NGI Archives | NGI All News Access

West, Rockies Down Hard; Analysts Mulling Seasonal Futures Low

Natural gas prices fell about 6 cents on average nationally on Thursday for Friday delivery, with soft power prices aiding the double-digit declines at California points. Rocky Mountain and other western points were also weak.

The Energy Information Administration (EIA) reported a build of 96 Bcf with 14 Bcf of that the result of a reclassification from base gas to working gas. Futures momentarily dropped but settled higher on the day. September added 5.0 cents to $3.297, and October gained 4.9 cents to $3.321. September crude oil fell 97 cents to $103.40/bbl.

Sliding next-day power prices at California and nearby market centers did little to help the cause of firming next-day gas. IntercontinentalExchange reported that on-peak power for delivery Friday at NP-15 fell $1.96 to $36.94/MWh and power into SP-15 eased $1.19 to $38.71/MWh.

At COB, power for Friday delivery fell $5.96 to $31.14/MWh, and deliveries to Mid-Columbia fell $6.21 to $30.52/MWh. At Four Corners, Friday peak power eased 50 cents to $37.25/MWh.

The California Independent System Operator reported early afternoon power loads Thursday at a light 31,834 MW with peak demand expected to reach only 33,477 MW. Friday’s peak power was forecast at 32,603 MW.

Gas for next-day delivery at Malin shed 10 cents to $3.18, and at the PG&E Citygates Friday packages came in at $3.52, down 5 cents. SoCal Citygate was quoted at $3.39, down 9 cents, and SoCal Border changed hands at $3.29, down 10 cents. On El Paso S. Mainline, gas for Friday was seen at $3.37, off about a dime.

Rocky Mountain next-day gas shared the same fate as that of California. On Northwest Pipeline Wyoming, Friday packages were quoted at $3.01, down 11 cents, and at Opal gas changed hands at $3.11, down 9 cents. Deliveries on CIG Mainline were seen 9 cents lower at $3.03, and on El Paso Non-Bondad gas came in at $3.13, down 8 cents.

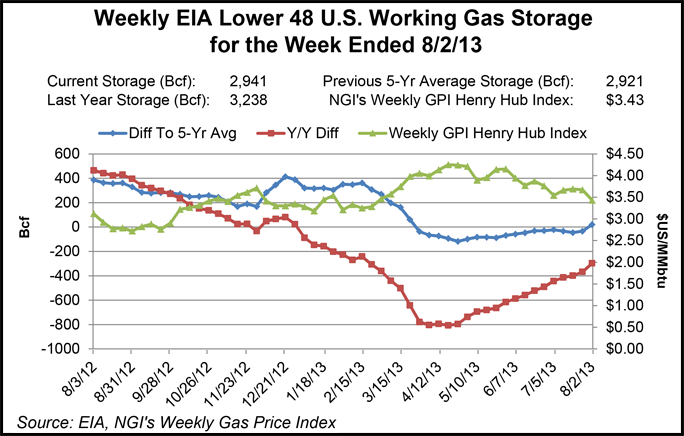

The 10:30 a.m. EDT storage report by the EIA did give traders an idea as to what extent the ongoing dynamic of deficit reduction remains in play. The stout 96 Bcf build showed that deficit reduction remained in high gear as last year a thin 25 Bcf was injected and the five year average stands at 42 Bcf.

The 96 Bcf injection figure was aided by a reclassification of base gas to working gas in the West Region of 14 Bcf. Without the adjustment the week’s injection would have been 82 Bcf.

The initial reaction to the report caused prices to plummet down to the day’s low of $3.129 as analysts were favoring a build in the 80 Bcf area. A Dow Jones survey showed an average 78 Bcf, and IAF Advisors of Houston calculated a 80 Bcf increase. Ritterbusch and Associates was looking for a build of 81 Bcf, and also forecasting an 81 Bcf build was Bentek Energy, utilizing its flow model.

“Total U.S. population-weighted cooling degree days [CDD] declined by 29% from the July 26 to the Aug. 2 storage week,” Bentek said. “The largest drop in CDDs occurred in the Upper Midwest, down 46 degree days from the prior week to 18 CDDs. Below-normal temperatures were recorded in all areas of the country, increasing injection rates in all three regions.” Bentek’s figures show total demand fell nearly 3 Bcf/d, with a decline of 3.8 Bcf/d in the power sector.

Inventories now stand at 2,941 Bcf and are 297 Bcf less than last year at this time and 20 Bcf above the five-year average. In the East Region 58 Bcf was injected and in the West Region 23 Bcf was added (including reclassifications). Inventories in the Producing Region increased by 15 Bcf. The Producing region salt cavern storage figure fell by 2 Bcf from the previous week to 265 Bcf, while the non-salt cavern figure rose by 16 Bcf to 784 Bcf.

Technical analysts see the day’s positive reaction to otherwise unsupportive supply data as constructive. “The $3.24 to $3.05 area is a very pivotal cluster of support that we all need to keep a close eye on, and we got one heck of a bounce from that zone and finished the day strong,” said Brian LaRose, a technical analyst with United ICAP.

LaRose added that there was more to a market bottom than just Thursday’s price action. “There are two key ingredients in the recipe for bottoming action. A turn higher from key support and a breach of key resistance. We had a nice turn higher today, but it is far from confirmation. We need to start taking out some key resistance levels.

“What I am going to be watching going forward is whether natural gas can reclaim the $3.56 level. If we can get above that, that will certainly go a long way in potentially solidifying the case for a bottom being in place seasonally. My concern with a seasonal rally this year is the shale gas play. There may be a very gradual advance into September-October. A slow steady slog higher with a possible test of the $4.40 highs.

“Several months ago I would have been a lot more confident of the prospects for a break above $4.40, but they are flaring $100 billion of gas off the wells each year and there is a lot of production shut-in. If prices start moving higher, that production is going to start coming back on line. Also in terms of shale gas there is not a hurricane risk. Is the same hurricane premium going to be built into the fall months? I would have to think not likely. In the short term that will probably hold natural gas prices down,” said LaRose.

“Once you start exporting or using natural gas as a more standard fuel instead of ULSD [ultra low sulfur diesel] or diesel or coal in a larger capacity, then I think you could have the potential for that normal seasonal cycle advance of 110% that you see this time of year.

“I’m on the fence. I think there is a good chance we’ve carved out a seasonal cycle bottom, but I’m not confident we will roar to new highs from here.

“I would like to see the market take another dollar’s worth of upside before I jump behind a run to, say, $6. Today’s price action was very favorable, and the epicenter of the seasonal cycle bottom is Aug. 14 based on 23 years of price history. Not a confirmed bottom just yet. That said I would much rather be buying here and working a protective sell stop below [Thursday’s] low.”

The weather picture is little changed. Commodity Weather Group in its Thursday morning six- to 10-day outlook showed widespread below-normal temperatures east of a broad arc from northern Florida to Nebraska to Minnesota. About the only heat in the picture continued to be seen in Texas.

“After hitting 105 F [Wednesday], Dallas should start to edging back cooler in the coming days, getting back to highs in the upper 90s by this weekend. We still see some rebounding heat at times next week, but it is not expected to match/exceed this week’s levels,” said Matt Rogers, president of the firm.

“The latest six-10 day trends are a bit cooler in the Midwest compared to [Wednesday], and there are cooler risks for the East too by late next week. However, the 11-15 day is starting to look more diluted with increased variability and less intense blocking support for the bigger cool pattern. This lowers our 11-15 day confidence due to detail challenges, but no major heat rebound is anticipated either. The Tropics are still mostly quiet, but the American ensembles favor an increase in deep Atlantic activity next week and the week after with very low U.S. threats though.”

As low as natural gas prices are, they still have a way to go to compete with coal. September Central Appalachian Coal Futures settled Thursday at $52.59/ton or $2.29/MMBtu.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |