Haynesville Shale | NGI All News Access | Permian Basin

Permian Oil Propels Devon to Record Average Daily Production

Strong growth in oil production — especially in the Permian Basin — propelled Devon Energy Corp. to record the highest average daily production rate in its history during the second quarter of 2013, as the company also saw positive test results in the Woodford Shale.

On Wednesday, Oklahoma City-based Devon said average daily production for its North American assets was 697,600 boe/d for 2Q2013, a 2.8% increase over 2Q2012 (678,900 boe/d).

During that same time frame, total period production for oil rose from 13.5 million to 15.4 million bbl (a 14.1% increase), as did natural gas liquids (NGL), which climbed from 9.3 million to 11.1 million bbl (a 19.4% increase). But total period production for natural gas fell 5.0%, from 233.8 Bcf to 222.0 Bcf.

“The second quarter was an outstanding one for Devon as we continued to successfully grow high margin oil production,” said CEO John Richels. “We remain on track to deliver total company-wide oil production growth in the high teens for 2013, led by light oil growth of nearly 40% in the U.S.”

The Permian Basin was the star of the show for Devon during 2Q2013, with oil production averaging a record 76,300 boe/d and increasing 32% from 2Q2012. The company reported that it had 30 operated rigs and 94 gross wells drilled in the Permian as of June 30. Both tallies are the highest among all of the regions where Devon operates.

Devon said oil production now accounts for 60% of its total Permian production.

“The most significant contributor to this oil growth was the Bone Spring play in the Delaware Basin,” the company said. “Also driving oil growth in the Permian was [a] strong performance from [our] Wolfcamp Shale position in the Midland Basin.”

Devon brought 29 wells in the Bone Spring, plus another 19 wells in the Wolfcamp Shale, into production during 2Q2013. Initial 30-day production rates averaged 675 boe/d in the Bone Spring, and went as high as 1,000 boe/d in the Wolfcamp.

In the Mississippian-Woodford Trend, Devon began production on 36 operated wells during the second quarter, with 10 wells targeting the Woodford Shale hitting an initial 24-hour production rate average of 840 boe/d. Overall production in the play was 7,000 boe/d at the end of June, a 100% increase from the end of 1Q2013.

COO Dave Hager said the company has identified 400,000 net acres in the Mississippian-Woodford Trend with oil shale potential. Devon holds 650,000 net acres in the play.

Devon’s oil exploration program in the Powder River Basin saw seven operated wells, with initial 30-day production rates averaging 675 boe/d, turned into production in the quarter. More than 90% of the wells’ production was light oil.

Net production from Devon’s two projects in the Canadian oil sands, Jackfish 1 and Jackfish 2, averaged 53,200 b/d in 2Q2013, a 4% increase from 2Q2012. Meanwhile in the Granite Wash, net production increased 33% during the same time frame. Initial 30-day production from nine wells brought online there during 2Q2013 averaged 1,600 boe/d, including 900 b/d of oil and NGL.

Elsewhere, second quarter production averaged 322 Mcfe/d in the Cana-Woodford Shale, and 1.4 Bcfe/d in the Barnett Shale. NGL production increased to 56,000 b/d in the latter play during 2Q2013, a 34% increase from 2Q2012.

Devon reported net earnings of $683 million for 2Q2013, compared to $477 million in net earnings realized during the previous second quarter. Diluted net earnings per diluted share were $1.68 for 2Q2013, compared to $1.18/diluted share for 2Q2012. Adjusted diluted net earnings were $1.21 per share for 2Q2013.

Analysts agreed that Devon posted solid results during the second quarter.

“Adjusted EPS of $1.21 [was] significantly ahead of our $0.94 estimate and the Street’s $0.95,” said David Tameron, senior analyst for Wells Fargo Securities LLC. “Production came in 8,000 boe/d ahead of guidance, which also exceeded our and consensus production estimates.

“Specifically, gas and NGL outpaced our estimates while oil production was slightly below our estimate. Except for NGL price realizations, pricing was slightly above our estimates.”

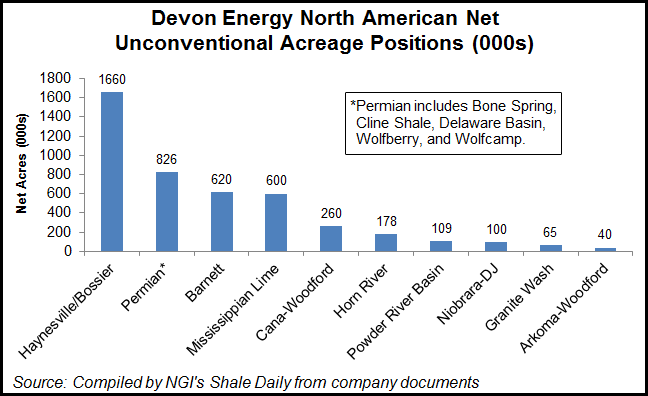

Devon has an estimated 1.67 million net unconventional acres in the Haynesville-Bossier and 826,000 acres in the Permian. It also has significant holdings in the Barnett (620,000 acres) and Mississippian Lime (600,000 acres), and more than 750,000 net acres in several other plays.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |