Marcellus | NGI All News Access | Utica Shale

Antero Gains Approval for IPO

Appalachian heavyweight Antero Resources LLC has opened its doors to public investment after gaining approval to launch an initial public offering (IPO) of 30 million shares, or more, of common stock.

The Denver-based operator in June filed with the U.S. Securities and Exchange Commission for approval to prepare the IPO (see Shale Daily, June 17). If the 30 million shares are sold out, Antero has set aside 4.5 million additional shares for sale. Shares are to be listed on the New York Stock Exchange under the symbol “AR.”

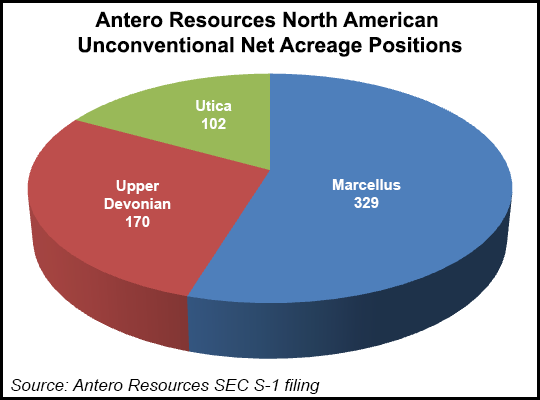

The Warburg Pincus LLC-backed producer develops natural gas- and oil-rich property in Ohio, Pennsylvania and West Virginia, with more than 325,000 net acres in the southwestern core of the Marcellus Shale and 100,000 net acres-plus in the core of the Utica Shale.

The new shares are expected to sell for $38.00-42.00, which means Antero could raise more than $1.4 billion if the stock is sold in the upper end of the range. Net proceeds from the offering are to reduce debt, which at the end of June was estimated at about $1.49 billion.

Barclays Capital, Citigroup, J.P. Morgan, Credit Suisse, Jefferies and Wells Fargo Securities are the book runners.

Antero in June increased its capital spending (capex) by $300 million to $1.95 billion, with $1.2 billion set aside for drilling and completion activity. About 85% is allocated for the Marcellus, where Antero plans to drill a total of 135 horizontal wells. Twenty-one horizontals in the Utica also are planned for 2013. Funds also have been set aside to complete an 80-mile water pipeline system in West Virginia and Ohio to service drilling projects (see Shale Daily, Aug 15).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |