NGI Archives | NGI All News Access

Quicksilver Cutting Costs, Still Seeking Horn River JV

During the first quarter, Quicksilver Resources Inc. lost more money than Wall Street was expecting as the company continued to “hammer on the cost side” of its business, deferring elective spending in the energy patch and cutting back on staff.

The company’s recently announced joint venture (JV) in the Barnett Shale with Tokyo Gas Co. Ltd. was welcome news (see Shale Daily, April 2), but there is more work ahead.

“Quicksilver Resources is continuing to make progress on our streamlining and deleveraging efforts,” said CEO Glenn Darden. “We are focused on the most important projects and we’re bringing in partners to both reduce debt and assist in the development of our assets.

“The company is very serious about reducing costs and living within cash flows,” Darden said during an earnings conference call Tuesday. Over the last 12 months, the company’s employee count has come down by about 20%.

The Fort Worth-based company reported an adjusted net loss of $6 million (minus 4 cents/share) compared to $15 million (minus 9 cents/share) in the prior-year period. The reported net loss, which includes $41 million of noncash derivative losses, was $60 million (minus 35 cents/share) compared to $212 million (minus $1.24/share) in the prior-year period. Reported first quarter 2012 results include a restated $318 million noncash ceiling test impairment.

Wall Street was expecting an adjusted net loss of 1 cent/share, but Wells Fargo Securities was looking for a loss of 5 cents/share, analysts said in a note Tuesday.

Quicksilver shares closed down more than 9% at $2.42 Tuesday.

Quicksilver said that since it was able to finally close its long-sought Barnett Shale deal and in light of the “challenging” pricing environment for natural gas liquids, it was shelving earlier plans for a Barnett Shale master limited partnership (see Shale Daily, Nov. 7, 2012).

The company began ramping up Horn River Basin production during the middle of December. However, because of limitations on surface equipment and water disposal, gross production is currently 87 MMcf/d from 11 of 12 wells capable of production. Quicksilver’s gas treating commitment in the Horn River stepped up to 100 MMcf/d on May 1 and will remain at that level until May 1, 2018.

The company is still working on a JV in the Horn River with the downstream marketing of gas production a “top priority.” Production from Horseshoe Canyon was 51 MMcf/d during the first quarter.

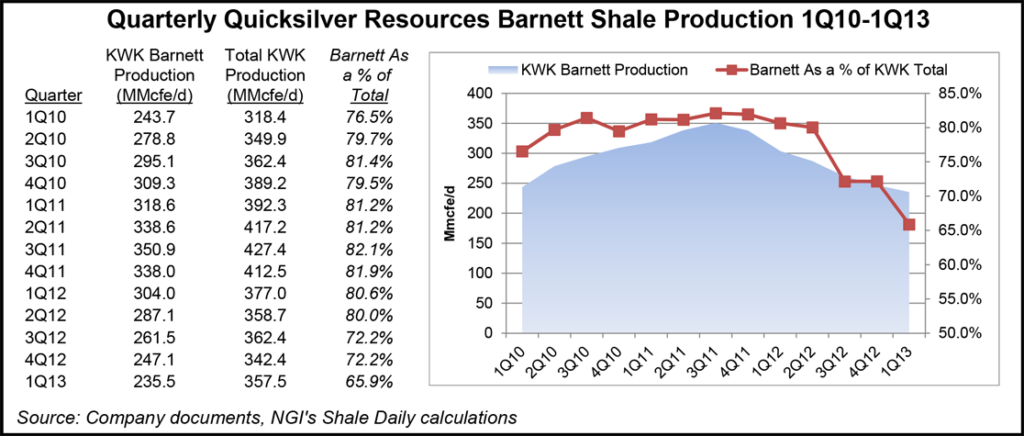

During the first quarter Quicksilver did not do any development in the Barnett Shale. However, the company expects to drill up to 10 Barnett wells beginning in the third quarter and have a more active program in the Barnett next year, arresting this year’s production declines.

Quicksilver said it expects to participate in the drilling and completion of up to eight Sand Wash Basin wells this year. The company expects a minimal drilling this year in its West Texas program, which targets oil from the Wolfcamp and Bone Spring formations.

As of April 30, total net debt was about $1.6 billion, which includes the pro forma effect of repayments under the company’s credit facility with the Tokyo Gas transaction proceeds.

First-quarter 2013 production was 32.2 Bcfe, or an average of 358 MMcfe/d. Production from the Barnett Shale was 21.2 Bcfe, or 236 MMcfe/d, which is down 5% from the fourth quarter due to minimal capital activity. Production from Canada was 10.7 Bcfe, or 119 MMcfe/d, which is 30% higher compared to the fourth quarter as gross production in the Horn River Basin was increased to approximately 85 MMcf/d.

Second-quarter average daily production is expected to be 282-288 MMcfe/d. Full-year average production is expected to be 290-300 MMcfe/d.

Quicksilver said it will “slightly” reduce its capital spending this year to reflect the Barnett Shale JV and the amount of capital Tokyo Gas is expected to contribute to the program.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |