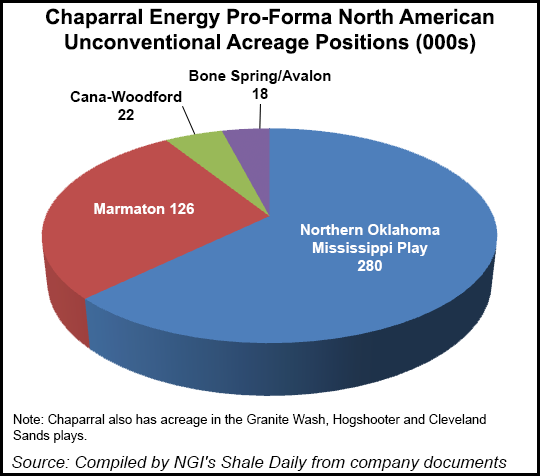

According to company records, Chaparral has in addition to its Marmaton assets approximately 280,000 acres in the NOMP, 22,000 acres in the Cana-Woodford and 18,000 in the Bone Spring/Avalon Shale. The company also has acreage in the Granite Wash, Hogshooter and Cleveland Sands plays.

Besides the deal with Chaparral, Cabot also announced that an undisclosed buyer agreed to acquire legacy conventional properties in West Texas for about $28 million. Production from these properties is 260 boe/d, and Cabot proved reserves are estimated at about 1.5 million boe.

The sale of the Marmaton assets by Cabot did not surprise Wells Fargo Securities analyst Gordon Douthat. Cabot had said it was considering a sale and had moved rigs from the Marmaton to the Eagle Ford Shale. “We believe that proceeds from the sale will likely be directed towards Eagle Ford development…” Douthat said in a note.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |