NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | NGI All News Access

EIA: Shale States Continue NatGas Production Surge

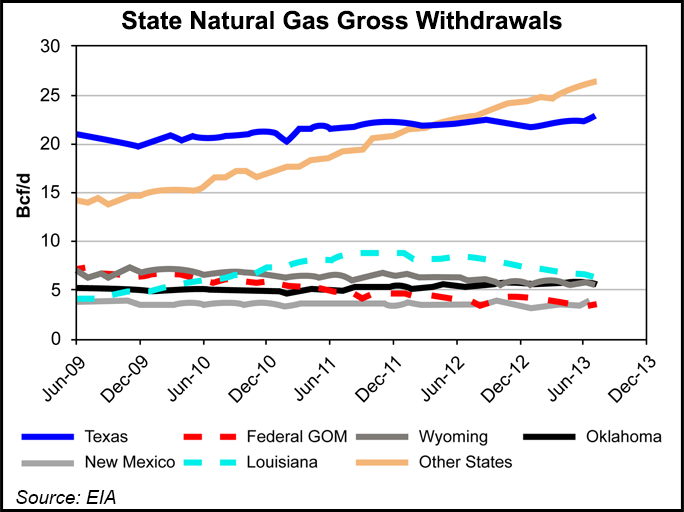

Natural gas production in the Energy Information Administration’s (EIA) Other States category, which includes Pennsylvania, Ohio and West Virginia — and, with them, some of the nation’s booming shale plays — reached 26.37 Bcf/d in July, compared with 26.13 Bcf/d in June and 22.67 Bcf/d in July 2012, EIA said last week.

“Other States saw an increase of 0.9% or 0.24 Bcf/d primarily because of new wells in the Marcellus Shale,” EIA said.

The Other States category, which had traditionally accounted for less production than Texas, overtook the Lone Star state last year and in July outproduced Texas by 3.53 Bcf/d.

Lower 48 output in July was 74.52 Bcf/d, up from 72.71 Bcf/d in July 2012, and the U.S. total hit 82.32 Bcf in July, compared with 79.38 Bcf/d in July 2012, according to the latest EIA report.

Increases compared to July 2012 were also reported for New Mexico (3.76 Bcf, up from 3.61 Bcf/d), Oklahoma (5.91 Bcf/d, up from 5.50 Bcf/d), Texas (22.84 Bcf/d, up from 22.18 Bcf/d) and Alaska (7.80 Bcf/d, up from 6.67 Bcf/d).

Production from the Federal Offshore Gulf of Mexico was 3.55 Bcf/d in July, up compared with June (3.43 Bcf/d), but down significantly compared with July 2012 (4.18 Bcf/d). EIA also reported declines compared with July 2012 in Louisiana (6.42 Bcf/d, down from 8.47 Bcf/d) and Wyoming (5.67 Bcf/d, down from 6.10 Bcf/d).

EIA also issued revised production figures for several categories for June (see NGI, Sept. 9). Revised were the June production numbers for New Mexico (to 3.73 Bcf/d), Oklahoma (to 5.85 Bcf/d), Texas (to 22.46 Bcf/d), Lower 48 States (to 74.00 Bcf/d) and U.S. Total (to 81.81 Bcf/d).

“Overall, with the new data points, strong monthly production growths since April of this year indicate that lower-48 natural gas production remained on a robust upward trajectory, as we expected,” according to Barclay’s analysts Biliana Pehlivanova and Shiyang Wang.

“Production data for August and September are likely to show some weakness, as key parts of the country were affected by temporary disruptions such as widespread heavy pipeline and well maintenances, and the Colorado flooding. Fires at two processing plants in the Northeast have also curtailed production. We expect U.S. Lower 48 production to regain strength and maintain a growth trajectory once it recovers from these temporary disruptions,” the analysts said.

Production from the eastern United States, including the powerhouse Marcellus Shale, will help make the country the world’s top producer of natural gas this year, ahead of Saudi Arabia, EIA said in a separate report Friday. The United States will also surpass Russia to be the world’s largest petroleum producer, EIA said.

“Since 2008, U.S. petroleum production has increased 7 quadrillion Btu, with dramatic growth in Texas and North Dakota,” said EIA. “Natural gas production has increased by 3 quadrillion Btu over the same period, with much of this growth coming from the eastern United States. Russia and Saudi Arabia each increased their combined hydrocarbon output by about 1 quadrillion Btu over the past five years.”

Production growth in Texas continues to increase, with robust crude oil production in August lifting the Texas Petro Index to its second consecutive monthly record, while the state’s oil and gas industry charted a new record as well, according to economist Karr Ingham (see related story). North Dakota’s oil production is racing toward the 900,000 b/d level and could hit 1.6 million b/d by 2017, according to Lynn Helms, director of that state’s Department of Mineral Resources (see related story).

The United States produced more natural gas than Russia last year and will produce even more this year, while Russian production will be down compared to 2012, EIA said. U.S. petroleum production is expected to increase for a fifth consecutive year.

For the United States and Russia, total petroleum and natural gas hydrocarbon production, in energy content terms, is almost evenly split between petroleum and natural gas, EIA said. Saudi Arabia’s production, on the other hand, heavily favors petroleum.

“Comparisons of petroleum and natural gas production across countries are not always easy,” the agency said. “Differences in energy content of crude oil, condensates and natural gas produced throughout these countries make accurate conversions difficult. There are also questions regarding the inclusion of biofuels and refinery gain in the calculations.

“Total petroleum and natural gas hydrocarbon production estimates for the United States and Russia for 2011 and 2012 were roughly equivalent — within 1 quadrillion Btu of one another. In 2013, however, the production estimates widen out, with the United States expected to outproduce Russia by 5 quadrillion Btu.”

The United States claimed the title in 2012 for the leading production growth for not only natural gas but also oil, boosted by its considerable unconventional stores, according to BP plc’s recent annual benchmark of global energy resources(see NGI, June 17). Global natural gas production grew by 1.9% in 2012, and the United States (4.7%-plus) “once again recorded the largest volumetric increase and remained the world’s largest producer,” BP said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 |