NGI Archives | NGI All News Access

Pennsylvania 2012 Impact Fee Made $102.7M for Localities

The Pennsylvania Public Utility Commission (PUC) said Thursday that localities affected by oil and gas drilling in 2012 will collectively receive $102.7 million from impact fee revenue generated by Act 13, the state’s omnibus Marcellus Shale law.

The PUC, empowered by Act 13 to collect impact fee revenue on behalf of local governments, said producers have paid $202.5 million in impact fees. The agency said $28 million will be paid to various state agencies for their regulatory duties. Under Act 13, 60% of the remaining revenue is awarded to localities affected by drilling, and 40% ($78.8 million this year) is deposited in the state’s Marcellus Legacy Fund.

“The more than $202.4 million collected this year brings the two-year total for impact fees collected to more than $406.6 million,” said PUC Chairman Robert Powelson. “The PUC is entrusted by the governor and the legislature with the collection and distribution of the impact fee monies. Again, we have met all of the deadlines in the legislation, which contains a complex and specific formula for getting this money into the hands of local communities.”

The PUC said it plans to mail payment checks on June 28.

Last year, producers paid $204.2 million in impact fees, and localities that hosted oil and gas drilling received $108.2 million, for wells that were spud in 2011 or earlier (see Shale Daily, Oct. 16, 2012; Sept 12, 2012). For 2012, the PUC was required to disburse collected impact fee revenue by Dec. 1, but for each subsequent year the PUC’s deadline is July 1.

Marcellus Shale Coalition CEO Kathryn Klaber called the disbursements “a vivid illustration and reminder of how safe, tightly regulated natural gas development is benefiting local communities, statewide programs and funding of government agencies.

“Our member companies are working each and every day to responsibly develop this clean-burning energy resource while also serving as good neighbors and community partners to ensure we get this historic opportunity right for all 12 million-plus Pennsylvanians.”

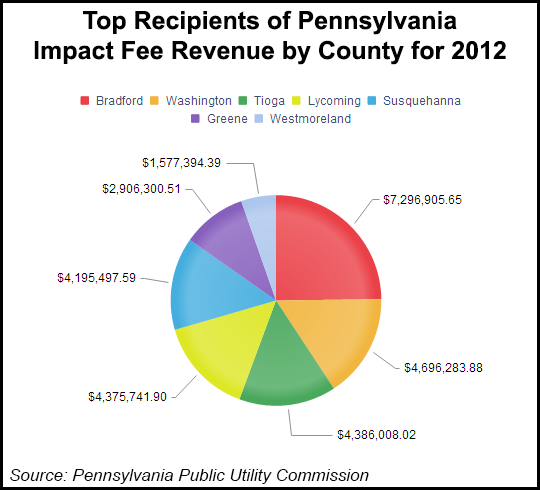

According to the PUC, Bradford County will receive about $7.3 million for 2012, placing it at the top of the list of counties with producing wells. Washington County is second with $4.7 million, followed by Tioga ($4.39 million), Lycoming ($4.38 million), Susquehanna ($4.2 million), Greene ($2.91 million) and Westmoreland ($1.58 million) counties.

Lawrence Township, located in Clearfield County, was the top municipal recipient of impact fee revenue for 2012 at more than $797,000. Cumberland Township, in Greene County, was second with more than $787,000. The City of Williamsport, in Lycoming County, is set to receive more than $593,000.

Two municipalities in Washington County — Chartiers and Amwell townships — followed with more than $578,000 and $576,000, respectively. Two Tioga County municipalities — Sullivan and Charleston townships — rounded out the top of the list with payments of more than $565,000 and $535,000, respectively.

Among producers, the PUC said Chesapeake Appalachia LLC paid the most in impact fees, about $27.39 million. Range Resources Appalachia LLC was second at about $23.94 million, followed by Talisman Energy USA Inc. ($20.25 million), SWEPI LP ($17.33 million), Anadarko E&P Co. LP ($13.47 million), Chevron Appalachia LLC ($11.44 million) and Cabot Oil & Gas Corp. ($9.7 million).

Excluding any disputed wells (see Shale Daily, May 15), the PUC said Bradford County was host to 1,125 oil and gas wells that were subject to the impact fee. Tioga County was second with 813 wells, followed by Washington (754), Lycoming (661), Susquehanna (641), Greene (511) and Westmoreland (229) counties.

Among municipalities, Lycoming’s Cummings Township had the most subject wells with 218. Bradford’s Columbia Township was second with 129 wells, followed by Lycoming’s Cogan House Township (125), Greene’s Cumberland Township (117), Clearfield’s Lawrence Township (114), Susquehanna’s Dimock Township (106) and Washington’s Mount Pleasant Township (97).

The PUC said 5,324 horizontal wells were subject to the impact fee. Another 284 vertical wells were also subject. Twenty-six horizontal and 563 vertical wells were deemed not subject to the fee, while 21 vertical wells remain in dispute.

Among counties receiving impact fee revenue, the PUC said Westmoreland County led in terms of county road mileage with 2,206.5 miles. Washington County came in second at 1,688.22 miles, followed by Bradford (1,438.06), Allegheny (1,429.41), Butler (1,415.11), Fayette (1,245) and Indiana (1,125.67) counties.

The agency also listed the top counties to receive impact fee funds in terms of population. Allegheny County, home to the city of Pittsburgh, topped the list with 372,340 people. Westmoreland County was second with 350,134, followed by Washington (208,282), Butler (183,607), Fayette (136,097), Beaver (123,517) and Lycoming (105,716) counties.

Act 13, which was signed into law by Corbett in February, amended Title 58 (oil and gas) of the Pennsylvania Consolidated Statutes (see Shale Daily, Feb. 15, 2012). The law gives Pennsylvania’s counties the choice to collect an annual per-well fee from operators. The fee is set annually based on the price of gas and declines over 15 years but is set at $50,000 for all unconventional horizontal gas wells drilled through 2011.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |