NGI Archives | NGI All News Access

Chesapeake Moving from Risk-Taker to Profit-Maker

Chesapeake Energy Corp., the mega-operator that Aubrey McClendon built shale-by-shale, is being repurposed brick-by-brick as the company transitions from risky exploration to steady production.

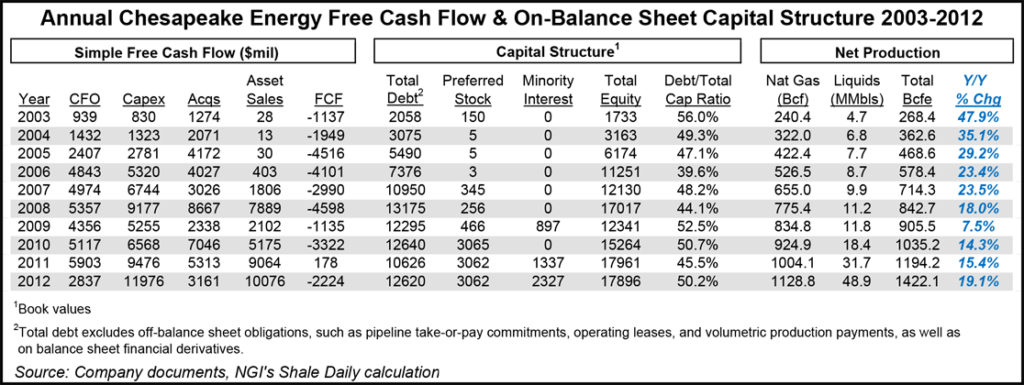

The Oklahoma City driller, now the No. 2 natural gas producer in the United States, was built over two decades, and while it holds some of the best unconventional oil and natural gas prospects in the country, it also has a lot of debt and it exceeded its cash flow last year. Investors remain wary.

Its peers in the onshore, such as EOG Resources Inc. and Continental Resources Inc., have finessed their operations into well-oiled machines, and the numbers show it. EOG was trading at about $136.00/share on Friday morning, while Continental was close to $91.00. Chesapeake was trading hands at a little more than $21.00.

The House that McClendon Built is being whittled down from a money-guzzling machine to a money-making enterprise. Last year almost $12 billion worth of assets were sold in big, splashy deals. This year, the sales targets are lower — $4-7 billion — and the announcements won’t be quite as sensational, COO Steve Dixon told investors in May. This month, two transactions, one completed and one announced, have moved the company into a much better position to be able to achieve 2013 cash flow projections:

McClendon, who was forced out in April, since has launched another exploration and production (E&P) company with offices not too far from his former headquarters. At the time Chesapeake’s board was shaken and stirred, with former ConocoPhillips chief Archie Dunham brought in to calm the troops.

COO Steve Dixon, who helped to ramrod many of the oil and gas discoveries, remains in place, as does longtime CFO Nick Del’Osso. It is a different company, however. Now at the helm is CEO Doug Lawler, who joined in June after running both onshore and offshore operations for Anadarko Petroleum Corp., which some might call an “un-Chesapeake” sort of operator (see Daily GPI, May 21).

A lot of the heavy work was under way by the time Lawler arrived, but he still faces a daunting task to ensure the company’s competitiveness. Chesapeake added close to 705 million boe in U.S. reserves in 2011 and 2012, making it the nation’s most successful E&P, according to IHS Inc. However, the company paid almost $25 billion over those two years for exploration and development costs, equivalent to about $35.00/boe — about $12/boe higher than second-place EOG.

Chesapeake has been planning the Eagle Ford sale for months, and the sales price it received demonstrates a bit of the dilemma the company is facing — that is, having to bargain from a defensive position. The 6,100 b/d of oil and 114 MMcf/d of gas being sold together were worth about $1 billion, based on other recent deals, which means Chesapeake didn’t make a profit on the transaction, according to Brean Capital.

The Exco sale also is far from the first to surprise analysts by the low price. Sinopec captured its 425,000 net acres in the Mississippian for about $2,500/acre gross, or less than $1,000/acre net — much less than Wall Street was expecting, said Stern Agee’s Tim Rezvan.Viewing Sinopec against the Exco transaction, it’s “yet another underwhelming sale,” he said.

However, the “takeaway from this news is that the company is executing toward its 2013 asset sale target with minimal cannibalization of its production stream.” Chesapeake is selling little existing oil and gas production to Exco, which would have eroded cash flow, he said. Production being sold to Exco only represented about 3.8% of Chesapeake’s total output from January through March. The sale to Exco also doesn’t include a lot of the portfolio. Only 55,000 acres are being sold in the Eagle Ford out of a 485,000-acre business. Executives in May already had said they planned to retain about 250,000 acres, where they saw the core of the play.

The Haynesville acreage, numbered at about 9,600 acres, also is a pittance compared to Chesapeake’s vast holdings; it’s the biggest leaseholder in the Haynesville. Still, Tudor, Pickering Holt & Co. analysts said the price received for the acreage set a “low watermark” for the value of Haynesville production, which is about 114 MMcf/d. UBS analysts chimed in that the overall deal implied a “modest” value per acre.

Simmons & Co. analysts acknowledged that the sales relieves some pressure on Chesapeake in that it may not have to dump a more profitable asset, such as producing Marcellus acreage. And said analysts, the Exco latest transaction gives notice of Chesapeake’s intention “to live within cash flow and cash in-flows without impacting forward production.”

The “bigger picture” for Wells Fargo analysts is the company’s previously set sales target of $4-7 billion for 2013. Less than a year ago, Wall Street didn’t think Chesapeake would be able to reach those types of targets, they said.

“We think $4 billion was the figure that management needed or wanted to hit (and we think Chesapeake will end up in the lower half of the $4-7 billion range), but any other future assets sales are now more voluntary. Another check mark off the ‘bear’ list…”

All together, Chesapeake had an estimated $1.4 billion of sales under contract as of May 8, according to Moody’s Investor Services. Sales agreements made this year include:

There are a couple of other big prospects, both in the Utica, that could be done soon, said analysts. In April Chesapeake carved out a 94,000-acre tract in Ohio’s Stark and Portage counties to sell, land that represents roughly one-tenth of its leasehold in the Utica/Point Pleasant Shale. Also, EnerVest Ltd. is selling the drilling rights to about 335,000 net acres in the Utica; EnerVest has 70% control, while Chesapeake and Total SA are partners.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |