Getting LNG from Canada to Asia Is a Costly Proposition

Canadian hopes to export liquefied natural gas (LNG) rely on oil prices to stay high and overseas supply contracts to uphold value parity between the two energy commodities, an industry analyst said Thursday.

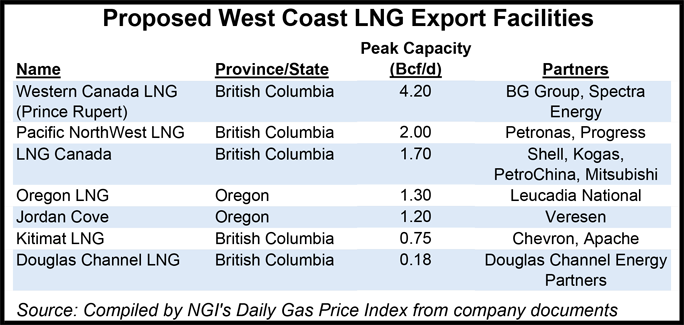

Industry analyst Paul Ziff described the formidable economic needs of LNG export plans for the northern Pacific Coast of British Columbia at a Calgary meeting of the Canadian Society for Unconventional Resources. His Ziff Energy Group has done supporting supply and demand reports for six of eight LNG terminal projects lined up for gas export licenses from the National Energy Board (NEB).

The proposed Canadian-Asian trade in LNG will be no bonanza even if its price stays near energy par with oil because new facilities will be costly to build from scratch in northern BC, according to Ziff.

At a forecast average oil price of C$85.62/bbl for 2017-2012, the period when BC projects aim to begin shipments, current near-parity overseas contract indexes would value LNG at $12.54/MMBtu.

The anticipated LNG price creates an arbitrage opportunity, or gain, of $7.96/MMBtu for Canadian production, which Ziff expects to fetch an average $4.58/MMBtu if it stays on glutted North American markets.

But $6.18/MMBtu or nearly 80% of the gain is eaten up by costs of reaching Asia from the northern BC or Alberta shale gas deposits where LNG supplies are expected to originate.

The projected LNG export expenses include C88 cents/MMBtu for tolls on jumbo new pipelines proposed to cross BC from gas-producing areas to ports at Kitimat or Prince Rupert, C$4/MMBtu for multibillion-dollar terminals to liquefy the gas, and C$1.20/MMBtu for tanker voyages across the Pacific.

Ziff’s sketch of the economic obstacle course faced by BC LNG export schemes drew no quarrels from the well-attended annual shale gas and oil congress in the Canadian industry capital of Calgary.

He echoed widespread consensus among gas producers, financial analysts and supporters of the Asian export campaign that it needs regulatory and political help. The hopes include brisk passage past environmental opponents of pipelines and shale development with hydraulic fracturing, and moderation of BC government ambitions to parlay LNG development into a $100 billion provincial “prosperity fund” of royalties and possibly a special export tax.

At the same time, BC supporters got a reminder that their entry is not the only contender in the gas race to Asia. A Calgary firm said it seen interest in overseas markets for Canadian gas that would be turned into LNG and loaded onto tankers at a terminal proposed for the Pacific Coast of the United States.

Veresen Inc. (formerly Fort Chicago Energy Partners LP), which has interests in Alliance Pipeline and northern Alberta gas processing plants, reported a marketing coup by its Jordan Cove LNG export project on the Oregon coast at Coos Bay (see Daily GPI, Sept. 23).

Prospective customers headquartered in Indonesia, India and an undisclosed east-Asian country have agreed to work on negotiating 25-year supply contracts with Jordan Cove, Veresen said.

The tentative deals are nonbinding heads of agreement to guide development of firm commitments for use of the proposed Oregon terminal and an affiliated pipeline project called Pacific Connector. Each of the prospective customers is a large gas buyer that would take 25% or more of Jordan Cove’s proposed initial annual shipments of six million tonnes (about 1 Bcf/day). Plans to grow annual capacity to nine million tonnes of LNG (1.4 Bcf/d) are built into the project.

Jordan Cove is the most recent entry into the lineup for NEB export licenses. The Calgary-owned, Oregon-located project has told the board that most and potentially all of its LNG will be made from Canadian-sourced gas.

Veresen-Jordan Cove’s target supplies can travel most of the way to the proposed Oregon terminal on current export legs in the TransCanada and Spectra pipeline systems between BC, Alberta and the U.S. Pacific Northwest.

Total costs of the entire Jordan Cove project are forecast to be $7.5 billion, including the Coos Bay terminal and its 232-mile proposed Pacific Connector link to the established pipeline grid at Malin near the Oregon-California border. In BC, forecast costs of new pipelines alone to Prince Rupert or Kitimat alone run into the range of $5 billion to $8 billion.

Veresen’s Jordan Cove package and the tall economic hurdles that the industry faces in BC prompted Calgary executive Jim Prentice, vice-chairman of the Canadian Imperial Bank of Commerce and a former senior federal Conservative cabinet minister, to predict recently that the first Canadian LNG to reach Asian markets could embark via a U.S. terminal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |