NGI Archives | NGI All News Access

Oklahoma Taxman: Horizontal Wells Don’t Need Incentive

An Oklahoma tax break for horizontal wells enacted in 2010 is depriving the Sooner State of revenue that could beef up its rainy day fund and should be reconsidered, the state’s secretary of finance and revenue said.

While state income and sales taxes are enjoying “sustained growth” and indicate that the Oklahoma economy “had another nice year,” thanks in large part to an energy boom, “the general revenue fund isn’t seeing the benefits it would have before 2010,” said Preston Doerflinger.

In 2010, legislation was signed into law reducing the gross production tax rate on horizontal wells from 7% to 1% for 48 months after the start of production. The 2010 law removed a stipulation in the previous rebate law that ended the tax break once the cost of the well was recovered. Under the 2010 law, the state general revenue fund (GRF) gets no money from new horizontal oil or gas wells over the 48-month period. The 1% tax goes entirely to counties and school programs.

For fiscal 2013, preliminary figures indicate that gross production tax collections to the GRF have fallen nearly $209 million, or 48.5%, since last year, with natural gas accounting for $199 million, or 79.8%, of the decrease, according to Doerflinger’s office.

The figures indicate a $9.9 million loss in oil taxes, but that figure is skewed because $92.6 million in fiscal 2012 oil money was diverted to a supplemental appropriation approved by the legislature, he said. If that money were included, the oil revenue loss for fiscal 2013 would be about $102 million.

According to the Oklahoma Tax Commission, rebates, refunds and tax credits tied to oil and natural gas drilling totaled $321 million in fiscal 2013. Rebates and refunds totaled $173 million, with $102.6 million linked to horizontal wells, of which $72.5 million was for gas and $30.1 million was for oil. In addition, state tax credits for horizontal wells totaled $148 million for the year, with $79 million for oil and $69 million for gas, Doerflinger said.

But looking at it another way, a fiscal 2013 gain of $248.4 million in income and sales tax collections over 2012 more than offset the $209 million drop in oil and natural gas collections, according to preliminary figures. “It was a good revenue year that would have been even stronger if not for losses stemming from gross production tax changes passed in 2010,” Doerflinger said.

A good year can always be better. “The 2010 law has led to some real revenue loss. In our estimation, policymakers should consider revisiting this law in consultation with the energy industry to determine whether it is fair and equitable to the industry, the state and all its taxpayers,” he said.

“Any fiscally responsible policymaker needs to seriously consider at what level government should incentivize something [horizontal drilling] that is now standard practice. It’s not responsible for government to give money away as an incentive if no incentive is needed.”

A deposit to the state’s rainy day fund “doesn’t look likely,” Doerflinger said, but the fund “is still flush with $532 million, although it’s always nice to make a deposit when possible.”

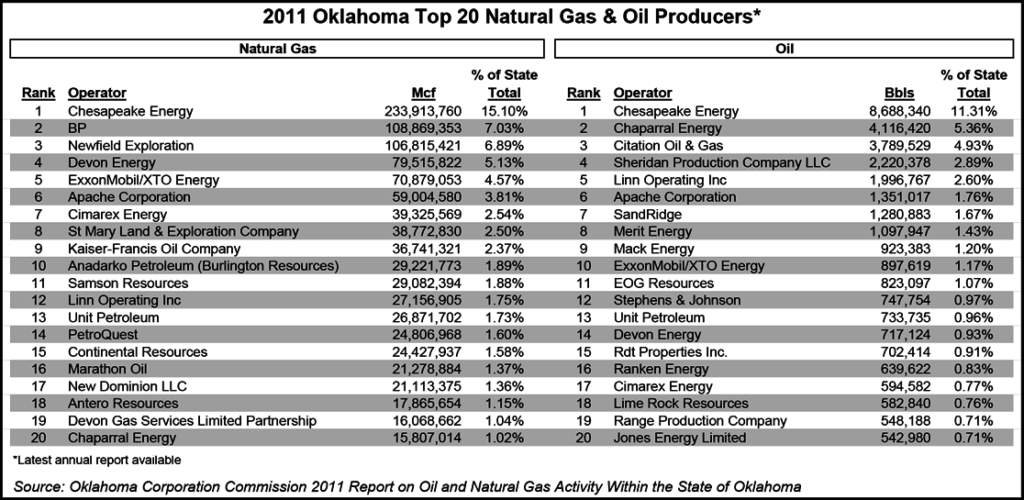

Chesapeake Energy was both the top natural gas producer and the top oil producer in Oklahoma in 2011, accounting for 15.10% of the state’s gas and 11.31% of its oil, according to the Oklahoma Corporation Commission (OCC). BP (7.03%) and Newfield Exploration (6.89%) were the other leading natural gas producers; Chaparral Energy (5.36%) and Citation Oil & Gas (4.93%) the other leading oil producers, according to OCC data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |