Marcellus | NGI All News Access

Chesapeake Ends Fight to Extend New York Leases

Chesapeake Energy Corp. no longer wants to fight the state of New York’s moratorium on unconventional drilling and is allowing leases it holds in the Southern Tier to expire.

The Oklahoma City operator had attempted to extend many of its expiring leases, some in place for more than 10 years, on the grounds that the high-volume hydraulic fracturing (fracking) ban was beyond its control and therefore, a force majeure. The courts have disagreed (see Shale Daily, April 11, 2011).

Following a legal battle with the New York Attorney General’s office, Chesapeake last year agreed to allow more than 4,400 landowners locked into gas leases to renegotiate their contracts (see Shale Daily, June 15, 2012).

A source told NGI’s Shale Daily that many landowners’ opinions have changed because of misinformation they have received about fracking. Others have wanted to extend their leases, but at a better price. Chesapeake secured some of the original leases in the state more than 10 years ago at prices less than $5.00/acre.

Landowners that have been receiving letters from their attorneys concerning the Chesapeake leases so far are in Broome and Tioga counties, but the intention to release others from their lease agreements probably will extend beyond those two counties, the source said.

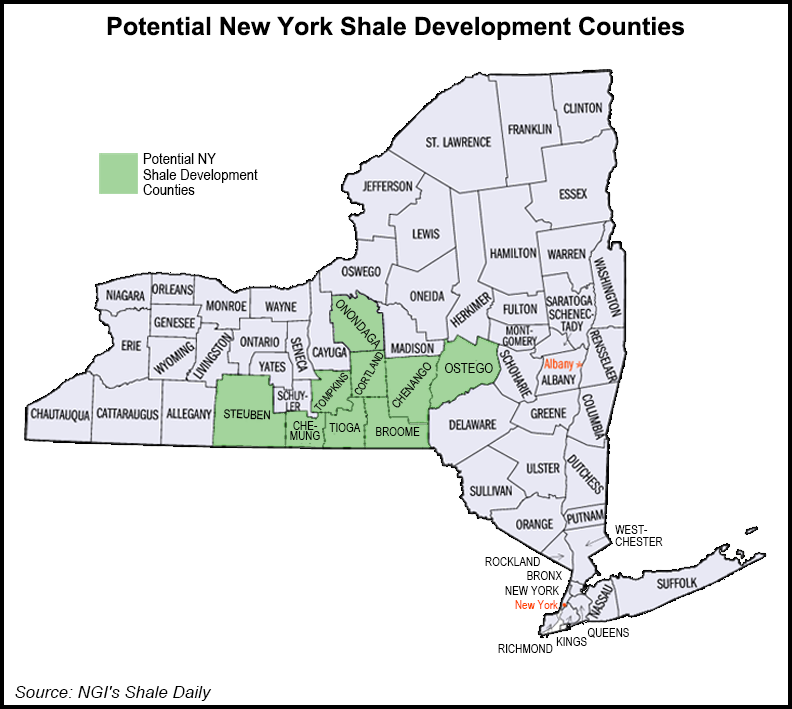

If the current moratorium on high-volume fracking in the state were to be removed, producers have shown interest in exploring the counties of Steuben, Chemung, Tioga, Broome, Tompkins, Cortland, Onondaga, Chenango and Ostego, which sit just over the border from the northeastern Pennsylvania Marcellus Shale hot spot counties of Tioga, Bradford, Susquehanna and Lycoming.

In Onondaga County, Chesapeake holds about 70% of the leases, and two-thirds of them have automatic extensions. Landowners that agreed to automatic extensions would not be affected by Chesapeake’s decision.

In related news, Chesapeake’s largest investor, Southeastern Asset Management (13.4% ownership), which had urged changes to governance and capital spending, has expressed confidence in the company and again will become a passive investor, it said in a Securities and Exchange Commission filing.

“Because of our confidence in management and board of directors, we are converting our Schedule 13D to Schedule 13G.”

In May Chesapeake accepted Southeastern’s recommendation to appoint Service Corporation International CEO Thomas L. Ryan to the board and audit committee.

With regards to the state lands in New York, Chesapeake was absent from 1999 and 2003 lease sales, but came on strong in the last major state lands lease sale held in 2006. In that sale, the company was high bidder on 11 of the 16 leases offered, picking up property in Chemung, Cortland, Schuyler, Tioga and Broome counties, according to New York Department of Environmental Conservation data. The 11 leases were won for about $8 million, with Fortuna Energy accounting for the other five leases for nearly $1 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |