Shale Daily | Bakken Shale | E&P | NGI All News Access

Rockies Poised for Resurgence, Says WPX Executive

The Marcellus Shale and other shale plays may continue to lead the U.S. natural gas renaissance in the near term, but the Rockies are primed for a resurgence later in this decade, a WPX Energy Inc. executive said Tuesday.

West Region Marketing Director Alan Killion called the Rockies “an under-appreciated resource” during a luncheon keynote address Tuesday at the LDC Gas Forum Rockies & West conference in Los Angeles.

“We’re adding rigs back in the Rockies to abate the recent decline in production [1 Bcf/d] there,” said Killion. The Tulsa-based operator realized drilling innovations and efficiencies as the former exploration and production arm of Williams. The region has experienced a decline in production, and WPX wants to reverse the trend.

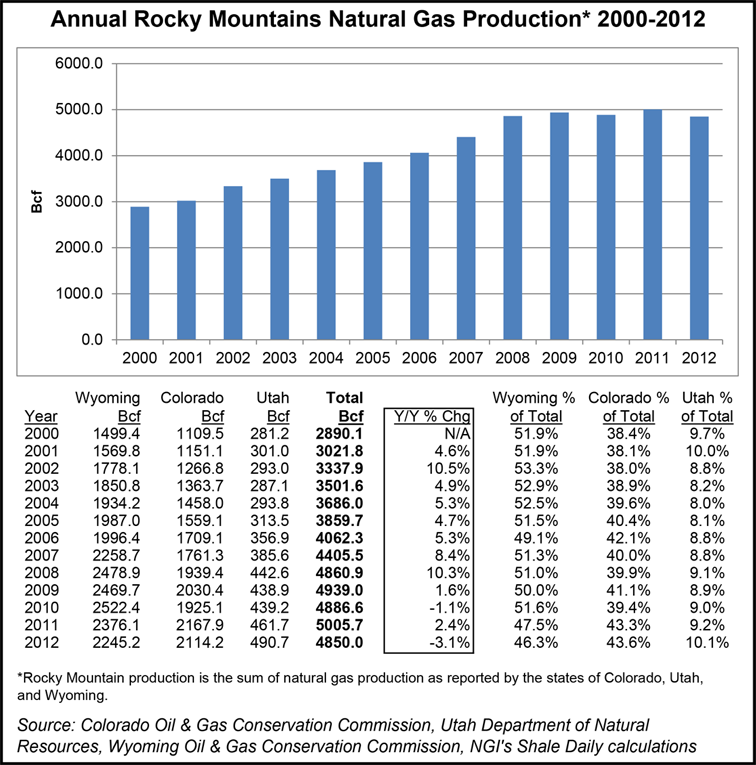

Data from the Colorado Oil & Gas Conservation Commission, Utah Department of Natural Resources and Wyoming Oil & Gas Conservation Commission show that Rockies natural gas production grew nearly every year from 2,890 Bcf in 2000 to 5,006 Bcf in 2011. Production in 2012 dropped to 4,850 Bcf (see chart).

“We’re poised for growth to fulfill increased demand later in the decade,” said Killion, referring to 2017-2019. He emphasized that WPX has invested heavily in technology advances and is operating in some of the prime U.S. basins. WPX has an estimated 4.6 Tcf of reserves and 1.5 million leased acres across the country.

Traditional price basis differences among major basins are eroding rapidly, and the gas flow is turning from an easterly direction to the West. This sets up the Rockies for a resurgence, said Killion. From now to 2018, “we’re [going to show] that in the West the demand is going to outstrip the supply…That’s predominantly because of the power generation needs in this area.”

While he sees the Canadian liquefied natural gas (LNG) exports being delayed until after 2020, Rockies resources are here and available when the market picks up, he noted. “Producers anticipate the Rockies to grow by about 12 Bcf/d, or they wouldn’t subscribe to the pipelines that they have.” Those resources have been available but there was a “reallocation of capital” driven by unconventional plays, including the Marcellus over the past five years.

“That doesn’t mean that the Rockies can’t play an important role when the time is right to fulfill a [added] demand need later in this decade. The Rockies are well positioned geographically and have the infrastructure already in place to feed all of the markets in need.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |